This article was written by Shalu Saraf and reviewed by Gilan Miller-Gertz.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Archer Aviation (ACHR) and Joby Aviation (JOBY) remain two of the most closely watched names in the eVTOL (electric vertical takeoff and landing) space as both work toward FAA approval and future commercial service. Using TipRanks’ Stock Comparison Tool, we compared how Wall Street rates each stock and where analysts see more upside in 2026.

Archer Aviation (NYSE:ACHR) Stock

Archer stock fell about 21% in 2025 as investors reacted to FAA delays, rising development costs, and ongoing cash burn concerns. The company said it is still working toward the next FAA milestone, with full commercial approval not expected until late 2026 or possibly into 2027.

Even so, Archer has continued to push forward with several strategic moves. The company has moved ahead with plans to take control of Hawthorne Airport in Los Angeles. It is also expanding overseas, with a new engineering hub in the U.K. In addition, Archer has signed an agreement with Saudi aviation regulators and joined early pilot programs aimed at preparing cities for future air taxi launches.

On the earnings front, Archer posted a smaller loss of $0.20 per share in Q3 2025, compared with $0.29 a year ago and better than Wall Street’s forecast of $0.30. The company ended the quarter with $1.64 billion in cash and short-term investments, giving it support as development continues. For now, Archer remains a pre-revenue business. However, CEO Adam Goldstein said revenue is expected to start in the first quarter of 2026, as the company moves closer to commercial launch.

Is Archer Aviation Stock a Good Buy?

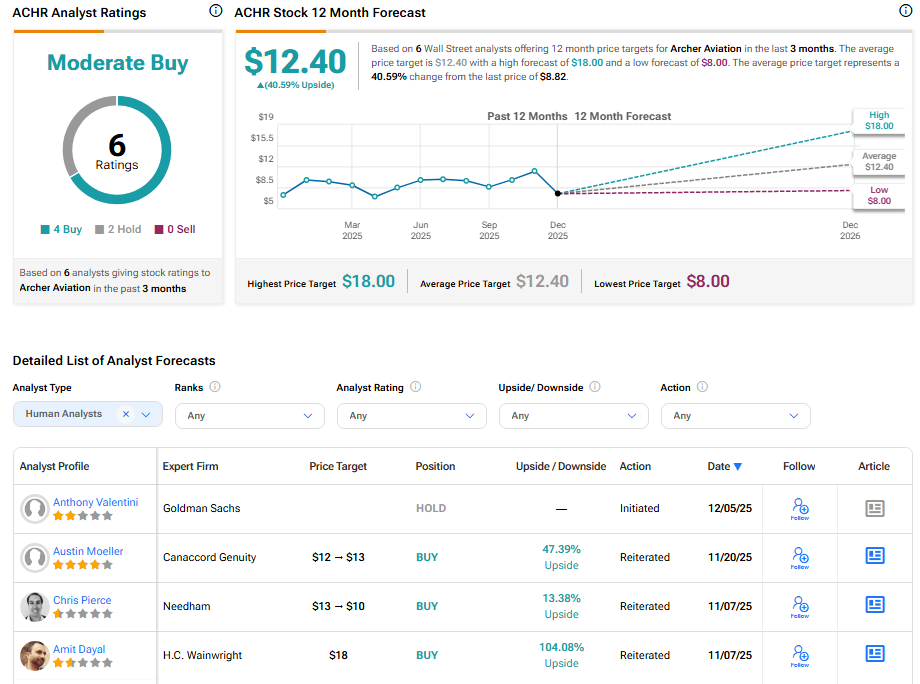

Wall Street analysts remain cautiously optimistic about the company’s prospects. Based on six recent ratings, Archer Aviation boasts a “Moderate Buy” consensus with an average ACHR stock price target of $12.40. This implies a 40.59% upside from the current price.

Joby Aviation (NYSE:JOBY) Stock

Joby shares rose about 58% in 2025 as investors grew more confident in the company’s FAA progress. The company recently reached an important step with its first aircraft built to full FAA standards and has moved into the next round of testing, including power-on tests with the regulator.

At the same time, Joby is preparing for expanded production. The company plans to double its U.S. factory capacity and aims to build up to four electric air taxis per month by 2027. It has also disclosed more than $1 billion in possible aircraft service sales, pointing to early demand ahead of launch.

On the earnings side, Joby reported a loss of $0.48 per share in Q3 2025. The company also reported $23 million in revenue, mainly from government and defense-related work, not from commercial air taxi service yet. Analysts see this as a positive step, showing Joby can generate income while it works toward approval and full commercial operations.

Is Joby Aviation a Good Company to Invest In?

According to TipRanks, JOBY stock has received a Hold consensus rating, with one Buy, four Holds, and two Sells assigned in the last three months. The average stock price target for Joby is $15.50, suggesting a potential downside of 4.91% from the current level.

Conclusion

Archer Aviation offers the higher upside, with analyst price targets pointing to about 41% potential gains. That comes even though the stock is down roughly 25% over the past year and carries a Moderate Buy rating.

By comparison, Joby Aviation is up about 56% over the past year. After that run, upside looks limited, as the average price target points to a small downside of around 5%, and analysts rate the stock a Hold.

In short, Archer offers higher risk and reward, while Joby shows steadier progress but less upside in 2026.