Mutual funds offer diversification to investors, allowing them to invest in various stocks simultaneously. These funds provide ample liquidity, facilitating convenient buying and selling. Today, we have focused on a multi-cap fund, VSMPX, with the potential to earn more than 10% appreciation in the next twelve months.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a closer look at this fund, which offers exposure to stocks with varying market capitalizations.

Vanguard Total Stock Market Index Fund Institutional Plus Shares

The VSMPX fund offers investors exposure to the entire U.S. stock market, including growth and value stocks of small, mid, and large-cap companies. What stands out is its significantly low expense ratio of 0.02% and broad diversification. As of today, VSMPX has 3,794 holdings with total assets of $1.31 trillion.

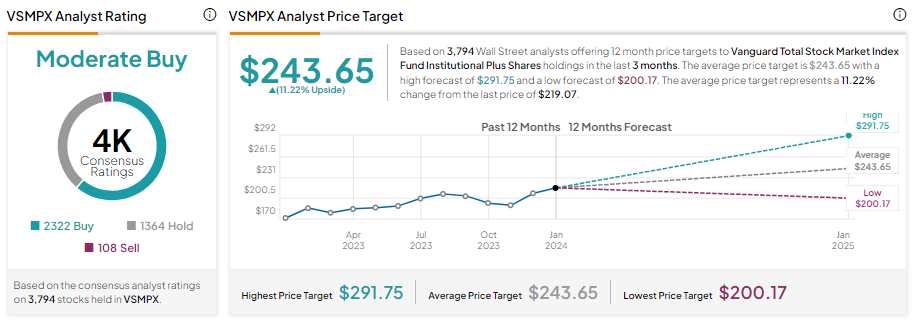

On TipRanks, VSMPX has a Moderate Buy consensus rating. This is based on 2,322 stocks with a Buy rating, 1,364 stocks with a Hold rating, and 108 stocks with a Sell recommendation. The average VSMPX mutual fund price target of $243.65 implies 11.22% upside potential from the current levels.

VSMPX has delivered a return of about 18% over the past year. Moreover, its top three holdings include technology giants such as Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Amazon (NASDAQ:AMZN).

Bottom Line

Investors seeking exposure to multi-cap growth and value stocks could consider VSMPX. Moreover, analysts’ average price target suggests that VSMPX provides an upside potential of about 11% over the next 12 months.