This article was written by Shalu Saraf and reviewed by Gilan Miller-Gertz.

Apple (AAPL) was the world’s top smartphone maker in 2025, holding a 20% global market share, according to new data from Counterpoint Research. Apple led all brands on strong demand from emerging and mid-sized markets. Sales of the iPhone 17 series also helped drive shipments, giving Apple the largest share among the top five smartphone makers, Counterpoint said.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The update comes ahead of Apple’s Q1 Fiscal 2026 earnings, due on January 29. Wall Street expects Apple to report earnings of $2.67 per share, up about 11% year-over-year. Revenue is forecasted to rise 10.5% from last year to $137.41 billion, based on TipRanks data.

Global Shipments Rose Modestly

Global smartphone shipments rose 2% year over year in 2025, supported by improved demand and better economic conditions in emerging markets. The gain marks a steady recovery after several weak years for the industry.

After Apple, Samsung (SSNLF) ranked second with a 19% share, showing modest shipment growth. Xiaomi (XIACF) placed third with a 13% share, helped by steady demand in emerging markets.

Early in 2025, many manufacturers shipped devices sooner than planned to get ahead of possible tariffs. That effect faded later in the year, leaving second-half shipment volumes largely unchanged.

Outlook Turns Cautious for 2026

Looking ahead, Counterpoint expects the global smartphone market to soften in 2026. Chip shortages and rising component costs are likely to weigh on production.

At the same time, chipmakers are shifting capacity toward AI data centers, which could limit supply for smartphones. While demand remains stable in some regions, higher costs and tighter supply may slow growth.

For Apple, the strong 2025 result shows its ability to gain share even in a slow market. Investors will now watch how supply limits and higher costs affect smartphone demand in 2026.

Is Apple a Buy or Sell Right Now?

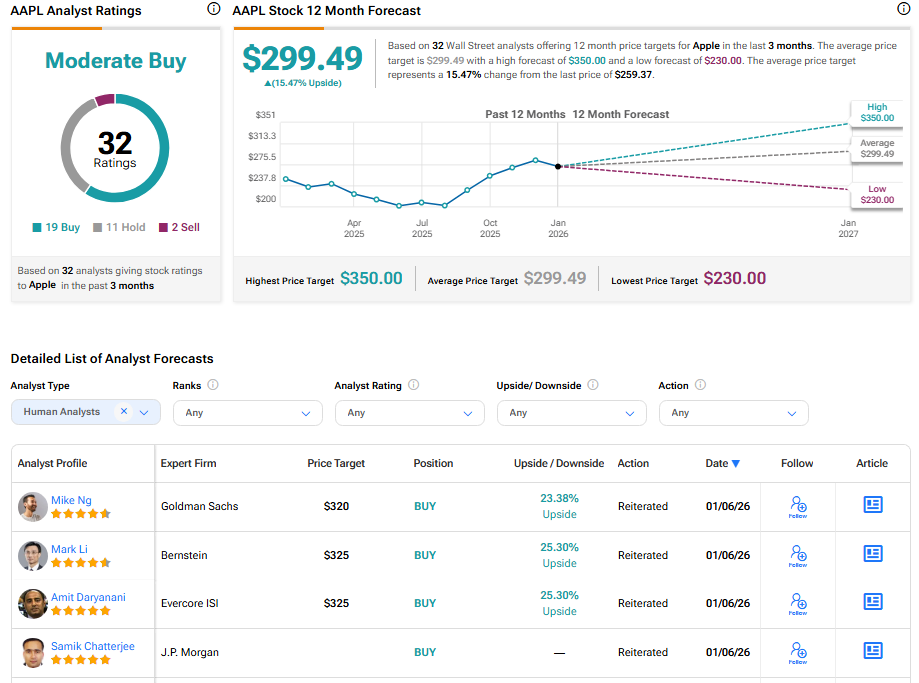

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 19 Buys, 11 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $299.49 per share implies 15.47% upside potential.