Cannabis exchange-traded funds (ETFs) offer a convenient and diversified approach for investors seeking exposure to this rapidly evolving sector. The prospects of the cannabis market look promising in 2024 as an increasing number of states legalize marijuana for recreational or medical purposes. Today, we have leveraged the TipRanks ETF Screener to scan for two ETFs from this sector with more than 20% upside potential: AXS Cannabis ETF (THCX) and Cambria Cannabis ETF (TOKE).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s explore what Wall Street thinks about these two ETFs.

Is THCX a Good Buy?

The AXS Cannabis ETF invests at least 80% of its total assets in the stocks of global cannabis companies and tracks the AXS Cannabis Index. THCX has $15.26 million in assets under management (AUM), with the top 10 holdings contributing 59.75% of the portfolio. Meanwhile, the expense ratio of 0.75% is encouraging.

On TipRanks, THCX has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 25 stocks held, 13 have Buys, 11 have a Hold rating, and one Sell rating. The average THCX ETF price forecast of $30.97 implies an 82.3% upside potential from the current levels. The THCX ETF has gained 11.2% in the past three months.

Is TOKE a Good Stock?

The Cambria Cannabis ETF is an actively managed and globally diversified ETF. The TOKE ETF seeks capital appreciation from investments in global equity markets that have exposure to the broad cannabis industry. TOKE has $10.14 million in AUM, with its top 10 holdings contributing 68.55% of the portfolio. Notably, its expense ratio stands at 0.42%.

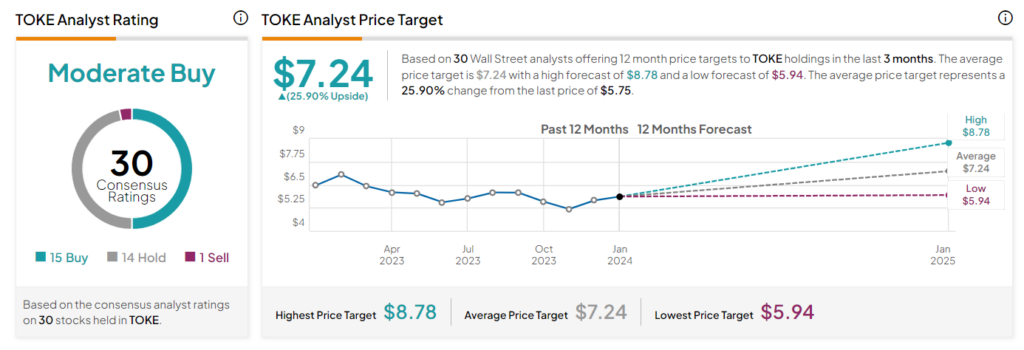

On TipRanks, TOKE has a Moderate Buy consensus rating. Of the 30 stocks held, 15 have Buys, 14 have a Hold rating, and one has a Sell rating. The average TOKE ETF price target of $7.24 implies a 25.9% upside potential from the current levels. The ETF has gained 9.7% in the past three months.

Ending Thoughts

Investing in sector-focused ETFs helps provide diversification and potential growth opportunities. Both THCX and TOKE ETFs are worth considering by investors given their solid upside potential.