Artificial intelligence (AI)-powered mobile ad-tech platform AppLovin (APP) saw its stock surge 6.5% in Friday’s extended trading session on the news of its inclusion in the S&P 500 (SPX). APP stock has rallied by more than 51% year-to-date and 456% over the past year, as investors are optimistic about the demand for the company’s AI technology, which enables advertisers to target mobile game users more effectively. Wall Street has a Strong Buy rating on APP stock and sees continued upside from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The inclusion of AppLovin in the S&P 500 Index is expected to drive institutional interest and potentially boost its stock price. Notably, AppLovin, Robinhood Markets (HOOD), and Emcor Group (EME) will replace MarketAxess Holdings (MKTX), Caesars Entertainment (CZR), and Enphase Energy (ENPH) in the S&P 500, respectively, on September 22.

Top Jefferies Analyst Is Bullish on AppLovin Stock

AppLovin reported stellar second-quarter results, which helped boost investors’ confidence despite certain allegations made by three short sellers – Fuzzy Panda Research, Muddy Waters, and Culper Research. The 77% year-over-year growth in APP’s Q2 revenue to $1.26 billion and a 168.5% jump in earnings per share (EPS) reflect strong execution and solid demand for the company’s offerings, mainly the Axon 2.0 ad engine.

Additionally, AppLovin is well-positioned to gain from the legal battle between Apple (AAPL) and Epic Games, as changes to the iPhone maker’s App Store monetization policies are expected to benefit mobile advertisers and app developers.

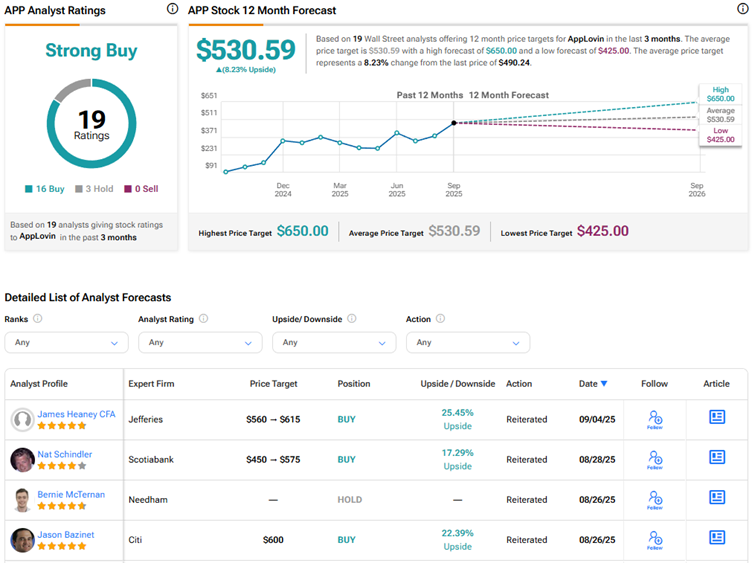

Last week, Jefferies analyst James Heaney reiterated a Buy rating on AppLovin stock and raised his price target to $615 from $560 following a meeting with the company’s management. Heaney raised his Fiscal 2026 revenue estimate by 2%. The analyst is optimistic about the company’s top-line growth, driven by higher spending by existing advertisers, international audience expansion, and significant new client onboarding.

The 5-star analyst sees multiple growth drivers that could drive an inflection in e-commerce advertising in Q4 2025. Furthermore, Heaney thinks that AppLovin’s supply expansion into non-gaming apps and in-app purchase games could present a huge growth opportunity. Despite significant investments, the analyst expects AppLovin to maintain its EBITDA margin of more than 80%.

Is AppLovin Stock a Good Buy?

Most analysts share Heaney’s optimism about AppLovin stock. Overall, Wall Street has a Strong Buy consensus rating on AppLovin stock based on 16 Buys and three Holds. The average APP stock price target of $530.59 indicates 8.2% upside potential from current levels.

Analysts may revise their price targets in response to the news of AppLovin’s inclusion in the S&P 500.