Apple’s new iPhone Air sold out within minutes of launching in China on Friday, according to the South China Morning Post. Ivan Lam, an analyst at Counterpoint Research, stated that this launch proved Apple still has strong brand loyalty in China despite rising competition from Chinese companies. In addition, it’s worth noting that iPhone sales have historically spiked in China whenever the tech giant introduces a new design that stands out. And with a thickness of just 5.1mm, the iPhone Air definitely stands out as Apple’s thinnest phone ever.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, the excitement around the launch was helped by Apple CEO Tim Cook’s recent visit to China. Over the past week, Cook toured several major cities to meet with fans, developers, and government officials. He also highlighted that Apple remains committed to creating local jobs and partnerships in China by announcing new investments, such as a research lab in Shenzhen. Cook also attended the China Development Forum and met with China’s Commerce Minister.

Moreover, his posts on Weibo (China’s version of X) went viral, which further added to the excitement of the phone’s release. While Apple hasn’t shared exact sales numbers, it is estimated that hundreds of thousands of iPhone Air units were sold within the first few minutes. As a result, even though Apple expands its manufacturing to other countries due to U.S. tariffs, China remains a very important market for the company.

Is Apple a Buy or Sell Right Now?

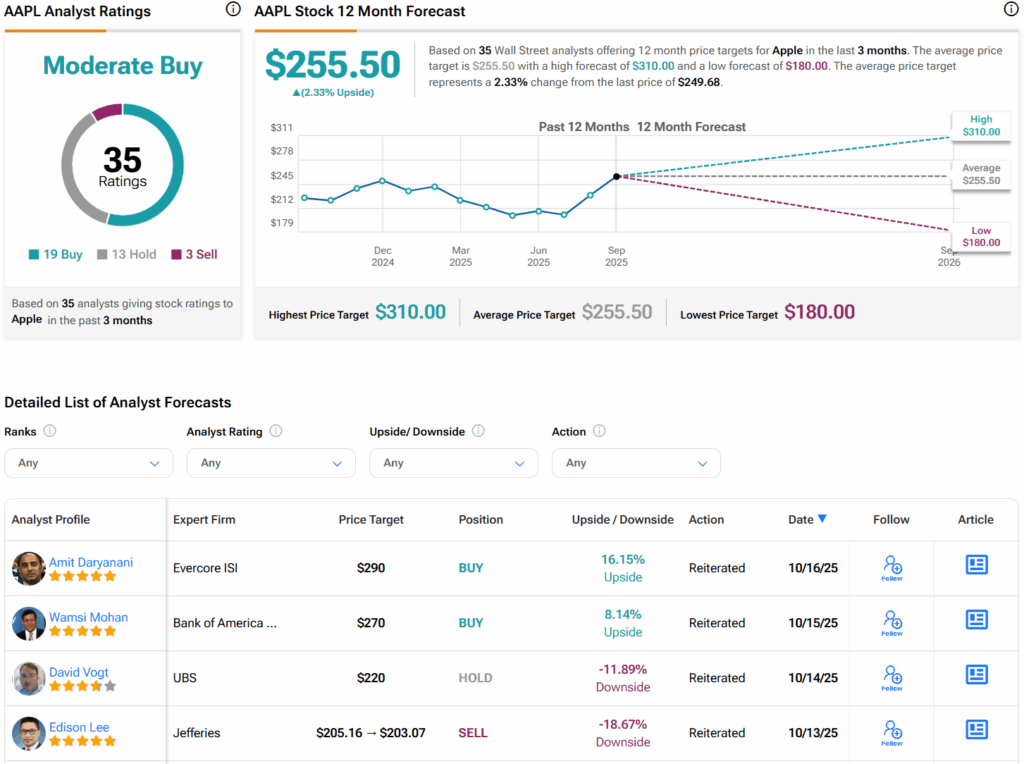

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 19 Buys, 13 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $255.50 per share implies 2.3% upside potential.