Shares of tech giant Apple (AAPL) hit all-time highs today as early data shows that the iPhone 17 is off to a stronger start than the iPhone 16. According to research firm Counterpoint, sales in both China and the U.S. during the first 10 days of launch were up 14% compared to the iPhone 16’s launch period. Notably, the standard iPhone 17 model nearly doubled its early sales in China and saw a combined 31% sales increase across China and the U.S.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts say one reason for this success is that the base iPhone 17 offers several upgrades while keeping the same price as last year’s model. More precisely, it includes a faster chip, a better screen, more starting storage, and an improved selfie camera, all of which contribute to stronger perceived value. “The base model iPhone 17 is very compelling to consumers,” said Mengmeng Zhang, a senior analyst at Counterpoint.

The iPhone 17 Pro Max also performed well in the U.S., thanks in part to larger subsidies from major carriers. Analyst Maurice Klaehne explained that mobile providers are using bigger discounts to lock in customers for longer periods, typically through 24 or 36-month payment plans. This strategy boosts long-term service revenue while making premium phones more accessible to buyers.

Is Apple a Buy or Sell Right Now?

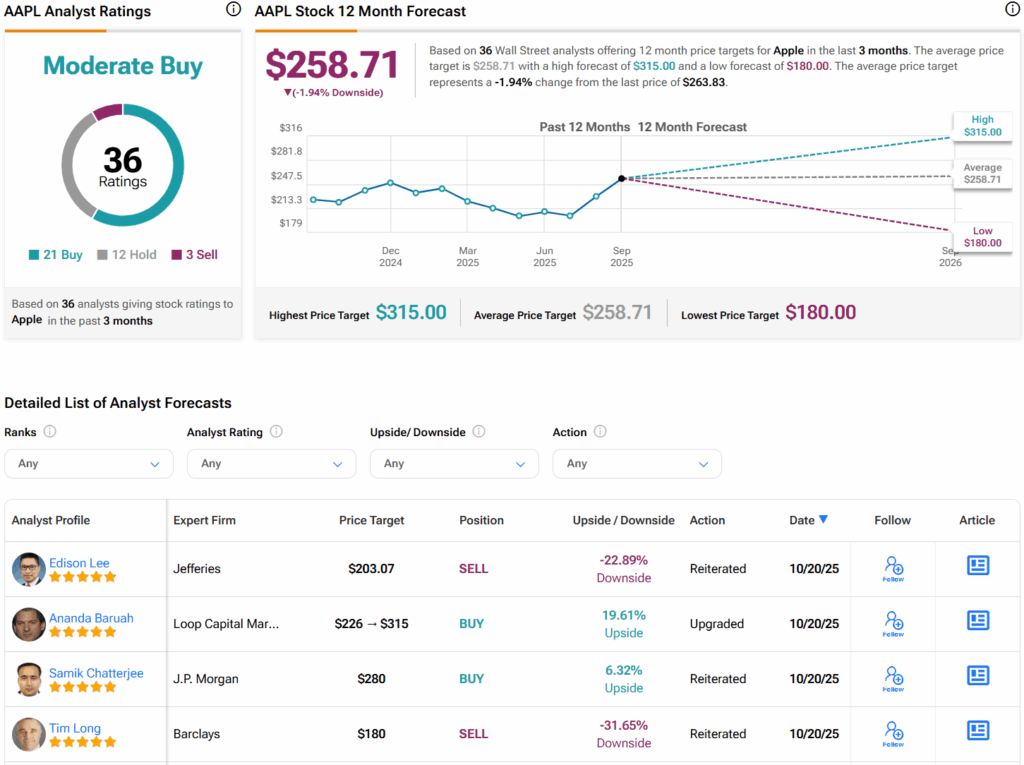

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 21 Buys, 12 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $258.71 per share implies 1.9% downside risk.