Technology giant Apple Inc. (AAPL) is in the process of launching a new Buy Now, Pay Later (BNPL) plan for purchases made through its Apple Pay services, according to Bloomberg. Shares hit a record high of $147.46 on the news and closed the day up 0.8% at $145.64 on July 13. (See Apple stock charts on TipRanks)

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bloomberg reports that the new service will allow customers to pay for their purchases with four interest-free installments, or split the payments across several months with interest. The service will be available in both online and retail stores.

Goldman Sachs Group, Inc. (GS), which has been Apple’s partner since 2019 for its Apple Cards, will act as the loan lender for the new service.

Apple receives a percentage from purchases made on Apple Pay, and the new service will potentially enhance its revenue.

The company already has Apple Cards in place to make purchases on its Apple Pay service, but the BNPL service will enable customers to use any cards for making payments towards the installments.

The news of Apple entering the BNPL market has already made existing players like Affirm Holdings Inc. (AFRM – down 10.5%) and Australia-based Afterpay Touch Group Ltd (AFTPF – down 6.3%) concerned for their growth prospects and sent their shares spiraling down on July 13.

Recently, BofA Securities analyst Wamsi Mohan maintained a Hold rating on the stock with a price target of $160, implying 9.9% upside potential.

Mohan is apprehensive about Apple’s growth prospects as third-quarter year-over-year app store revenues showed a lower growth rate compared to the growth rate witnessed in 2020.

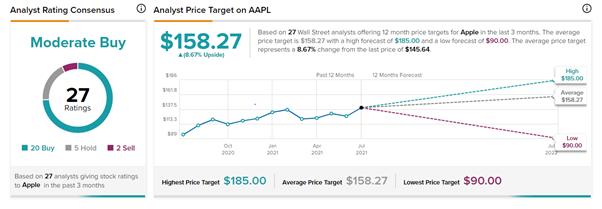

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 20 Buys, 5 Holds, and 2 Sells. The average Apple price target of $158.27 implies 8.7% upside potential to current levels. Shares have gained 50% over the past year.

Related News:

Nokia Plans to Raise FY21 Guidance; Shares Jump

Boeing to Halt 787 Production Amid Structural Problems – Report

Upstart Spikes 8.3% with a Buy from Goldman Sachs