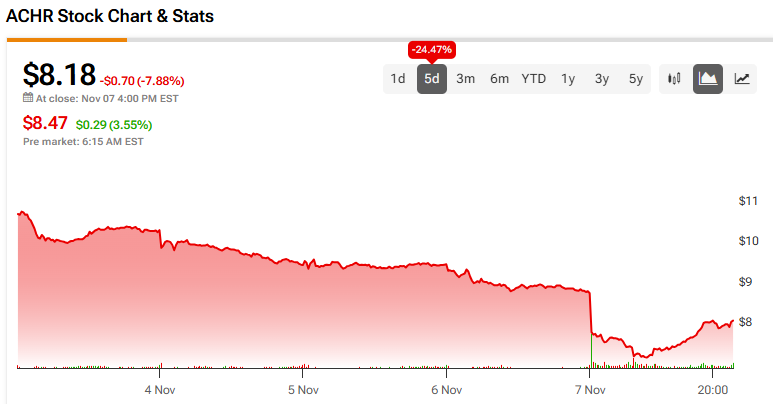

Archer Aviation (ACHR) reported its third-quarter results late last week, and investors reacted with a sell-off. Since then, the share price has dropped more than 45% from its October peak and closed at $8.18 on November 7. Even so, Wall Street analysts remain broadly positive, and the stock holds a Strong Buy consensus based on seven ratings. However, two well-followed investors, five-star investor The Alpha Analyst and top investor JR Research, offer a more measured view.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

FAA Progress and Liquidity in Focus

First, top investor JR Research sees the recent sell-off as part of a broader move away from speculative, cash-burning stocks. While Archer raised $650 million in new equity, boosting its total liquidity above $2 billion, JR notes that the path to certification remains complex. According to the investor, FAA approval is the most critical hurdle for Archer, and the timeline includes multiple steps that could stretch over several years. Archer expects to begin its first Type Inspection Authorization by the end of 2025, but that milestone is only the start of a longer process.

Five-star investor The Alpha Analyst agrees that certification will define the near-term outlook but sees peer company Joby Aviation (JOBY) as better positioned. Joby is further along in FAA testing, with for-credit pilot trials already underway and commercial readiness expected to arrive sooner. In contrast, Archer is still working through earlier certification phases. The Alpha Analyst believes that this timing gap gives Joby an edge in market entry, credibility, and adoption.

Strategy Diverges Between Peers

The two investors also highlight the different capital strategies taken by the two electric aircraft makers. Archer spent $126 million in cash to acquire Hawthorne Municipal Airport, which it plans to use as a future hub for operations in Los Angeles. JR Research sees this as a strategic move but questions the timing, given the company’s current spending needs and pre-revenue stage.

Meanwhile, Alpha Analyst notes that Joby is focusing more on manufacturing and real-world testing. Joby added over 100 production jobs, scaled up parts output, and flew more than 600 test flights in 2025. Alpha Analyst also states that Joby already reported $22.6 million in early revenue from Blade services in the third quarter. While both firms have letters of intent from major airlines, Joby’s actual revenue sets it apart at this stage.

JR Research maintains a Hold rating on Archer, citing the company’s high valuation and the need for perfect execution through 2029 to meet long-term targets. The Alpha Analyst takes a more active approach, recommending a pair trade: buy Joby Aviation while selling Archer Aviation to hedge sector risk, leaning toward the company that shows stronger near-term progress.

For now, Archer’s story depends on certification timelines, capital discipline, and commercial execution. Investors following JR Research and The Alpha Analyst are watching closely to see if the company can meet high expectations with the funding now in place.

Is Archer Aviation Stock a Good Buy?

Despite the bearish and neutral sentiment of both investors and the stock’s steep decline after earnings, the Street’s analysts remain optimistic about the company’s prospects. Based on seven recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average ACHR stock price target of $12.43. This implies a 51.96% upside from the current price.