Apple stock (AAPL) has been the laggard of 2025’s Magnificent Seven, but Wedbush analyst Dan Ives believes the tide is turning. In a note Sunday, Ives raised his price target to $310 from $275, implying Apple shares could climb 26% from Friday’s close.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“The Street is clearly underestimating this iPhone cycle in our view…after a few years of disappointing growth,” Ives wrote. He believes the iPhone 17 launch will trigger a “pent-up consumer upgrade cycle” that Apple hasn’t seen in years.

iPhone 17 Demand Drives Apple Higher

Preorders for the iPhone 17 lineup began Sept. 12, and shipping times already point to strong demand. The new lineup, featuring the iPhone 17, 17 Air, 17 Pro, and 17 Pro Max, hit stores worldwide Friday. According to Wedbush, between 315 million and 1.5 billion global users haven’t upgraded their phones in the past four years, setting the stage for a supercycle.

Apple shares were up 0.7% in Monday’s pre-market trading, trading at $240.68. The stock is up just 3% year-to-date, far behind Nvidia (NVDA) and Microsoft (MSFT), but analysts think momentum could build quickly as iPhone 17 sales accelerate.

AI Could Add Another Layer

Beyond phones, Ives sees AI as a major long-term catalyst. He estimates “the AI monetization piece could add $75 to $100 per share to the Apple story over the coming few years.” This upside isn’t priced into Apple stock today, he argues, which is why the name looks compelling despite its weaker 2025 performance.

Apple is also rumored to be working on a foldable iPhone for 2026 and has partnerships brewing with Alphabet to bring more AI features to iOS. With those catalysts in play, Ives says Apple’s rebound is more than just an iPhone story, it’s about finally unlocking an AI premium Wall Street has ignored.

Is Apple Stock a Good Buy?

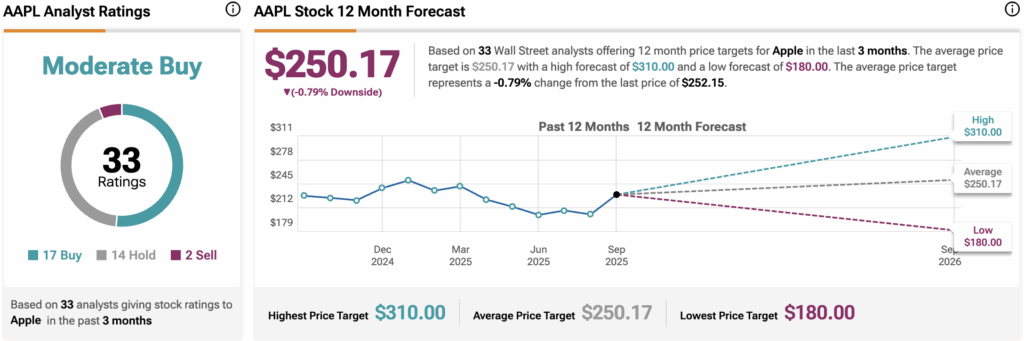

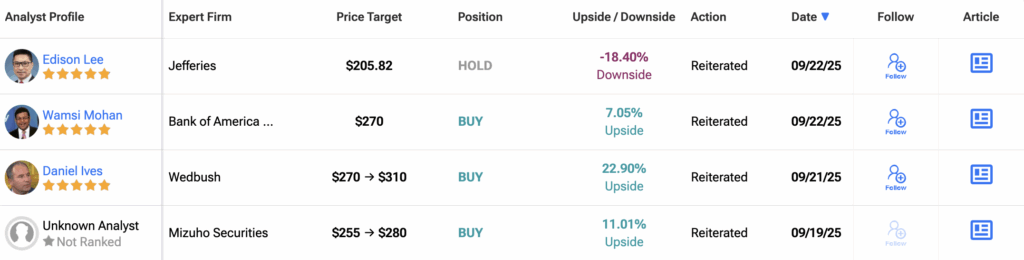

Turning to TipRanks, Apple stock carrying a “Moderate Buy” rating. Out of 33 analysts tracked in the past three months, 17 recommend Buy, 14 rate Hold, and two suggest Sell. The average 12-month AAPL price target sits at $250.17, just under current trading levels.