The ongoing Israel-Hamas war and fears of the conflict escalating further in the Middle East are expected to drive defense stocks higher. In fact, several defense stocks surged on October 9, the first trading day in the U.S. after the Israel-Hamas war began. The list includes Northrop Grumman (NYSE:NOC), General Dynamics (NYSE:GD), Lockheed Martin (NYSE:LMT), Kratos Defense (NASDAQ:KTOS), and AeroVironment (NASDAQ:AVAV).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With Israel’s Prime Minister Benjamin Netanyahu making it clear that there will be no ceasefire until Hamas is destroyed, the current backdrop might drive favorable investor sentiment for defense stocks. Investors keen on the defense space amid the ongoing wars in Ukraine-Russia and the Middle East can also consider investing in exchange traded funds (ETFs) like SPDR S&P Aerospace & Defense ETF (XAR), Invesco Aerospace & Defense ETF (PPA), and ARK Space Exploration & Innovation ETF (ARKX).

Let’s take a look at two defense stocks that could rise in the days ahead, as per Wall Street analysts.

Kratos Defense & Security Solutions (NASDAQ:KTOS)

Kratos offers defense products and services, including unmanned systems, satellite communications, missile defense, and hypersonic systems, to the United States National Security-related customers, allies, and commercial enterprises.

Kratos generated revenue of $488.7 million in the first six months of Fiscal 2023, reflecting 16.2% year-over-year growth. The company brought down its GAAP net loss per share to $0.08 in the first six months of Fiscal 2023 compared to $0.16 in the prior-year period.

Kratos is scheduled to announce its third-quarter results on November 2. The company exceeded analysts’ expectations for adjusted earnings per share (EPS) in the first two quarters of Fiscal 2023. Analysts expect Kratos to report adjusted EPS of $0.09 in Q3 2023, up from $0.08 in the prior-year quarter.

Is Kratos Defense a Good Stock to Buy?

On October 16, RBC Capital analyst Kenneth Herbert raised his price target for KTOS to $18 from $16 and reiterated a Buy rating on the stock as part of his broader research note ahead of the third-quarter results of the Aerospace and Defense sector.

Herbert is projecting a favorable reporting season for the defense stocks. He expects a low-to-mid single-digit defense sales growth and strong backlogs to favorably impact investor sentiment, even as revenue comparables in the second half of the year could get more challenging.

The analyst added that while expectations for improvement in defense margins are more muted, the elevated geopolitical tensions could limit downside risk and magnify any positive results.

With five Buys and one Hold, Kratos stock earns Wall Street’s Strong Buy consensus rating. The average price target of $18.33 implies 9% upside. KTOS stock has advanced about 12% over the past month and has rallied 63% year-to-date.

Northrop Grumman (NYSE:NOC)

Shares of defense giant Northrop Grumman surged more than 11% on October 9, in reaction to the Israel-Hamas war that erupted in the Middle East. Last Thursday, the company impressed investors with better-than-anticipated third-quarter results, fueled by strong demand for its weapons. The company also raised its revenue outlook for the full year.

The company’s Q3 2023 sales increased 9% to $9.8 billion, thanks to solid growth across all segments – Aeronautics Systems, Defense Systems, Mission Systems, and Space Systems. Further, Q3 EPS grew about 5% to $6.18, easily exceeding analysts’ consensus estimate of $5.81.

Northrop is bullish about the demand for its offerings, noting that the Biden administration “continues to make supplemental request for urgent needs, including those in Ukraine and Israel to include investments in weapon systems and defense industrial-based readiness.”

What is the Projection for NOC Stock?

Following the Q3 print, Argus Research analyst John Eade raised his price target for Northrop Grumman stock to $520 from $500 and reiterated a Buy rating on Monday.

The analyst highlighted that Northrop has often exceeded earnings expectations irrespective of whether defense spending is growing or declining, or a Republican or a Democrat is in power. He noted that lately, U.S. defense spending in certain areas has risen, and this trend could continue.

The analyst has a favorable view of NOC’s focus on international revenue diversification and on the Space Systems segment. He expects the ongoing geopolitical tensions to benefit Northrop’s sales and earnings.

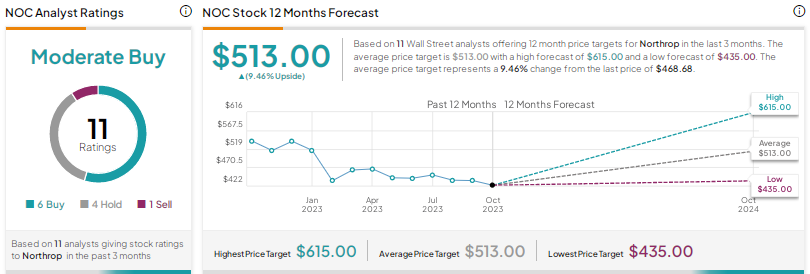

Wall Street’s Moderate Buy consensus rating on NOC stock is based on six Buys, four Holds, and one Sell. The average price target of $513 indicates 9.5% upside potential. NOC shares have advanced 6.5% over the past month but are down 14% year-to-date.

Conclusion

Rising geopolitical concerns are expected to drive higher demand for arms and ammunition, thus benefiting companies in the defense sector and their stocks. Any further escalation of the Israel-Hamas war in the Middle East could strengthen the bullish stance for the two stocks discussed here and drive further upside.