Rather than pouring billions into standalone AI ventures, Apple (AAPL) is focused on putting AI directly into consumers’ hands. The iconic innovator is proving once again why it remains one of the world’s most powerful companies—backed by aggressive AI integration and the early success of the iPhone 17.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This year’s price action suggests that Apple has solidified its position to the extent that occasional sentiment slumps do not significantly impact the conglomerate all that much. April’s tariff tantrum saw the stock suffer its steepest decline in years — only to bounce back and post new record highs of around $255 last week.

While the stock trades at a premium valuation, I remain Bullish as Apple’s innovation engine, strong balance sheet, and shareholder-friendly policies make it a compelling Buy.

Apple’s Differentiated AI Strategy

Apple’s aggressive bet on artificial intelligence sets it apart from peers. In 2025, the company has invested $9.5 billion year-to-date in capital expenditures, up from $6.5 billion over the same period last year, with a significant portion directed toward AI and private cloud computing.

Unlike competitors that focus on centralized, cloud-heavy AI models, Apple’s approach is built around “on-device intelligence.” By prioritizing privacy, speed, and contextual fidelity, Apple is embedding its proprietary “Apple Intelligence” directly into iPhones, iPads, Macs, Watches, and Vision Pro headsets. Tasks are handled locally whenever possible, with private cloud compute serving as a secure fallback. This hybrid design delivers ultra-low latency, offline functionality, and higher trust, driving both hardware upgrades and deeper ecosystem lock-in.

In other words, Apple is adopting a slow-roller soft-launch approach and seeking to gain traction in both implementation and directionality. Who knows what consumers will want next? Therefore, it makes sense to stay nimble rather than splurging hundreds of billions on computing capacity.

Tech Innovations Arrive to Support Apple’s Strategy

Key features already announced include Live Translation, Genmoji, and AI-driven health insights. Apple has also opened API access to its foundation model, enabling developers to build private, intelligent features across devices. As a result, the tech giant’s management has gone on record to forecast Apple Intelligence unlocking as much as $150 billion in hardware revenue and up to $15 billion in annual services growth over the next three years.

To accelerate development, Apple has acquired seven AI startups in 2025 alone and remains open to more deals. It is also investing $600 billion in U.S.-based infrastructure, including new data centers and manufacturing facilities. This not only supports AI development but also reduces geopolitical risks, strengthens supply chain resilience, and protects margins.

Apple’s AI roadmap extends across Siri, health monitoring, AR/VR integration, and even a potential AI-powered search engine. Its focus on privacy-first, seamless, and personalized “ambient intelligence” has the potential to reshape user expectations across the entire consumer electronics industry.

iPhone 17 Demand Outpaces Expectations

The iPhone remains Apple’s crown jewel, and the launch of the iPhone 17 is already proving to be a blockbuster. Early data suggests unit demand is tracking 10%–15% ahead of the iPhone 16 cycle.

Globally, 315 million out of 1.5 billion iPhones have not been upgraded in the past four years. With Street estimates calling for roughly 230 million units in fiscal 2026, I believe forecasts remain too conservative. This iPhone cycle could be significantly stronger than anticipated.

In my view, Wall Street is underestimating both the scale of this upgrade cycle and the services tailwind that comes from embedding Apple Intelligence deeply into new hardware.

Cash Flow Machine and Shareholder Returns

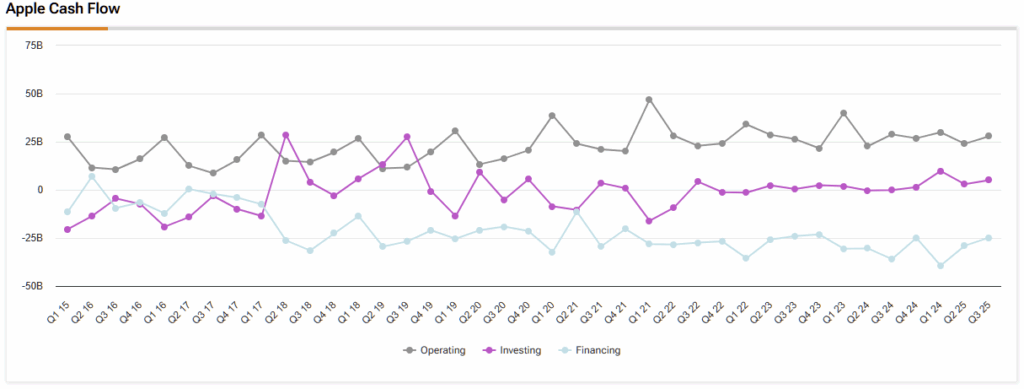

Beyond innovation, Apple’s ability to generate and return cash remains unmatched. In fiscal 2024, the company returned more than $110 billion to shareholders through $94.95 billion in buybacks and $15.23 billion in dividends. In fiscal 2023, it returned $92.5 billion.

