When Arcadium Lithium (NYSE:ALTM) reports 2024 first-quarter earnings after the close on May 7, market expectations will be low. The $0.04 consensus EPS estimate reflects depressed lithium prices caused by an electric vehicle (EV) demand slowdown and industry oversupply. Regardless of whether the company outperforms, I believe that its ties to global EV growth and sub-$5.00 share price make it an intriguing longer-term investment.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

What Does Arcadium Lithium Do?

Arcadium Lithium is one of the world’s largest integrated lithium chemical producers. After completing a merger of equals between Allkem and Livent in January 2024, the newly combined company has a presence in all three major lithium geographies — the South American Lithium Triangle, Western Australia, and Canada.

Its hard rock and brine lithium resources could be a significant part of the EV supply chain in addition to being valuable inputs for consumer electronics and airplane parts manufacturers.

Lithium Prices Have Begun to Stabilize

In recent weeks, lithium prices have begun to stabilize, thanks to a strong EV market in China, which accounted for nearly 70% of all EV sales in 2023. While still well below November 2022 peak levels, the price of lithium carbonate is up about 20% year-to-date.

A potential lithium rebound could be very timely for Arcadium Lithium, which, post-merger, expects higher production volumes this year. Depending on realized pricing, management predicts that this will translate to revenue of $1.25 billion to $1.90 billion in 2024.

Based on this forecast, Wall Street sees this leading to EPS of $0.21 this year. This gives Arcadium Lithium stock a 2024 P/E ratio of approximately 22x. By comparison, global lithium producer Albemarle (NYSE:ALB) is trading at 33x this year’s earnings estimate.

To be fair, Arcadium Lithium and Albemarle isn’t an apples-to-apples comparison. Arcadium Lithium is a lithium pure play, while Albemarle produces bromine and other commodities. Still, Arcadium trades at a 50% discount to its larger peer. In my view, this is an attractive valuation, considering that both companies are highly exposed to long-term EV battery growth.

Technical indicators and Wall Street bullishness are other reasons to be bullish on the stock. Let’s discuss these reasons below.

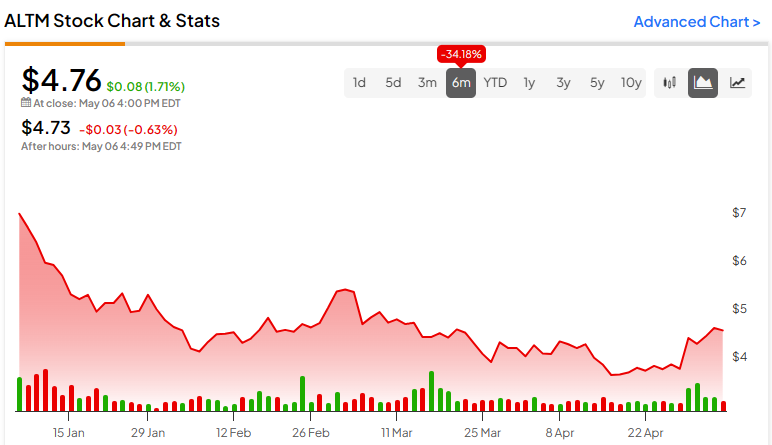

ALTM Technical Indicators Are Turning Bullish

Technical analysis of Arcadium Lithium has turned decidedly bullish. On the daily chart, several simple and exponential moving averages suggest that the stock is a Buy. For instance, the ALTM share price is significantly below both the 20-day and 50-day exponential moving average lines.

In terms of other technicals, Arcadium Lithium’s price rate of change (ROC) is 17.88. This momentum-based indicator tells us that the stock’s price is trending higher in the near-term, which could signal a longer-term uptrend. Although ALTM is still in penny stock territory because of its sub-$5.00 price, it has recovered roughly $1.00 from last month’s all-time low.

Wall Street Is Also Turning Bullish on ALTM Stock

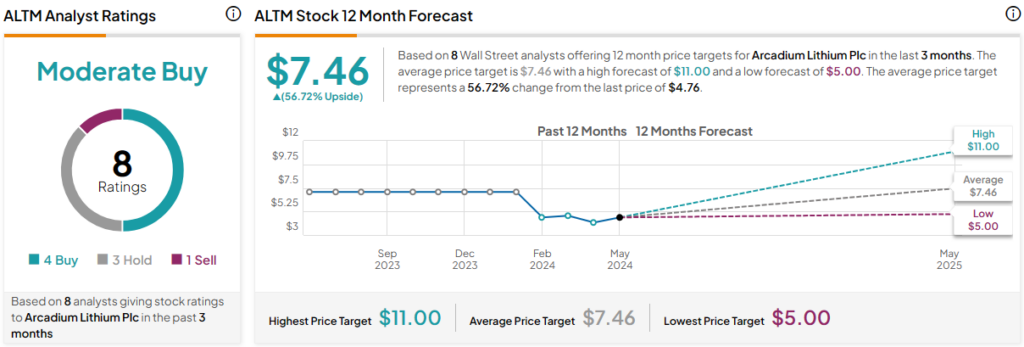

According to sell-side research firms, Arcadium Lithium’s bounce off its 2024 low may be the start of a longer recovery. Since April, three analysts have offered opinions on the newly merged company, and all three have been bullish.

Last month, Raymond James analyst Pavel Molchanov upgraded Arcadium Lithium from Outperform to Strong Buy. Molchanov cited stabilized lithium pricing and post-merger synergies as reasons for the upgrade.

Five-star analyst Aleksey Yefremov from KeyBanc recently maintained an Overweight rating on the lithium producer. While he lowered his price target from $12.00 to $11.00, this still suggests that Arcadium Lithium stock can more than double from here.

Last week, Argus Research analyst Bill Selesky became the latest to go bullish on Arcadium Lithium. Selesky began coverage with a Buy rating and noted that the world’s third-largest lithium producer will report its first quarter as a combined company tomorrow.

What Is the Consensus Price Target for ALTM Stock?

Of the eight ratings that have been issued on Arcadium Lithium over the past three months, four are Buys, three are Holds, and one is a Sell. This gives the company a Moderate Buy rating. Analyst price targets for ALTM currently range from $5.00 to $11.00. This is reason to be bullish for two reasons: 1) Even the most bearish target points to upside and 2) the $7.46 average ALTM stock price target implies 57% upside from current levels. This could certainly get the stock’s valuation more in line with that of Albemarle.

The Bottom Line on ALTM Stock

Arcadium Lithium stock has been clobbered by the sharp downturn in lithium prices. Fresh off a merger that created the world’s third largest lithium producer, though, the company looks well positioned to benefit from a lithium price recovery and rising production volumes. Its growth prospects as a major EV battery input supplier, low valuation, and bullish technicals could form the makings of a big comeback.