Apple (AAPL) is making headlines today due to a legal dispute and plans for a new bond sale. First, the company filed an appeal after a U.S. judge ruled that it violated a court order related to its App Store. Judge Yvonne Gonzalez Rogers said that Apple did not follow the order from the Epic Games v. Apple case, which required Apple to allow apps to offer outside payment options. Although Apple did make changes by adding a 27% commission and a warning screen about security risks, the judge said that these steps discouraged users and violated the intent of the order. As a result, Apple has been told to remove these measures.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, Apple is also preparing for its first corporate bond sale in two years. In fact, the company plans to issue investment-grade bonds in up to four parts, with the longest being a 10-year note that is expected to be priced at about 0.7% above U.S. Treasuries. In addition, major banks like Barclays (BCS), Bank of America (BAC), Goldman Sachs (GS), and JPMorgan (JPM) are handling the deal.

This bond sale comes during a busy time for the debt market, as $35 billion to $40 billion in new U.S. high-grade corporate bonds are expected this week, mostly from technology and industrial companies. Interestingly, Apple’s last bond sale happened in May 2023, when it raised $5.25 billion. Since then, Apple has reduced its debt from around $113 billion in 2022 to $92 billion as of March 2025 due to higher borrowing costs. Unsurprisingly, the new bonds are expected to receive strong credit ratings of Aaa from Moody’s (MCO) and AA+ from S&P (SPGI).

Is Apple a Buy or Sell Right Now?

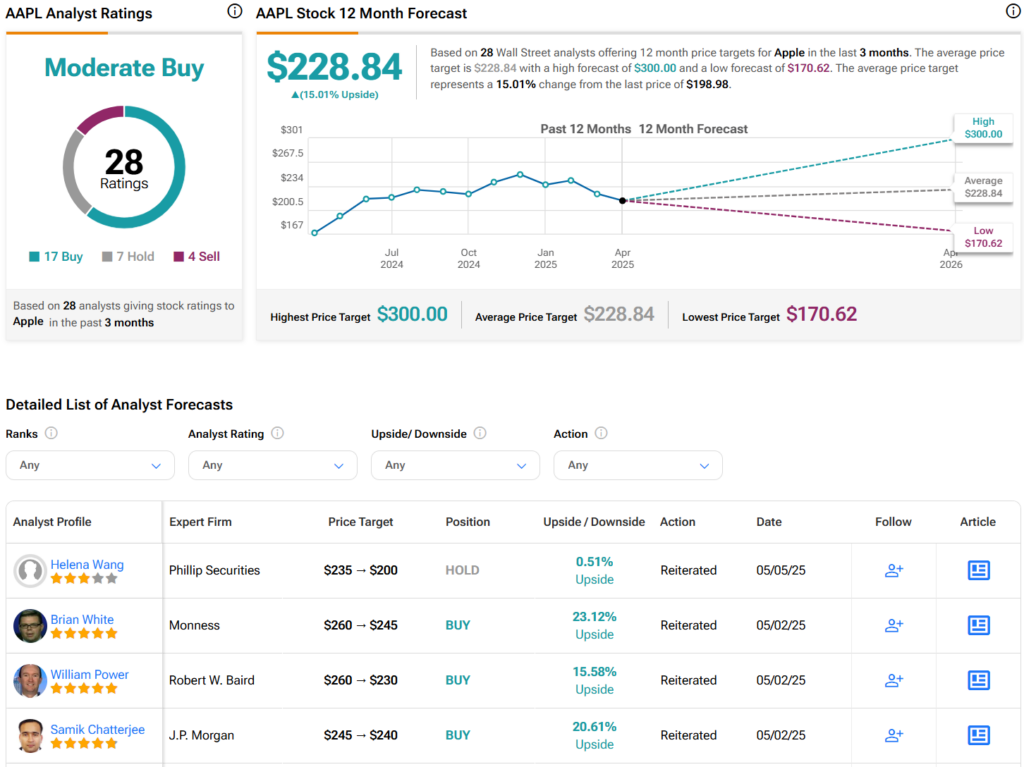

Overall, analysts have a Moderate Buy consensus rating on AAPL stock based on 17 Buys, seven Holds, and four Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $228.84 per share implies 15% upside potential.