Seaport Research Partners has initiated coverage of Apple (AAPL) stock with a Buy rating, citing optimism around sales of the company’s latest iPhone 17 device.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition to the Buy rating, Seaport analyst Jay Goldberg gave AAPL stock a $310 price target. That suggests 20% upside from the current share price. Goldberg wrote in a note to clients that one of Apple’s biggest strengths is its “sticky” business model.

“Once a user has an iPhone, they are much more likely to buy other Apple offerings,” wrote the analyst. Currently, about 1.4 billion people around the world own an iPhone, according to Apple. However, sales have been largely flat over the past three years as consumers hold onto their smartphones longer or trade down to a cheaper device.

Promising iPhone 17 Sales

Apple is also struggling to roll out an artificial-intelligence (AI) strategy, and the delayed launch of a new Siri digital assistant has irritated some analysts and investors. Nevertheless, Goldberg says that “Apple has gotten much better at monetizing its user base.”

Seaport Research Partners also notes that Apple’s services business, which includes streaming and digital subscriptions, is now the company’s second-largest operating unit and is helping to revive growth at the company. Apple has also steadily raised prices across the iPhone line-up, with its new low-end model, the iPhone Air, starting at $999.

In Goldberg’s view, Apple’s valuation looks compelling amidst what he calls a “solid upgrade cycle this year.” AAPL stock has gained 2% in 2025.

Is AAPL Stock a Buy?

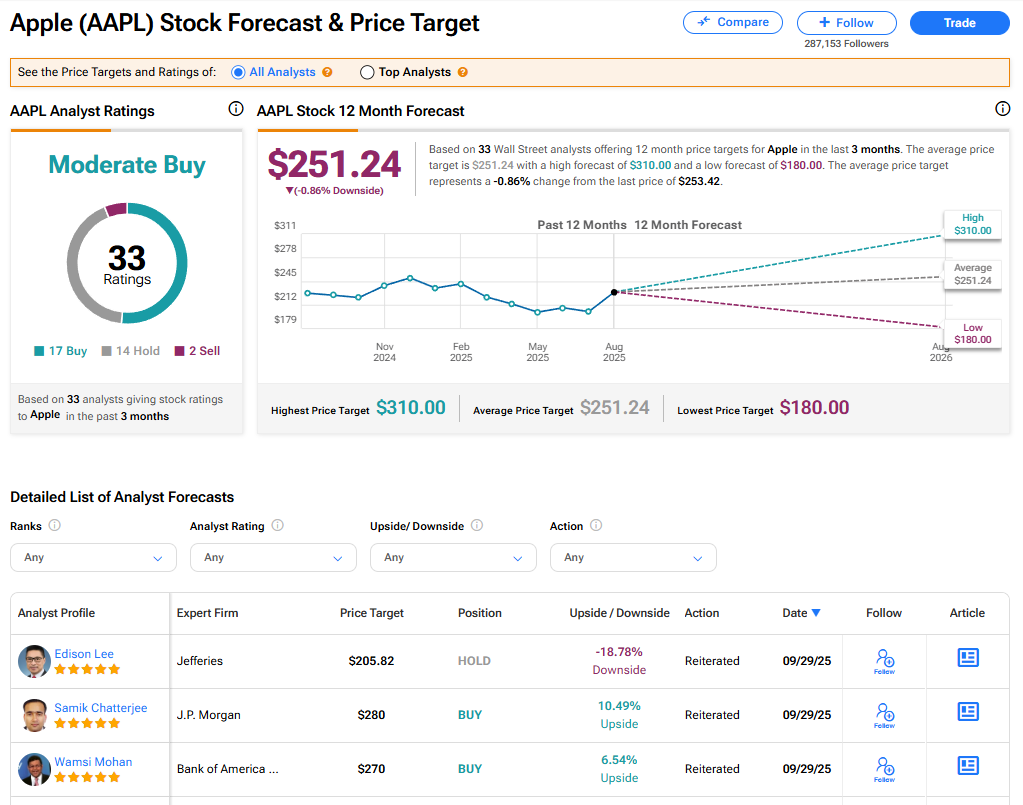

The stock of Apple has a consensus Moderate Buy rating among 33 Wall Street analysts. That rating is based on 17 Buy, 14 Hold, and two Sell recommendations issued in the last three months. The average AAPL price target of $251.24 implies 0.86% downside from current levels.