Archer Aviation (ACHR) and Joby Aviation (JOBY) are two of the most closely followed electric air taxi companies. Both are early stage, both carry high losses, and both are pushing for certification milestones. Yet analysts see them very differently. In this piece, we’ll explore the different takes and angles of the Street’s analysts regarding both companies’ long-term prospects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Archer Aviation: Strong Buy Consensus

Archer Aviation has built a strong base of support from Wall Street. In the past month, ACHR has received 16 Buy ratings, 1 Hold, and zero Sell ratings. The average price target is $13.14, which points to over 40% upside from the current price of $8.95. H.C. Wainwright is the most bullish, placing an $18 target on the stock.

The company’s second-quarter call showed progress despite heavy costs. Archer reported a net loss of $206 million and an adjusted EBITDA loss of $190 million. At the same time, management guided toward international expansion and new defense deals. The company has six Midnight aircraft in production and has been named as the official air taxi for the 2028 Los Angeles Olympics. It also closed the quarter with $1.7 billion in cash, helped by a new $850 million financing round in June.

Still, risks are high. Archer faces challenges with FAA certification, and its Q2 report flagged policy hurdles that could affect the timeline. Risk tracking reveals 48 risks in total, with finance and corporate issues accounting for 42%. Even so, analysts continue to favor the long-term story, pointing to government support, fleet growth, and strategic acquisitions, all of which justify the heavy losses. Moreover, Archer has accumulated enough cash to absorb these losses.

Joby Aviation: Mixed Views and Hold Consensus

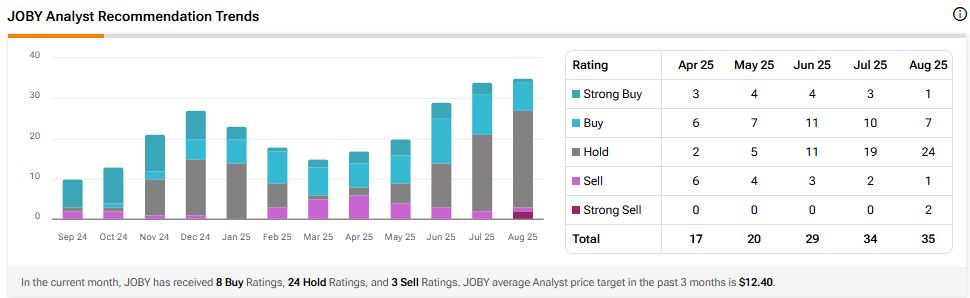

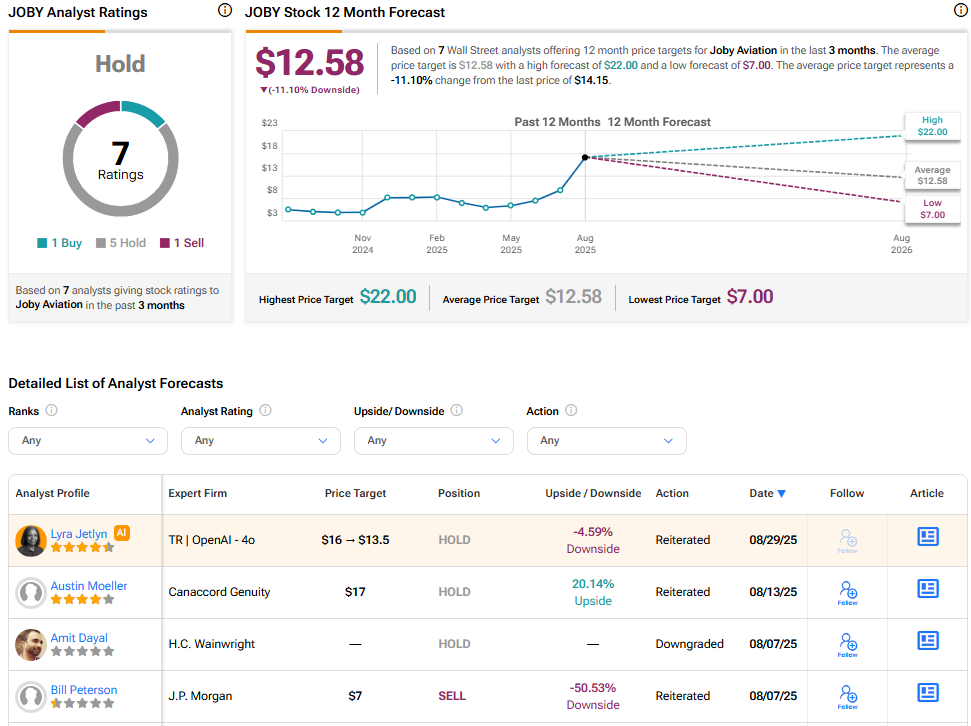

Joby Aviation shows a different pattern. In the latest month, eight analysts rated it a Buy, 24 a Hold, and 3 rated it a Sell. The average price target is $12.40, which implies a 12% downside from the current price of $14.15. Needham stands out as the most bullish, with a $22 target that points to 55% upside. On the other end, J.P. Morgan and Morgan Stanley both see the stock falling to $7, a drop of about 50%.

The second-quarter earnings call reflected that split view. Joby reported a net loss of $325 million, including a $168 million operating loss and a $157 million non-operating loss. Operating expenses were $168 million, up from the prior quarter. Yet the company highlighted progress on certification, saying it had completed 70% of Stage 4 with the FAA. Joby also announced the acquisition of Blade’s passenger business and a new defense project with L3 Harris.

Joby’s risk profile remains heavy. It carries 50 tracked risks, spread across finance, legal, production, and ability to sell. Its record against analyst expectations is weak, with earnings beats only 25% of the time over the past year. That explains why most analysts stay cautious, even as the company grows its revenue base and flight testing program.

The Bottom Line

Archer Aviation has won stronger conviction from analysts, who see government ties, expansion plans, and a large cash reserve as key strengths. Joby Aviation has made important gains in certification and acquisitions, but faces more mixed views due to higher expenses and weaker consistency. For now, Wall Street views Archer as the stronger Buy, while Joby earns a more cautious Hold.