This week, Archer Aviation (ACHR) and Joby Aviation (JOBY) are drawing investor attention as both prepare to report their third-quarter results. The two air taxi makers are racing to bring electric vertical takeoff and landing (eVTOL) aircraft to market. Archer has announced new partnerships and steady progress with regulators, while Joby continues to expand testing and production.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As both remain pre-revenue companies, investors will watch closely for updates on certification, flight milestones, and plans for commercial launch.

Joby Aviation (NYSE:JOBY) Stock

Joby Aviation stock has surged 244% in one year, fueled by rising interest in its electric air taxis and expanding partnerships. The company recently teamed up with Nvidia (NVDA), becoming its sole aviation launch partner for the new IGX Thor platform. The deal aims to advance Joby’s Superpilot system and move closer to autonomous flight. Joby is also expanding production with new in-house propeller manufacturing at its Dayton, Ohio facility, a key step toward future commercial air-taxi operations.

Looking ahead, JOBY is scheduled to report its Q3 2025 earnings on November 5. Analysts expect the company to report a loss of $0.19 per share, versus a loss of $0.21 in the same quarter last year.

Ahead of the Q3 print, JPMorgan analyst Bill Peterson raised the price target on the stock to $8.00 from $7.00, while maintaining an Underweight rating.

Archer Aviation (NYSE:ACHR) Stock

Archer stock has surged 242% in the past year, driven by progress toward FAA approval, support from partners like United Airlines (UAL) and Stellantis (STLA), and expanding global deals. Earlier this month, Archer became the exclusive Air Taxi Partner of the Los Angeles Sports & Entertainment Commission, making it an official supporter of the 2026 FIFA World Cup and Super Bowl LXI. Shares also gained after Archer won a bid to acquire about 300 patent assets from Lilium GmbH for roughly €18 million ($21 million).

Following the deal, Canaccord Genuity analyst Austin Moeller reaffirmed a Buy rating on Archer, with a $13 price target. He said the acquisition gives Archer access to valuable eVTOL technologies that could strengthen its future aircraft lineup.

Looking ahead, Archer is scheduled to report its Q3 2025 earnings on Thursday, November 6, after market close. Analysts expect a loss per share of $0.30, compared to a $0.29 loss in the same period last year. Meanwhile, analysts project Q3 revenues at $400K, according to the TipRanks Analyst Forecasts Page.

Analysts Remain More Bullish on ACHR Ahead of Q3 Results

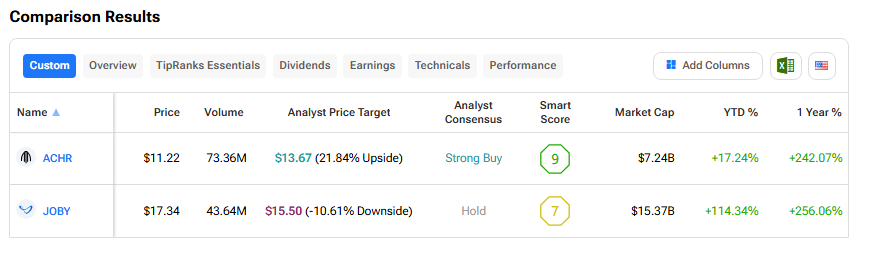

Using TipRanks’ Stock Comparison Tool, we compared Archer and Joby Aviation to see which air taxi stock analysts currently favor. Archer stands out with a Strong Buy rating and a Smart Score of 9, while Joby holds a Hold rating and a Smart Score of 7.

Analysts see greater upside potential in Archer, with an average price target of $13.67, implying about 22% upside from current levels. In contrast, Joby’s average price target of $15.50 points to a possible 11% downside.