In a recent interview on Bloomberg Businessweek Daily, Adam Goldstein, Chairman and CEO of Archer Aviation (ACHR), shared new details about the company’s timeline for commercial rollout, providing investors with a clearer view of the near-term future. He said that Archer expects to start recognizing revenue in the first quarter of 2026, marking its transition from research and development to early commercialization. The numbers will be minor at first, but will start to ramp up from thereon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Goldstein added that full-scale passenger flights are planned for 2028 once all required certifications, infrastructure, and fleet systems are ready. Before that stage, Archer’s Midnight aircraft is set to begin flying in mid-2026. The company also plans to announce five launch cities soon, covering both U.S. and international markets.

At the same time, Goldstein noted that discussions with the Federal Aviation Administration (FAA) are ongoing, though progress has slowed due to the current government shutdown. Still, he emphasized that Archer is balancing domestic certification work with international partnerships, including one with the United Arab Emirates, to help speed up adoption of urban air travel.

Stock Pullback Follows a Strong Year

In the meantime, ACHR shares fell 7.1% on November 3 to close at $10.42 and dropped another 4.4% in pre-market trading the next day. The decline followed a strong year in which shares rose more than 220%, driven by optimism around partnerships and flight milestones.

However, some investors are now taking profits after the rally, while others are waiting for clarity on the company’s certification progress and upcoming financial report. Although the pullback may reflect short-term caution, Archer remains one of the key early players in the electric vertical takeoff and landing market, aiming to be among the first to bring air taxis to cities around the world.

Is Archer Aviation Stock a Good Buy?

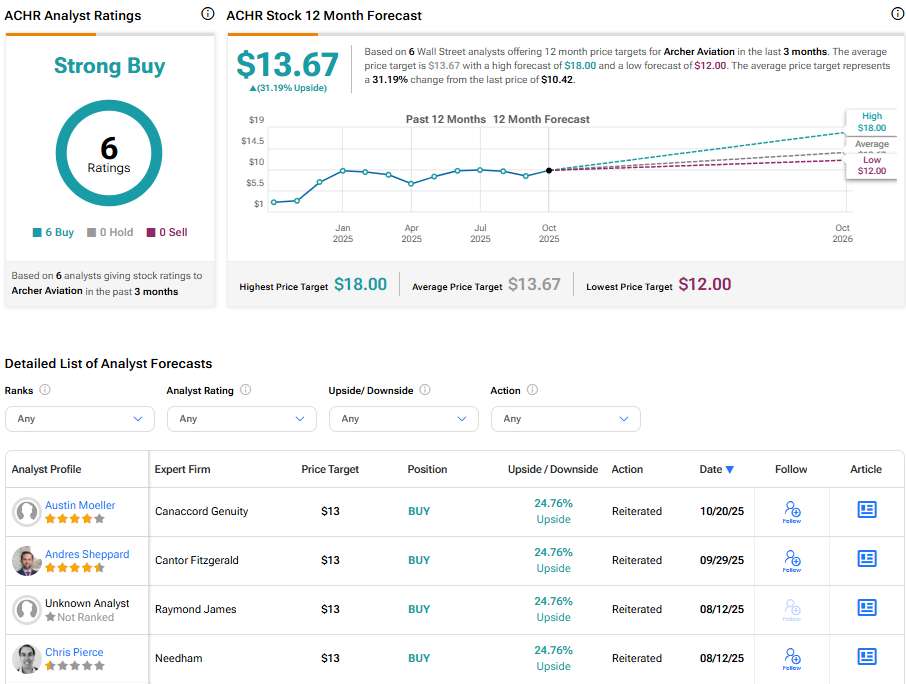

On Wall Street, analysts remain optimistic about the company’s prospects. Based on six recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.67. This implies a 31.19% upside from the current price.