Archer Aviation (ACHR) will report its third-quarter results on November 6, and the feeling is that the company stands at a key point in its push toward commercial flight. The electric air taxi maker has shown visible progress in flight testing and global deals, but it still faces the long road of certification and spending before real revenue begins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In this piece, we look at where Archer Aviation stands today as it moves closer to commercial flights and prepares to report its third-quarter results.

Certification and Operations

Archer’s top goal remains U.S. certification for its Midnight aircraft. So far, about 15% of the required work has been cleared by the Federal Aviation Administration. The company has joined the new federal eVTOL Integration Pilot Program, which will allow it to test flights with the Department of Transportation and the FAA as early as 2026. The move gives Archer a pathway to show its aircraft can operate safely in cities before full approval.

At the same time, test flights have grown more advanced. Recent flights in California reached 7,000 feet and covered up to 55 miles in about 30 minutes. These results suggest that Midnight is gaining range and speed with each stage of testing. Still, design changes, such as a new front propeller, indicate that more work needs to be done before full readiness.

Global and Local Deals

Beyond technical improvements, Archer continues to expand its global network. In the United Arab Emirates, the company delivered its first Midnight aircraft to Abu Dhabi and began flight trials under a deal with Abu Dhabi Aviation and the Abu Dhabi Investment Office. A separate project with Cleveland Clinic Abu Dhabi aims to create the first hospital-based vertiport in the region. These steps mark the start of Archer’s commercial setup abroad, with early programs valued at $18 million to $30 million each.

In Japan, Archer’s partner Soracle, a venture between Japan Airlines and Sumitomo Corporation, was chosen to lead air taxi services in Osaka. In South Korea, Archer signed an exclusive deal with Korean Air that includes the option to buy up to 100 aircraft. In the U.S., Archer became the official air taxi partner for the Los Angeles Sports & Entertainment Commission, which supports major events such as the 2026 FIFA World Cup and the 2028 Olympic Games.

Financial Standing

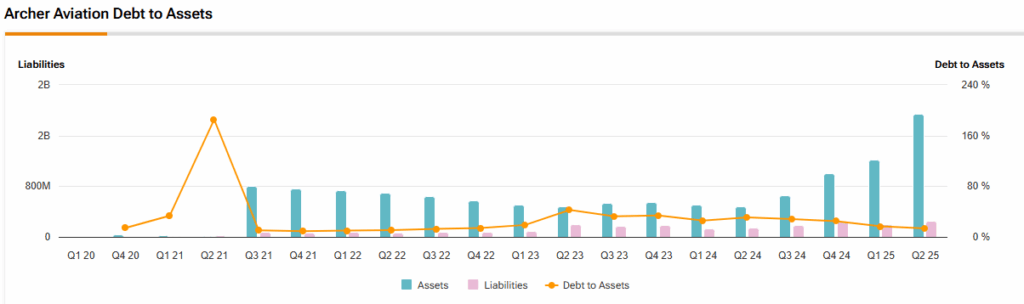

From a financial point of view, Archer remains in a heavy investment phase. In the second quarter, it reported a net loss of $206 million, missing analyst expectations. Cash use reached about $127 million, mainly due to higher spending on production and international programs. However, the company ended the period with $1.7 billion in cash and equivalents, helped by an $850 million capital raise earlier this year. That balance still gives Archer room to keep building without raising more funds in the short term.

Archer also issued up to $5 million in warrants to a service provider as payment based on performance goals. The move limits cash spending but adds slight dilution for shareholders.

Grizzly’s Short Report

Wall Street analysts remain largely positive. Still, investors have faced mixed signals. Short seller Grizzly Research recently questioned Archer’s order book, certification pace, and production claims, comparing it to troubled past ventures. In contrast, bullish investors highlight its global deals, large cash position, and steady progress in testing as proof of momentum.

The upcoming earnings call may not deliver major surprises, but investors will be watching for any update on FAA milestones, cash use, and near-term revenue plans. For now, the story remains one of building, testing, and waiting for clearance to fly.

Is Archer Aviation Stock a Good Buy?

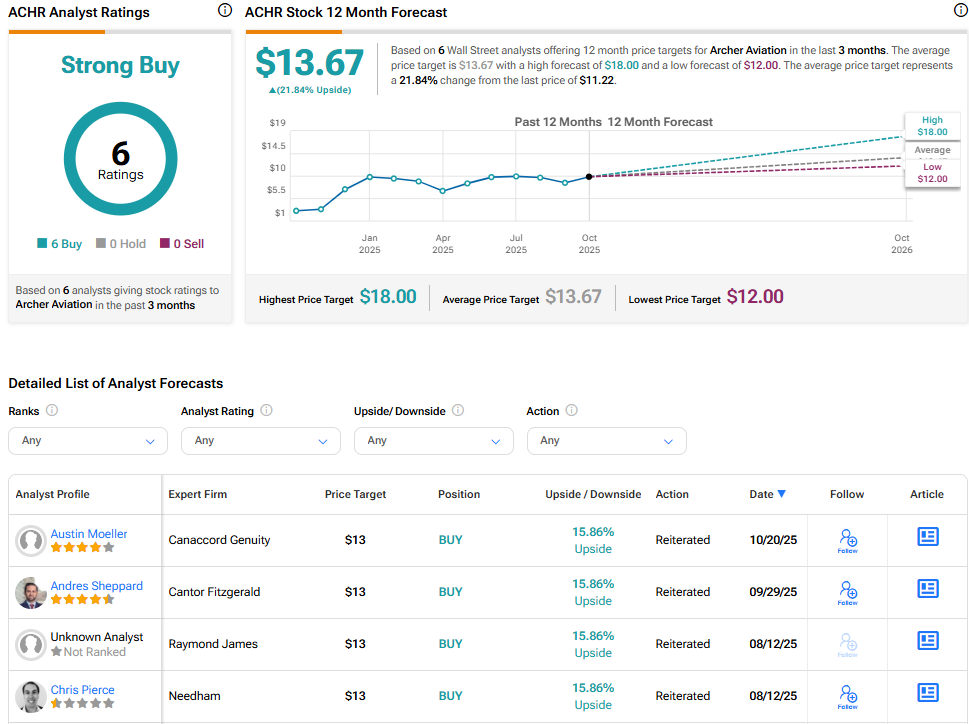

On Wall Street, analysts remain optimistic about the company’s prospects. Based on six recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.67. This implies a 21.84% upside from the current price.