Applied Industrial Technologies (AIT) announced top-and-bottom-line beats for Q2 of FY2025. This comes on the heels of the strategic acquisition of Hydradyne, a leading provider of fluid power solutions, along with various industrial macro data points showing signs of improvement, signals potential further upside on the horizon. With a recent 24% increase in the quarterly cash dividend, AIT may be an attractive option for income-oriented investors seeking growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Building a Leading Market Position

Applied Industrial Technologies is a global distributor and service provider of industrial motion and control technologies, which include bearings, power transmission, fluid power, flow control, and automation solutions. The company’s services focus on enhancing the performance and cost efficiency of customers’ major capital equipment and production infrastructure, emphasizing technical expertise, comprehensive aftermarket support, and service capabilities.

While customer demand has slightly increased recently, the company still faces a challenging macro environment, interest rate uncertainties, and varying end-market demand. On a positive note, various industrial macro data points show signs of improvement, and a less strict regulatory agenda under the new Trump administration offers potential opportunities in many of the company’s legacy end markets.

AIT Targets Growth Through Investments

Management has recently initiated a concerted effort to position the company for more substantial growth through continuous investment in sales tools, operational systems, and technical talent. This also includes the recent strategic acquisition of Hydradyne.

Hydradyne is a prominent provider of fluid power solutions. The acquisition is anticipated to strengthen Applied’s leading position in fluid power distribution in the U.S., leveraging Hydradyne’s technical expertise and product range across hydraulics, pneumatics, electromechanical systems, instrumentation, filtration, and fluid conveyance.

Hydradyne, which employs nearly 500 associates across 33 locations in the Southern U.S., will help expand Applied’s footprint while enhancing its current fluid power service and solutions portfolio. With about 30% of Hydradyne’s sales linked to repair, engineering, and design, the acquisition aims to enhance customer offerings and boost cross-selling and market penetration. The combined technical teams will be better positioned to seize growth opportunities in emerging end markets and commercial applications.

The acquisition is expected to contribute around $260 million in sales and $30 million in EBITDA before anticipated synergies in the first year. The company also anticipates it will be accretive to EPS, excluding transaction-related expenses and purchase accounting adjustments.

Better-than-anticipated Recent Results

Applied Industrial Technologies has announced its Fiscal 2025 second-quarter results. Revenue of $1.1 billion surpassed expectations, exceeding estimates by $20 million. Although net sales of $1.1 billion reflect a 0.4% year-over-year decrease, EBITDA rose by 3.3% year-over-year, reaching $135.1 million. Applied’s operating cash flow totaled $95.1 million, and free cash flow amounted to $89.9 million.

The company reported a 6.7% increase in net income from the prior-year adjusted EPS, totaling $93.3 million or $2.39 per share, exceeding analyst expectations by $0.18.

Applied announced that it would raise its quarterly dividend by 24% to $1.48 per share, the 16th increase since 2010.

Management has offered revised fiscal guidance for 2025, projecting EPS in the range of $9.65 to $10.05, compared to the earlier projection of $9.25 to $10.00. Sales growth is now expected to be between 1% and 3%, a significant improvement from the previous guidance of a decline of 2.5% to an increase of 2.5%. EBITDA margins are predicted to land between 12.2% and 12.4%, slightly higher than the previously estimated 12.1% to 12.3%.

Analysts Are Bullish

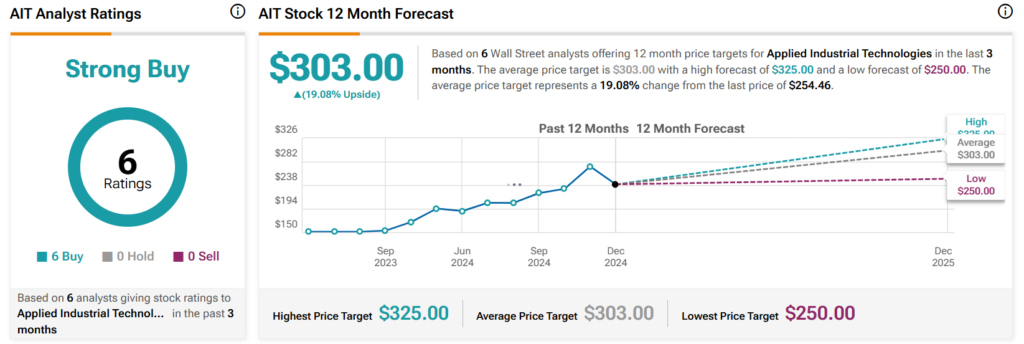

The stock has been trending upward, climbing over 40% in the past year. It trades near the upper end of its 52-week price range of $176.32 – $282.98 and shows positive price momentum by trading above the 20-day (254.07) and 200-day (223.05) moving averages. With a P/S ratio of 2.17x, it appears relatively richly valued compared to the Industrials sector average of 1.55x.

Analysts following the company have been bullish on AIT stock. Based on the recent recommendations of six analysts, Applied Industrial Technologies is rated a strong buy overall. The average price target for AIT stock is $303.00, which represents a potential upside of 19.08% from current levels.

Final Analysis on AIT

Applied Industrial Technologies’ recent impressive performance, bolstered by the strategic acquisition of Hydradyne, is shaking things up in the industrial tech sector. The company has exceeded expectations for its top-and-bottom lines for Q2 of FY2025. This, combined with an optimistic macro environment and a generous 24% increase in the quarterly cash dividend, positions AIT as a potentially solid option for income-oriented investors seeking growth.