A new study, funded by tech giant Apple (AAPL), criticized the European Union’s Digital Markets Act by claiming that it hasn’t helped consumers save money. The research, done by the Analysis Group, found that even though developer fees in the EU dropped by about 10%, most developers didn’t lower their prices. In fact, in over 90% of cases, app prices either stayed the same or increased.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Jane Choi, vice president at Analysis Group, explained that only around 9% of developers in EU storefronts lowered their prices after joining Apple’s small business program. However, those price drops were due to normal pricing trends, not the reduced fees. Choi added that this pattern matches what Apple has seen before. For example, in the U.S., when commission rates were lowered for thousands of developers, only a small number actually reduced their app prices.

Under the new EU rules, Apple now lets developers sell apps outside the App Store and use their own payment systems, thereby cutting Apple’s commission from 30% to about 20%. The study looked at over 41 million transactions and 21,000 apps, and estimated that developers saved around €20.1 million in fees. Still, the study claims that these savings haven’t reached users, as prices have mostly stayed the same despite the lower costs for developers.

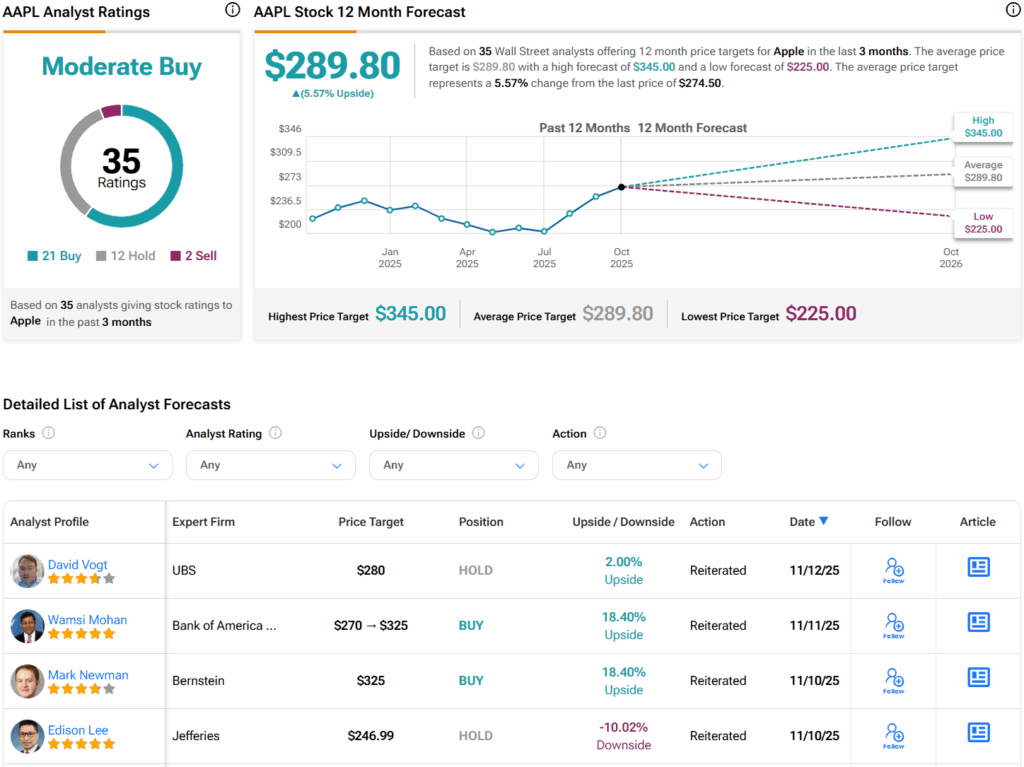

Is Apple a Buy or Sell Right Now?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 21 Buys, 12 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $289.80 per share implies 5.6% upside potential.