Apple (AAPL) stock received a vote of confidence from Jefferies, which upgraded the stock from Sell to Hold following its recent pullback. The investment firm believes Apple could be exempted from the steep U.S. tariffs set to hit Chinese imports, considering the tech giant’s pledge to invest $500 billion in the country over the next four years. It further expects Apple to announce manufacturing commitments in the U.S., potentially including iPhone production.

Speaking of risks, Jefferies warned that Apple’s price could fall to around $150 if 54% tariff is imposed on the company. In the last five days, AAPL stock has tumbled over 20% as investor anxiety mounts over Trump’s tariffs potentially increasing iPhone prices. As of writing, the stock is trading at $172.42.

Jefferies Slashes Apple’s Earnings Outlook and Price Target

Despite the rating upgrade, Jefferies’ five-star-rated analyst Edison Lee reduced his price target on AAPL stock to $167.88 from $202.33. The lower price target reflects worries that a global recession could hurt iPhone sales and expected price increases for upcoming models.

Additionally, Jefferies has lowered its iPhone shipment estimates for the next three years by 3.6% for 2025, 7.7% for 2026, and 5.5% for 2027, citing weaker demand. In terms of iPhone prices, it predicts a $50 hike for iPhone 18 models in 2026 (excluding the base version) and a $100 increase across all iPhone 19 models in 2027.

Overall, Lee has cut its revenue forecasts by 2% to 4% and expects Apple’s earnings per share (EPS) to fall below market expectations by 2.5% to 8.5% over the same period.

Jefferies Flags AI Headwinds in Smartphones

Another major reason for the lowered estimates is concern over AI adoption on smartphones, including the iPhone. Lee pointed out two key challenges. First, the hardware just isn’t there yet. Without quicker memory and better tech design, iPhones can’t run large or powerful AI features. Second, the AI tools struggle to learn how people use their phones because they can’t access enough app info.

That said, Jefferies is optimistic. They believe the right hardware for bigger, smarter AI models will arrive by 2027 and Apple will likely be the first to use it in the iPhone 19.

Is AAPL Stock a Buy?

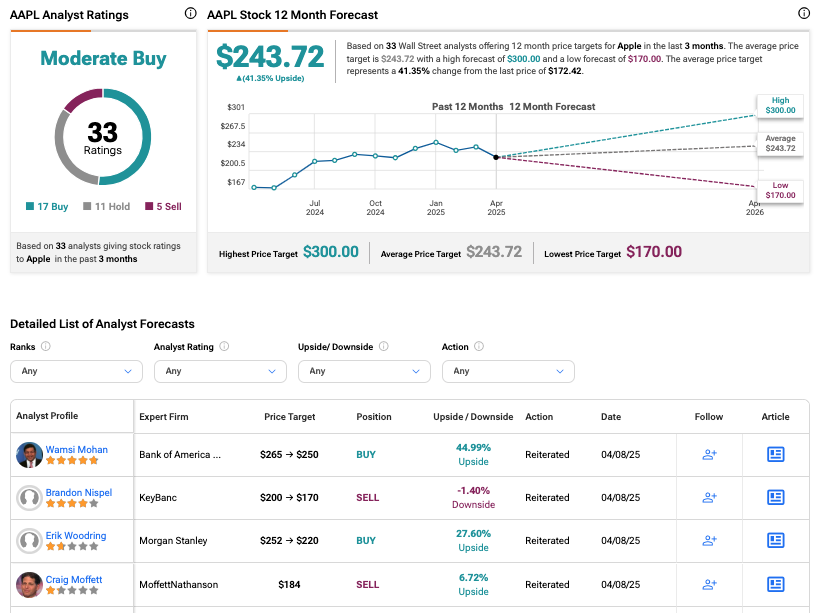

On TipRanks, AAPL stock has a consensus Moderate Buy rating among 33 Wall Street analysts. That rating is based on 17 Buy, 11 Hold, and five Sell recommendations assigned in the last three months. The average AAPL price target of $243.72 implies a 41.35% upside from current levels.