Archer Aviation (NASDAQ:ACHR) stock is coming back down to earth today, tumbling ~14% as investors lock in gains after its post-earnings rally. Shares had soared more than 40% following Archer’s upbeat Q1 2025 report, but the pullback suggests a dose of realism, as the company still faces a long road to certification and commercialization.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

That said, the dip doesn’t necessarily change the long-term story, which remains full of promise. The company reiterated that it remains “on track” with its piloted Midnight aircraft for the UAE market this summer. Archer’s partnership with the white-hot Palantir is also generating buzz, as the two work together to develop advanced AI systems aimed at powering the next generation of electric aviation.

So, is this a buy-the-dip moment? Top investor Dhierin Bechai thinks so, seeing Archer on the verge of a pivotal turning point.

“Archer Aviation is making small but very meaningful steps toward certification and service entry of its Midnight aircraft. In many ways the company is at an inflection point with capital expenditures expected to tick down for the full year, piloted flight test to start and commercial service entry later this year with a significant increase in production,” says the 5-star investor, who sits in the top 1% of TipRanks’ stock pros.

Bechai is encouraged by ACHR’s putative air taxi service in the New York area, especially its progress in working with notable infrastructure partners to ready the ground with electronic charging stations.

The investor is also very pleased with the company’s international ambitions, pointing out that the collaboration with Ethiopian Airlines opens up a vast range of new opportunities in geographies with less developed infrastructures in place.

Bechai expects piloted test flights and commercial service to ramp up as the year progresses, which will be coupled with a meaningful increase in production. While the company did absorb a hefty EBITDA loss of $109 million during the recently concluded quarter, the investor is confident that Archer’s large cash balance lessens liquidity risks going forward.

“All of those are positives and… I am attaching a strong buy rating,” Bechai summed up. (To watch Bechai’s track record, click here)

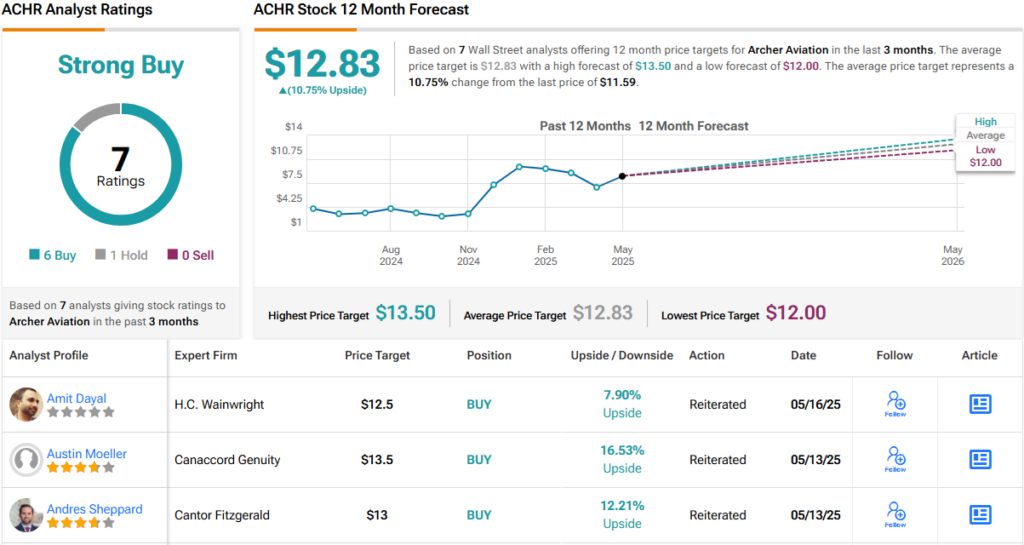

Strong Buy is also the verdict on Wall Street. With 6 analysts calling it a Buy and just 1 sitting on the fence with a Hold, ACHR boasts a Strong Buy consensus rating. The average 12-month price target stands at $12.83, implying there’s ~11% upside ahead. (See ACHR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.