Bermuda-based specialty insurance firm Arch Capital Group (ACGL) has beat earnings estimates by an average of 23.6% in its last two quarters, and analysts across Wall Street do not see the company’s momentum slowing down any time soon.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Thanks to a broadly diversified business model, Arch Capital has successfully managed risk and revenue volatility. Its recent acquisition history strengthens this diversification and contributes meaningfully to the firm’s efforts to build its client base. Additionally, Arch Capital benefits from strong pricing and premium growth in its property and casualty (P&C) and reinsurance businesses in particular.

These are some of the reasons why I joined the group of analysts who are bullish on Arch Capital’s future.

Diversification and Mitigation

Arch Capital maintains a healthily diversified array of products in its Insurance and Reinsurance businesses, including professional lines, property, energy, marine, aviation, construction, travel, and many other offerings. Its net premiums are also well-balanced between both Insurance and Reinsurance, with the 12-month period ending March 31, 2024, logging $6.0 billion in the former area and $7.1 billion in the latter.

Having a variety of business lines that each maintain positive expected margins has allowed Arch Capital to weather catastrophe-related losses successfully, such as the collision of the Dali cargo ship with the Francis Scott Key Bridge in Baltimore earlier this year.

Middle-Market Scaling

Key to Arch Capital’s near- and long-term growth prospects is its acquisition of the U.S. MidCorp and Entertainment insurance businesses from Allianz Global Corporate & Specialty SE, announced in April of this year.

The U.S. middle-market P&C insurance market is valued at more than $100 billion, providing Arch Capital plenty of room for expansion. The firm also stands to benefit from the addition of stable businesses with regularly recurring premiums in its North American business.

Favorable Rates and Growth

Arch Capital has enjoyed robust underwriting income and growth in multiple areas in recent months. In the first quarter, its Reinsurance business boomed, with underwriting income of $379 million and a 41% year-over-year increase to gross premium written.

Despite difficult market conditions, the company’s P&C area also posted strong gains in the first three months of the year. This unit wrote $5.6 billion of gross premium in that period, representing an increase of 26% compared with the prior-year quarter.

All told, the firm reported underwriting income of $736 million for the first quarter, an impressive 29.1% ahead of where it was a year earlier.

A favorable rates space has also allowed Arch Capital to grow its first-quarter net income available to common shareholders to $1.1 billion, or $2.92 per share, for a 24.6% annualized net income return on average common equity. Book value per common share rose by more than 5% year-over-year, reaching $49.36 as of the end of March 2024.

Arch Capital has been steadily growing its profit in recent quarters and posting better-than-expected figures to beat analyst predictions. However, as a P&C insurance firm, Arch Capital will always face exposure to catastrophic loss events such as the Dali mentioned above. This risk will always remain at play and can cause dramatic volatility in the company’s underwriting results in any particular quarter.

Analysts Say Arch Capital Stock Is a Buy

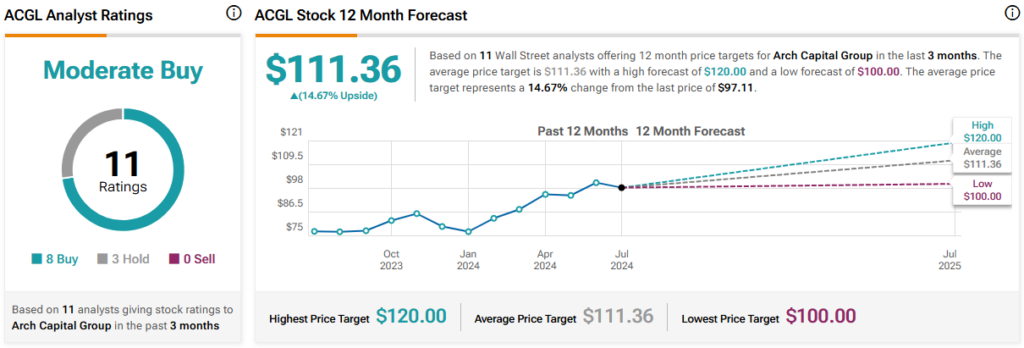

Nonetheless, analysts remain mostly optimistic about Arch Capital’s trajectory, going forward. The company enjoys a Moderate Buy rating based on eight Buys, three Holds, and zero Sells. The average ACGL stock price target of $111.36 represents upside potential of 14.7%.

Conclusion: Diversification, Acquisitions, and Growth

Arch Capital has managed the thorny insurance and reinsurance markets successfully by broadly diversifying its business, including through key acquisitions that will allow it to continue to expand into new sections of the market and will likely drive customer base growth. The firm’s underwriting has been robust despite the ongoing risk of catastrophic events. Further, analysts expect that the company will continue to rise from here. These factors combine to make the stock attractive at the moment.