Semiconductor giant ARM Holdings (ARM) will release its Q2 FY25 results on November 6. Wall Street analysts expect the company to report earnings of $0.26 per share, representing a 28% decrease year-over-year. On the contrary, revenues are expected to grow slightly, by 0.5%, from the year-ago quarter to $810 million, according to data from the TipRanks Forecast page.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Interestingly, ARM Holdings has an impressive track record, consistently surpassing EPS estimates in each of the past four quarters. Additionally, its stock has surged 83% year-to-date and 159% over the last 12 months.

Insights from the TipRanks Bulls & Bears Tool

Despite an expected rise in revenues, analysts forecast a decline in earnings, adding to the mixed outlook on the company’s performance.

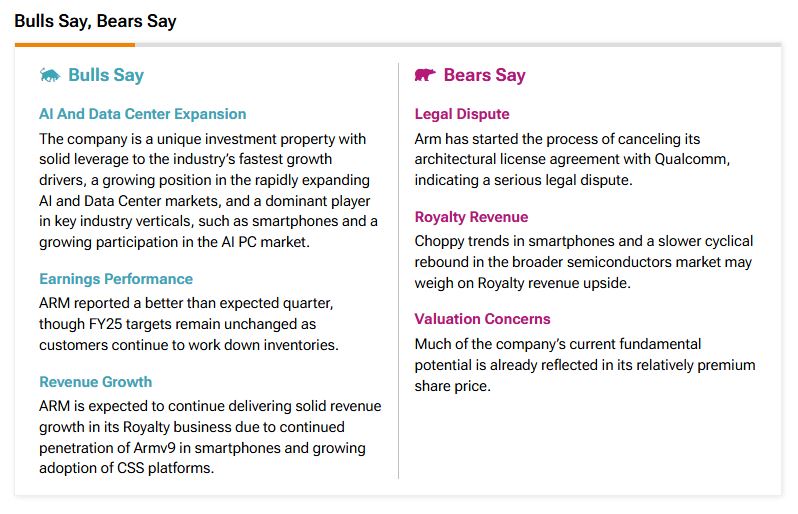

According to TipRanks’ Bulls Say, Bears Say tool pictured below, bullish analysts highlight ARM’s strong position in smartphones and its growth into AI-powered PCs. They are also encouraged by ARM’s better-than-expected Q1 results. Looking ahead, they expect solid growth in the Royalty segment due to increasing adoption of the company’s Armv9 architecture.

On the other hand, bearish analysts have their own concerns that cannot be ignored. They note ARM’s legal dispute with Qualcomm, which may hurt business relations. They also highlight concerns about fluctuating smartphone demand and a slower recovery in the semiconductor market.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting an 11.60% move in either direction.

Is ARM Holdings a Good Stock to Buy?

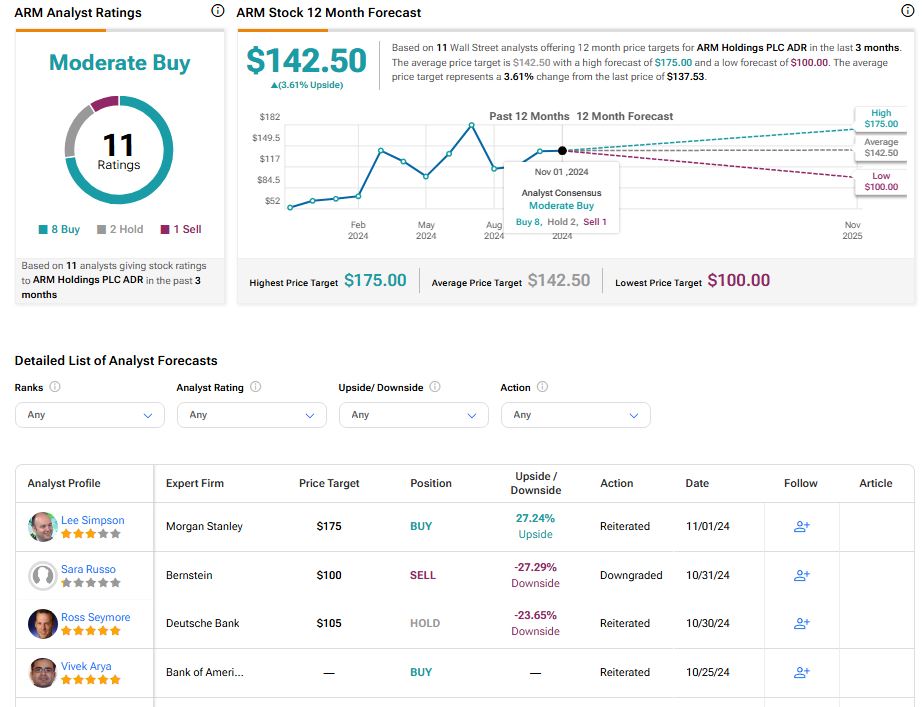

Turning to Wall Street, Arm earns a Moderate Buy consensus rating based on eight Buy, two Hold, and one Sell ratings assigned in the past three months. The average ARM stock price target of $142.50 implies 3.61% upside risk from current levels.