A key market measure called the “Buffett Indicator” is suggesting that U.S. stocks are relatively cheap, which supports the idea that the recent rebound still has room to continue. The indicator compares the total value of U.S. stocks, using the Wilshire 5000 Index, to U.S. GDP and is now at its lowest point since early September, even after stocks have risen sharply in recent weeks. In the past, Warren Buffett, CEO of Berkshire Hathaway (BRK.B), has called this ratio the “single best measure” of stock valuations. Last year, it hit record highs and warned of risk, but it has since dropped to 180%, a level last seen after a brief market selloff in 2024 that paved the way for a strong S&P 500 (SPY) rally.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Some investors view this as a chance to buy. Adam Sarhan of 50 Park Investments said cheaper valuations are encouraging buyers, especially since trade tensions have eased for now. However, uncertainty remains. The S&P 500 has bounced 12% from April lows but is still down about 9% from its February peak. Investors are now debating whether momentum will push stocks higher or if risks like trade war concerns and disappointing earnings could pull them back down. Therefore, upcoming earnings reports and a Federal Reserve meeting are expected to help decide the market’s direction.

Even though valuations are lower, they are still higher than during previous market bottoms. For example, during the COVID-19 selloff in 2020, the Buffett Indicator fell to nearly 100%. Critics argue that this indicator has flaws, especially since it doesn’t factor in higher interest rates, which can reduce profits and hurt stock prices. Still, investors pay close attention to Buffett, who is known for buying undervalued stocks, and many will be eager for Berkshire Hathaway’s annual meeting this Saturday to see if Buffett used some of the company’s $321 billion cash reserves to buy stocks during the recent dip.

What Is a Fair Price for BRK.B?

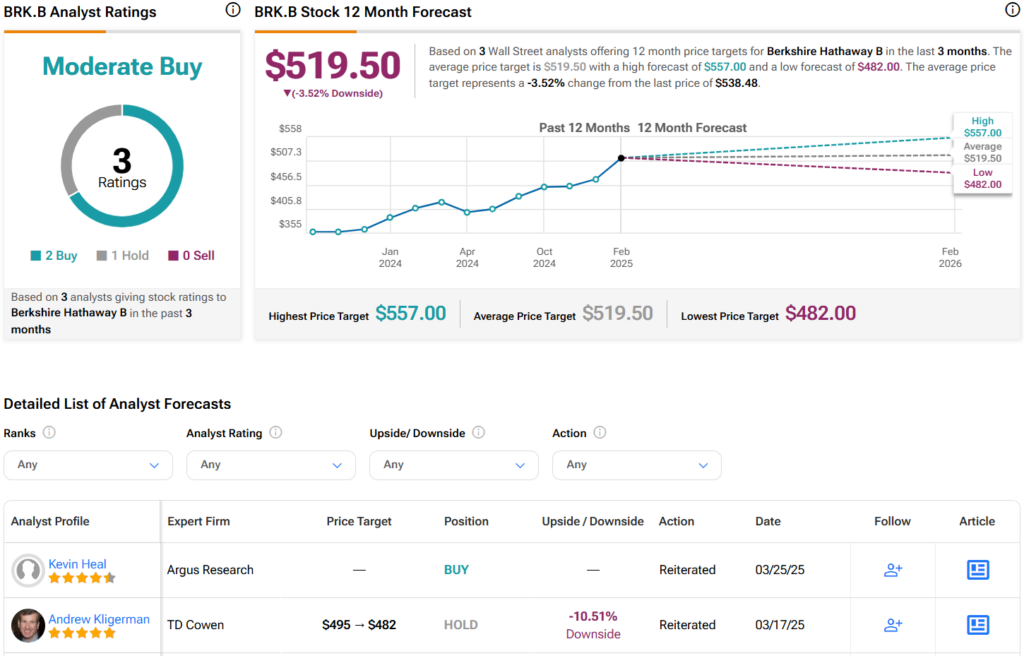

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BRK.B stock based on two Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average BRK.B price target of $519.50 per share implies 3.5% downside risk.