AppLovin (NASDAQ:APP) surged in pre-market trading after delivering an earnings beat in the first quarter. The mobile technology company swung to a profit in the first quarter with earnings of $0.67 per share as compared to a loss of $0.01 per share in the same period last year. Analysts were expecting earnings of $0.57 per share in Q1.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

AppLovin’s Q1 Revenue Breakdown and Stock Buyback

The company’s revenues surged by 48% year-over-year to $1.06 billion, exceeding consensus estimates of $973.7 million. APP’s revenues continued to be driven by its software platform, whose revenue grew to a record $678 million, a whopping increase of 91% year-over-year.

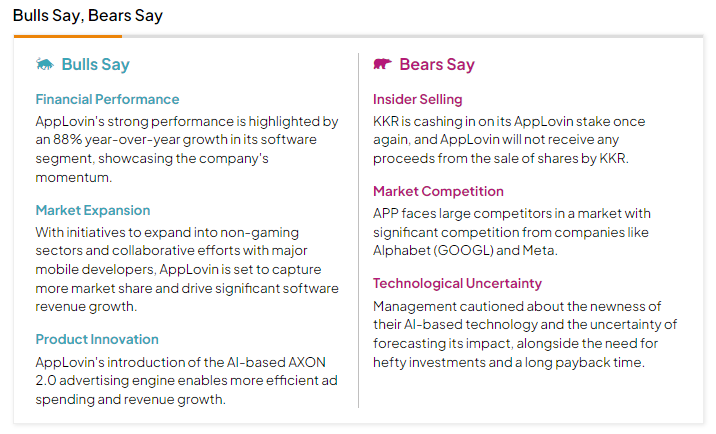

Indeed, according to the TipRanks stock analysis tool, “Bulls Say, Bears Say,” analysts bullish on APP believe that the rise in the company’s software segment’s revenues highlights its momentum.

Separately, AppLovin bought back 14.9 million shares of its Class A common stock and reduced its total shares outstanding by around 3%.

APP’s Q2 Outlook

Looking forward, in the second quarter, the company expects its revenues to be in the range of $1.06 billion to $1.08 billion. This is above Street estimates of $1.01 billion. APP estimates Q2 adjusted EBITDA to be between $550 million and $570 million.

Is APP Stock a Buy?

Analysts remain cautiously optimistic about APP stock, with a Moderate Buy consensus rating based on 11 Buys, five Holds, and one Sell. Over the past year, APP has surged by more than 300%, and the average APP price target of $74.71 implies an upside potential of 0.96% from current levels. These analyst ratings are likely to change following APP’s Q1 results today.