iPhone maker Apple (NASDAQ:AAPL) has approved Epic Games’ gaming marketplace app on iOS in Europe, Reuters reported. This comes after a prolonged feud between the two companies. Epic Games, the company behind the popular game Fortnite, accused Apple of hindering its efforts to establish a gaming store on the iOS platform.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Epic Games stated that Apple rejected their documents twice for launching the Epic Games Store, citing design similarities in buttons and label designs. Epic Games criticized Apple’s rejection and defended its design choices. In response, Apple said that the latest disagreement focused on the Epic Sweden AB Marketplace, not Fortnite, which had already received approval.

Background of the Feud

The dispute between Apple and Epic Games dates back to 2020, when Epic accused Apple of violating U.S. antitrust rules by charging up to 30% commissions on in-app payments. In January, the U.S. Supreme Court refused to hear the case, a decision seen as a win for Apple.

In March, Apple terminated Epic Games’ developer account, preventing it from developing the Epic Games Store for iOS. However, Apple quickly reversed this decision amidst increasing pressure from European regulators.

Apple, often criticized for tight control over the iOS app ecosystem, promised to offer greater flexibility to app developers and users within the European Union.

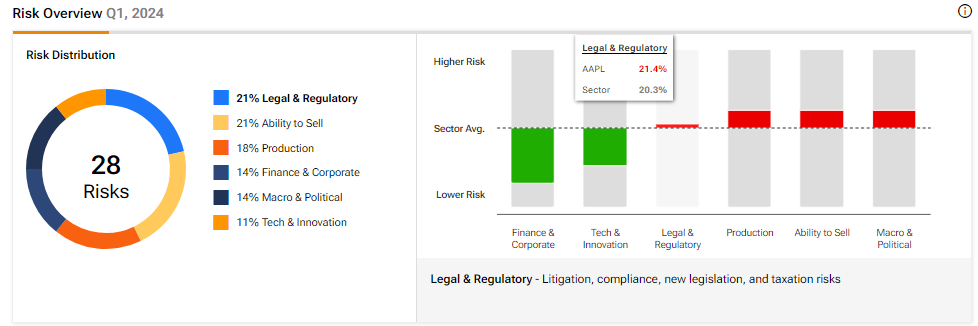

Apple’s Risk Analysis

Apple’s exposure to legal and regulatory issues is a significant factor for investors to consider. While it has a history of resolving disputes through settlements or agreements, there is no assurance of favorable outcomes.

In a recent development, the European Commission has initiated an investigation into Apple’s app validation processes and alternative app stores. Additionally, Apple is facing a class-action lawsuit for gender-based pay disparities.

According to TipRanks’ Risk Analysis tool, Apple’s legal and regulatory risks account for 21.4% of its overall risk, higher than the industry average of 20.3%.

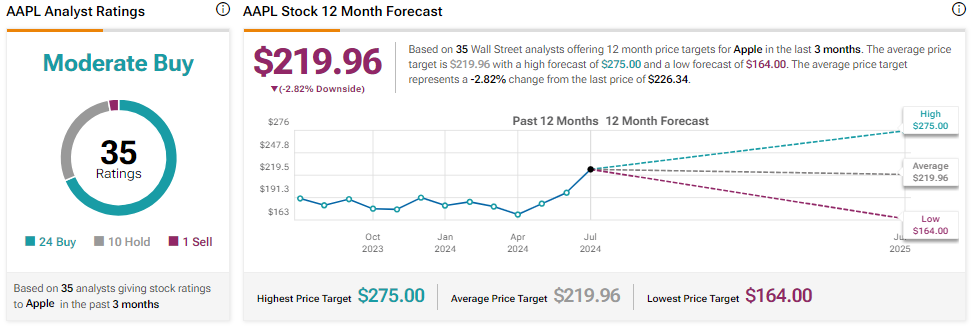

Is Apple a Buy or Sell Right Now?

Apple stock is up about 18% year-to-date. With 24 Buys, 10 Holds, and one Sell recommendation, AAPL stock has a Moderate Buy consensus. The average AAPL stock price target stands at $219.96, implying 2.82% downside potential.