So far in 2025, Apple has already repurchased $70.58 billion of stock and paid $11.56 billion in dividends. As of June, the firm held $112.55 billion in excess cash — about $7.55 per share — and is projected to generate more than $210 billion in economic operating cash flow over the next 12 months. Clearly, the engine room is humming along.

Capital investment is also ramping up. Capex growth stands at 42% year-over-year, far above Apple’s five-year average of 4% and the sector median of just 6%. Management expects annual capital expenditures (capex) to average $13 billion over the next five years, with a focus on proprietary AI infrastructure, private cloud computing, and global data centers. Importantly, this spending is disciplined, representing just 2%–3% of revenue, and is fully supported by Apple’s robust cash flow.

This combination of high investment, massive cash returns, and balance sheet strength underscores Apple’s unique ability to fund growth while still rewarding shareholders.

Capital Efficiency and AI Counter Apple’s Toppy Valuation

Apple’s stock is not cheap. Its non-GAAP P/E stands at 35.2, well above the sector median of 24.5. EV/EBITDA is 26.5 versus the sector median of 19.5. By some measures, Apple trades at a nearly 20% premium to fair value.

Using an average of 14 valuation models — including DDM, EV/Revenue multiples, P/E multiples, and five-year DCF growth exits — I estimate Apple’s fair value at $205 per share, implying about 20% downside from the current price of $255.

But valuation alone doesn’t tell the whole story. Apple generates a return on total capital of 48.5%, compared to a sector median of just 3.7%. It continues to compound shareholder value through consistent buybacks, dividends, and aggressive innovation. In my view, Apple’s premium valuation is justified—and likely to endure—as long as the company continues to lead in hardware, services, and now AI, all while executing in its characteristically unique way.

What is the Target Price for AAPL?

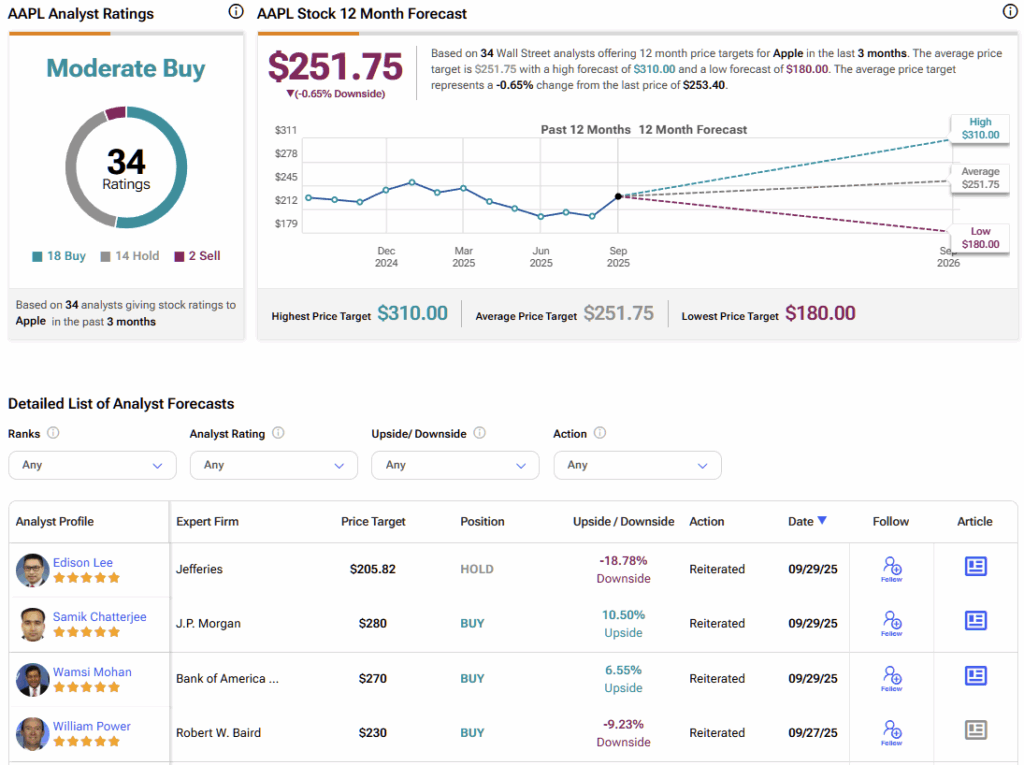

According to TipRanks, Apple carries a Moderate Buy consensus rating based on 34 analyst reviews. Eighteen rate the stock a Buy, 14 a Hold, and two a Sell. Apple’s average stock price target is $251.75, implying a modest downside of less than 1% from current levels, with forecasts ranging from $180 to $310.

Why Apple’s Premium is Worth Paying

Apple is entering a new era, driven by a differentiated AI strategy built around on-device intelligence, privacy, and seamless hardware integration—an edge few rivals can replicate. The iPhone 17 cycle is already surpassing expectations, with hundreds of millions of devices poised for upgrade. At the same time, Apple’s massive cash flows continue to fuel growth, buybacks, and dividends at an unparalleled scale.

The stock does trade at a premium, but Apple has earned it through execution, innovation, and scale unmatched by any other company.