Tech giant Apple (AAPL) can continue importing certain Apple Watch models into the U.S. after a federal judge denied an attempt by medical tech firm Masimo (MASI) to block those imports, according to Bloomberg Law. In a short order issued on Tuesday, Judge Ana Reyes rejected Masimo’s request for both a temporary restraining order and a preliminary injunction. As a result, Apple is allowed to keep selling and importing the watches while the legal dispute continues.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, the case is about the Apple Watch Series 9 and the Apple Watch Ultra 2. Masimo, which develops non-invasive health-monitoring technology, argues that these models infringe on its patents related to light-based blood-oxygen sensing. Interestingly, this dispute goes back to October 2023, when the U.S. International Trade Commission issued a limited exclusion order to protect Masimo’s patented technology.

In response, Apple redesigned how its Blood Oxygen feature works through a software update. As part of Apple’s update, blood-oxygen data is now measured and calculated on a paired iPhone rather than directly on the watch, with the results shown in the Health app. Apple said the change was allowed by a U.S. Customs ruling, but Masimo doesn’t believe that it solves the patent issue. Moreover, Masimo criticized Customs for reversing an earlier import decision without any notice or input.

Is Apple a Buy or Sell Right Now?

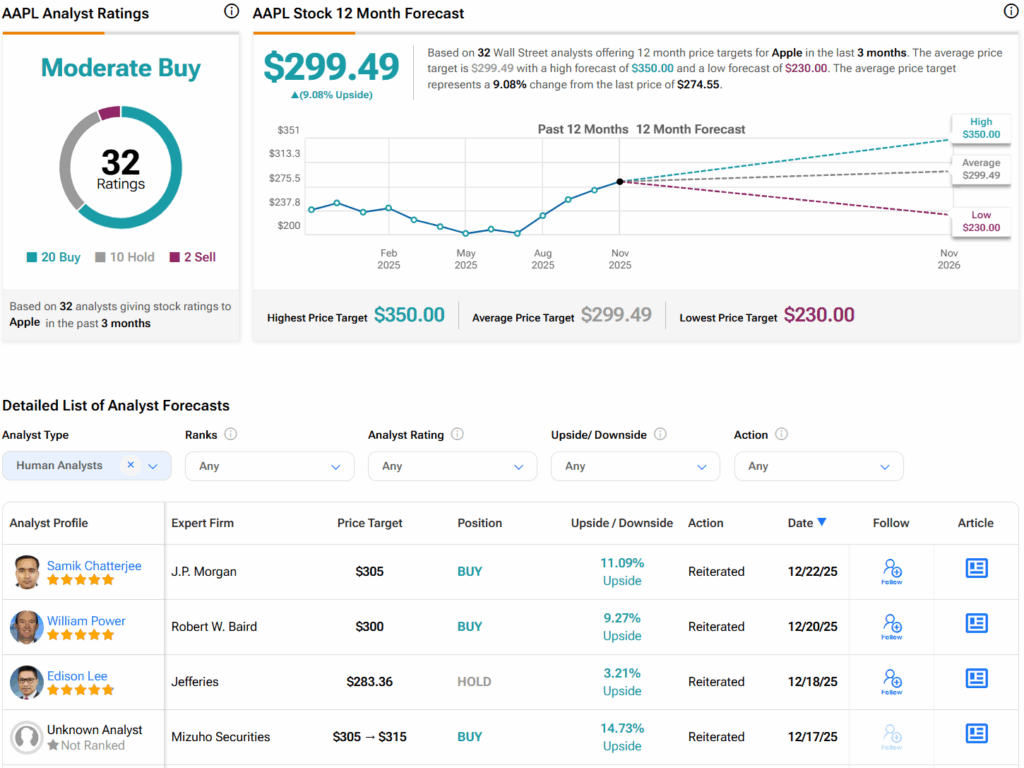

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 20 Buys, 10 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $299.49 per share implies 9.1% upside potential.