Archer Aviation (NYSE:ACHR) stock blasted 22% higher in Tuesday’s session after the eVTOL company dialed in its Q1 results. As Archer is still in the pre-revenue stage, the numbers were all about how much it spent during the quarter rather than any sales figures.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Archer reported an adjusted EBITDA loss of approximately $109 million and used around $105 million in free cash during the quarter. The adjusted EBITDA result was at the upper end of the company’s prior Q1 guidance and represents an increase in losses of roughly 15%. R&D expenses rose 9.6% from the previous quarter to $103.7 million, driven by progress in Archer’s commercialization strategy and ongoing prototype and component production activities in Georgia and California. Additionally, G&A expenses rose about 36% quarter-over-quarter to $40.3 million, largely due to increased staffing levels to support development, testing, and the ramp-up of manufacturing operations in Covington, Georgia.

All of that is hardly the kind of stuff investors are likely to get excited about. Yet, the positive reaction can be put down to the fact Archer appears to be making real progress toward reaching the revenue-generating stage.

Management said that the company has successfully completed ground tests, transition tests, and a range of other technical evaluations to prepare its aircraft for flight. As a result, piloted flights are expected to kick off within the next few days.

H.C. Wainwright analyst Amit Dayal underscores the significance of this milestone, noting: “We believe this is an important development as it should allow the company to deliver at least one aircraft to UAE by this summer to begin regional testing. We believe this timeline aligns with the company’s reiterated target of deployment in UAE by year-end.”

The company expects total cash usage for the year to stay around $450 million, with management projecting an adj. EBITDA loss of $100–120 million for Q2 2025.

“We believe these needs are very comfortably accounted for with over $1B in the company’s balance sheet, excluding $400M Stellantis funding to scale eVTOL manufacturing,” Dayal opined.

Beyond the commercial launch, Archer continues to make headway in defense and software initiatives. Its collaboration with Anduril Industries to develop a hybrid VTOL aircraft for defense applications is actively underway, with engineering teams now working together on-site. Meanwhile, its partnership with Palantir to co-develop aviation software could unlock future revenue streams that Dayal notes are not yet priced into his forecasts.

Looking ahead, Daya sees several near-term catalysts. “We believe regulatory support to bring eVTOLs to market remains in place. We continue to maintain that aircraft deliveries, certification completion, and piloted flight milestones should be the key catalysts for the stock,” the analyst said.

To this end, Dayal rates ACHR shares a Buy, alongside a $12.5 price target, implying the stock will climb 12% higher in the months ahead. (To watch Dayal’s track record, click here)

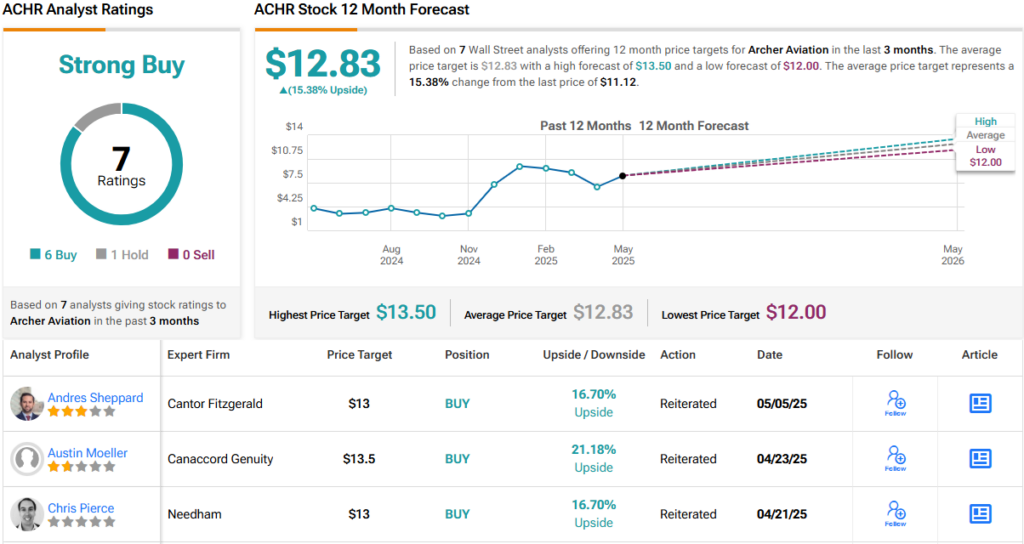

Wall Street largely shares the optimism. With 6 Buys and just 1 Hold, the consensus rating lands at Strong Buy. The average price target of $12.83 suggests the stock could climb about 15% over the next 12 months. (See ACHR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue