Archer Aviation (ACHR) filed a Form 144 with the SEC that shows a planned insider share sale. As a result, some investors may wonder if this move signals a change in outlook. However, when viewed in full context, the filing points to a routine action rather than a warning sign.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meanwhile, ACHR shares were off to a strong start in 2026, rising 8.11% on Friday to close at $8.13.

What the Filing Shows

The filing comes from Thomas Muniz, an officer at Archer Aviation. He disclosed plans to sell up to 125,000 shares of Class A stock. The shares are valued at about $1 million based on recent prices. The sale may take place on or after January 2, 2026 and would be handled through Fidelity Brokerage Services.

Importantly, these shares came from stock compensation that vested in May 2024. This means they were earned as part of pay rather than bought in the open market. In addition, the sale is tied to a Rule 10b5-1 trading plan that was set up in September 2025. Such plans are made in advance and help avoid trades based on non-public data.

How Investors Should Read It

In scale, the planned sale is small. Archer Aviation has more than 650 million shares outstanding. This sale equals about 0.02% of the total share count. As a result, it has no real impact on ownership or supply.

There is also recent context to note. Muniz sold shares in November 2025 under similar terms. That activity followed the same pattern of gradual stock sales tied to compensation. Therefore, this filing fits a steady approach rather than a sudden shift.

In the end, Form 144 filings often look alarming at first glance. However, many reflect normal pay related sales by company leaders. In this case, the details point to a planned and limited move. For investors, attention is likely to stay on Archer’s progress toward certification and future launches rather than on routine insider filings.

Is Archer Aviation Stock a Good Buy?

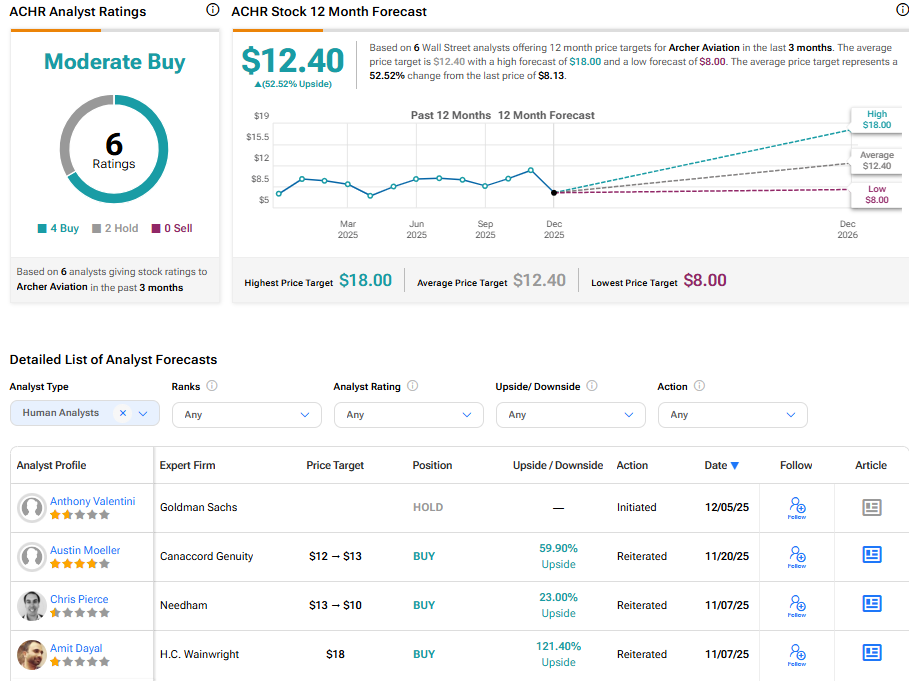

Despite volatility in Archer’s shares in 2025, Street analysts remain optimistic about the company’s prospects. Based on six recent ratings, Archer Aviation boasts a “Moderate Buy” consensus with an average ACHR stock price target of $12.40. This implies a 52.52% upside from the current price.