After soaring more than 23% in the past three months, Apple (NASDAQ:AAPL) stock has been making up for the slow start to the year. Despite the hot gain going into (and after) the company’s annual WWDC (worldwide developers conference) and Apple Intelligence announcement, AAPL stock is still lagging behind most members of the Magnificent Seven. This could change as Apple looks to add to its breakout ahead of what could be a robust hardware showing in the back half of 2024. As such, I’m staying bullish as a potential AI device supercycle looks to play out over the next 18 months.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Wedbush Securities’ Daniel Ives, one the bulls who also foresees an AI-induced supercycle, recently doubled down on his bullishness, referring to Apple CEO Tim Cook as worthy of sharing the title of “Godfather of AI” with Nvidia (NASDAQ:NVDA) top boss Jensen Huang.

Though only time will tell if Tim Cook’s AI strategy will propel AAPL stock to the forefront of AI, I think many investors will probably not be convinced of the full extent of Apple’s capabilities until they’ve had the opportunity to try Apple Intelligence for themselves later this year.

The AI Supercycle Won’t Just Jolt iPhone

The good news is that existing iPhone 15 Pro users won’t need to upgrade their devices to get the significant AI upgrades in store with iOS 18. For everybody else who’s hanging onto an aging device, the iPhone 16 could be the device that finally kicks off that long-awaited upgrade boom.

Given that Apple Intelligence isn’t exclusive to the iPhone, other hardware products stand to receive a massive sales boost. Specifically, those with Macs or iPads that lack Apple Silicon chips may be inclined to upgrade their hardware so that Apple Intelligence works seamlessly across devices.

In any case, Apple finally has the “killer” software feature to convince people to upgrade all of their devices to the latest and greatest. Indeed, Apple hasn’t seen strength across iPhone, iPad, and Mac since the lockdown days of the pandemic.

Perhaps Apple Intelligence could power an upgrade cycle that tops the one enjoyed during 2021. Back then, annual sales surged close to 30% in what was a drastic pull forward in demand. This time, it’s not a work-from-home (WFH) boom or a pandemic-induced lockdown that could spark upgrades; it’s the desire to not be left behind as AI finally gets that personal touch we all desire.

If Apple Intelligence lives up to the hype, then perhaps analysts are discounting Apple’s sales growth prospects. They may need to jack up their price targets markedly going into 2025 after gaining the first hint of how the latest AI-enhanced iPhones fare in the year’s final quarter.

Apple Silicon: A Huge Edge It Has in the AI Race

If Tim Cook is to become one of the “Godfathers of AI,” Apple not only needs to deliver a seamless Apple Intelligence experience later this year, but the company needs to continue putting its foot on the AI gas. Indeed, Apple Intelligence and its partnership with OpenAI are a good start. In the long term, however, Apple must ensure that it’s accelerating forward on AI to pull further ahead in the AI race. On that front, the firm must push Apple Silicon to the limit.

Apple Silicon has been successful in powering modern-day Apple wares. However, we may all have just experienced the tip of the iceberg, given that we haven’t had the opportunity to throw truly intensive AI processes at it yet. With Apple Intelligence, perhaps we’ll unlock the full power of Apple Silicon’s Apple Neural Engine (ANE, Apple’s neural processing unit (NPU)) and better understand the value of running AI models in hand.

Furthermore, with Apple reportedly planning to use M2 Ultra (the most advanced tier in the M2 line) chips in its Apple Private Cloud, perhaps Apple is leading the race in custom AI chips. Also, the M3 Ultra may not be too far off.

Undoubtedly, other mega-cap tech titans are also planning to build their own AI accelerators for the data center. However, Apple may just beat them to it in the race to in-house AI hardware and reduce dependence on third-party GPU makers.

Considering the power of Apple Silicon in the cloud and in the palm, I find it absurd that AAPL stock goes for just 28.4 times forward price-to-earnings (P/E), far below the AI-savviest Magnificent Seven rivals like Nvidia (NASDAQ:NVDA), which goes for closer to 50 times forward P/E.

Is Apple Stock a Buy, According to Analysts?

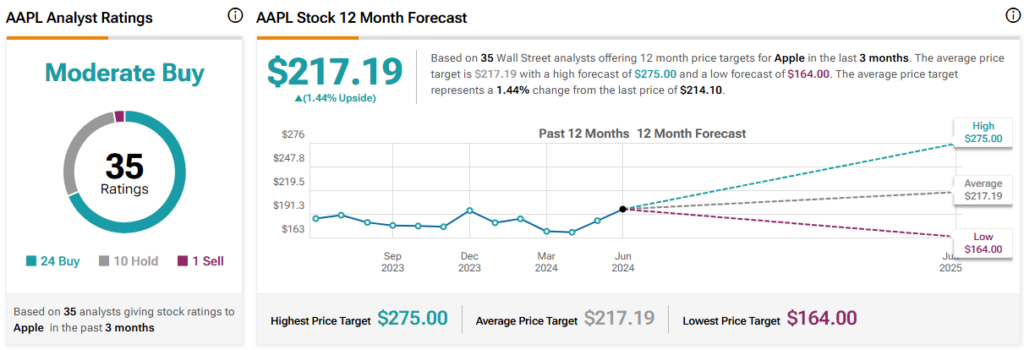

On TipRanks, AAPL stock comes in as a Moderate Buy. Out of 35 analyst ratings, there are 24 Buys, 10 Holds, and one Sell recommendation. The average AAPL stock price target is $217.19, implying upside potential of 1.4%. Analyst price targets range from a low of $164.00 per share to a high of $275.00 per share.

The Takeaway

Apple looks like an AI tortoise that may surprise everybody and win the race. With Apple Intelligence’s potential to kick off a device refresh cycle in late 2024 and 2025, perhaps the bulls are right to praise Apple, even after its recent breakout.

Additionally, Apple Silicon may allow the company to power its AI ambitions without depending too heavily on third parties. Maybe it’s not so outlandish to hear people like Daniel Ives refer to Apple’s top boss as a “Godfather of AI.”