Investment firm Argus upgraded coffee chain Starbucks (SBUX) to a Buy rating after labeling its recent stock decline as a buying opportunity. Investors have been worried about slowing same-store sales in the restaurant industry due to economic concerns, but Argus believes that these fears may be overblown. Indeed, the firm expects Starbucks to benefit from its focus on digital improvements and brand marketing, as well as its reduction of sales promotions.

As a result, 4.6-star analyst John Staszak is optimistic that Starbucks’ plan to simplify its menu and remodel stores will help attract more customers and increase same-store sales growth. Therefore, he raised his FY25 earnings per share estimate to $3.18 and expects FY26 EPS to reach $3.80. These improvements, along with Starbucks’ strong brand presence, could support long-term growth for the coffee giant.

Argus also assigned a long-term Buy rating on Starbucks and a price target of $115 due to its attractive dividend yield, strong business outlook, and shift from stock buybacks to expanding store locations. Indeed, the company has not repurchased shares since Q4 2023. It is also worth noting that, so far, Staszak has enjoyed a 57% success rate on SBUX stock, with an average return of 15.5% per rating.

Is Starbucks a Buy or Sell?

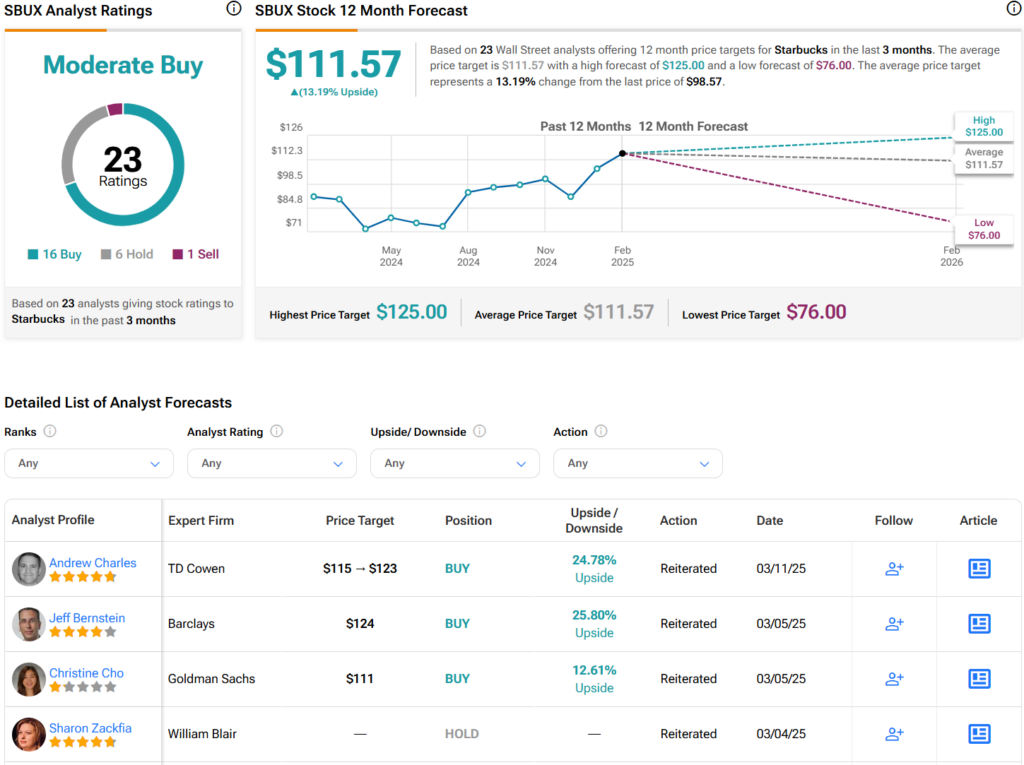

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SBUX stock based on 16 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average SBUX price target of $111.57 per share implies 13.2% downside risk.