Investors looking for exposure to the alternatives asset class, including hedge funds, long/short, and managed futures, among others, could take a look at Alternatives ETFs. Today, we have leveraged the TipRanks ETF Screener to scan for two such ETFs with more than 10% upside potential: Future Fund Long/Short ETF (FFLS) and Changebridge Capital Long/Short Equity ETF (CBLS).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a look at what Wall Street thinks about these two ETFs.

Future Fund Long/Short ETF (FFLS)

The Future Fund Long/Short ETF aims to achieve capital appreciation by investing in equity securities anticipated to benefit from emerging growth trends. Simultaneously, it employs short positions in securities expected to be adversely affected by these trends. FFLS has $2.04 million in assets under management (AUM), with its top 10 holdings contributing 93.24% of the portfolio.

On TipRanks, FFLS has a Moderate Buy consensus rating. Of the 32 stocks held, 28 have Buys, and 4 have a Hold rating. The average FFLS ETF price target of $23.63 implies a 17.1% upside potential from the current levels. The ETF has gained 7.1% in the past three months.

Changebridge Capital Long/Short Equity ETF (CBLS)

The Changebridge Capital Long/Short Equity ETF seeks long-term capital appreciation while minimizing volatility. CBLS has $8.21 million in AUM, with the top 10 holdings contributing 57.02% of the portfolio.

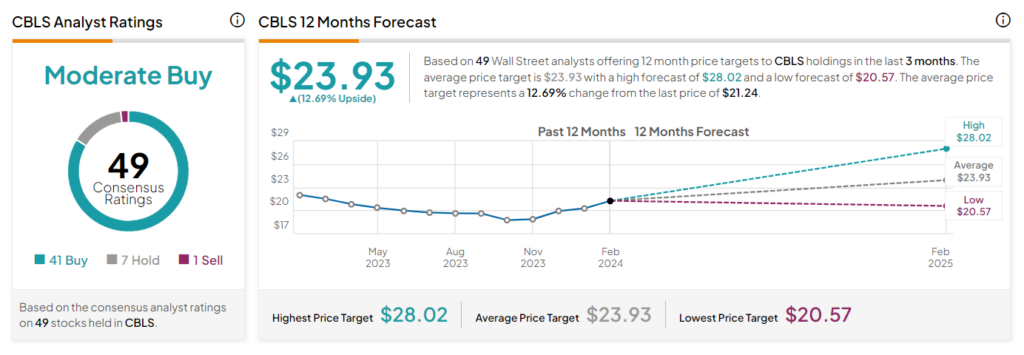

On TipRanks, the CBLS ETF has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 49 stocks held, 41 have Buys, seven have a Hold rating, and one Sell rating. The average CBLS ETF price forecast of $23.93 implies a 12.7% upside potential from the current levels. The CBLS ETF has gained 12.1% in the past three months.

Ending Thoughts

Alternatives ETFs are an affordable and transparent way to gain exposure to several alternative asset classes and investment strategies. Moreover, these ETFs have the potential to reduce portfolio risk and provide access to niche sectors.