Shares in private equity group Apollo Global Management (APO) were flat in pre-market trading today as it looked for a new European chief to hunt for more deals on the continent.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Next Generation Talent

According to an article in the Financial Times, Apollo is searching for a replacement for its current head of Europe, Rob Seminara. It is understood that Apollo wants Seminara to take on more of a global role with the business.

“We are always focused on leadership planning and next-generation talent development,” Apollo said.

Apollo is making the change in its European leadership as it, like other U.S. private equity groups, identifies Europe as a land of new deal-making opportunities. That’s because of the EU seeking to revitalize economic growth on the continent, develop its tech and AI sectors, and consider easing its tough regulatory regimes.

As head of Europe, Seminara has led a number of deals on the continent including a €3 billion buyout of French glass bottle company Verallia. In November, Apollo also bought a majority stake in Spanish football giant Atletico Madrid for around €2 billion.

Under the deal, Apollo Sports Capital, its new $5 billion global sports investment company, will become the club’s majority shareholder.

Apollo Remains Resilient

Apollo said at the time that the deal would reinforce Atletico’s position among football’s elite and support its ambition to deliver long-term success for millions of fans worldwide. That means putting money into the teams and major infrastructure projects.

Apollo has also looked to become a major player in life insurance and retirement annuities through its Athora affiliate. Back in July, Athora snapped up the U.K.’s Pension Insurance Corporation Group for £5.7 billion.

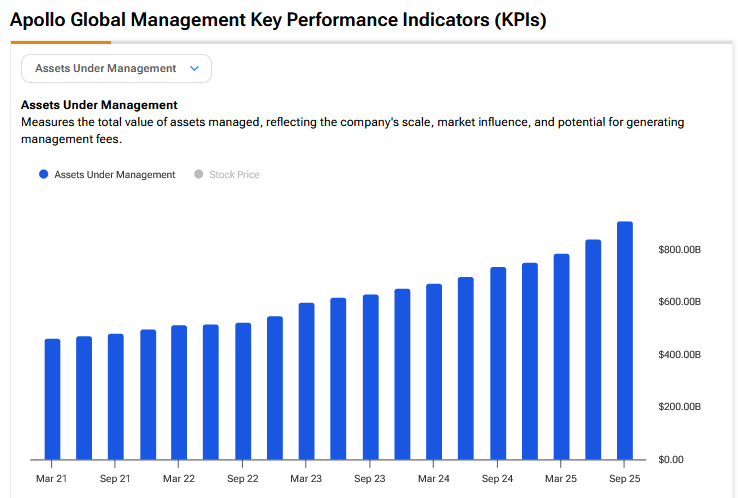

Boosting its European presence will also help Apollo’s assets under management in what has been a tricky 12 months for private equity given tariff and interest rate uncertainty.

According to recent figures, European M&A came in at $746 billion to the beginning of December 2025. That is up to 12% higher than the total for the whole of 2024.

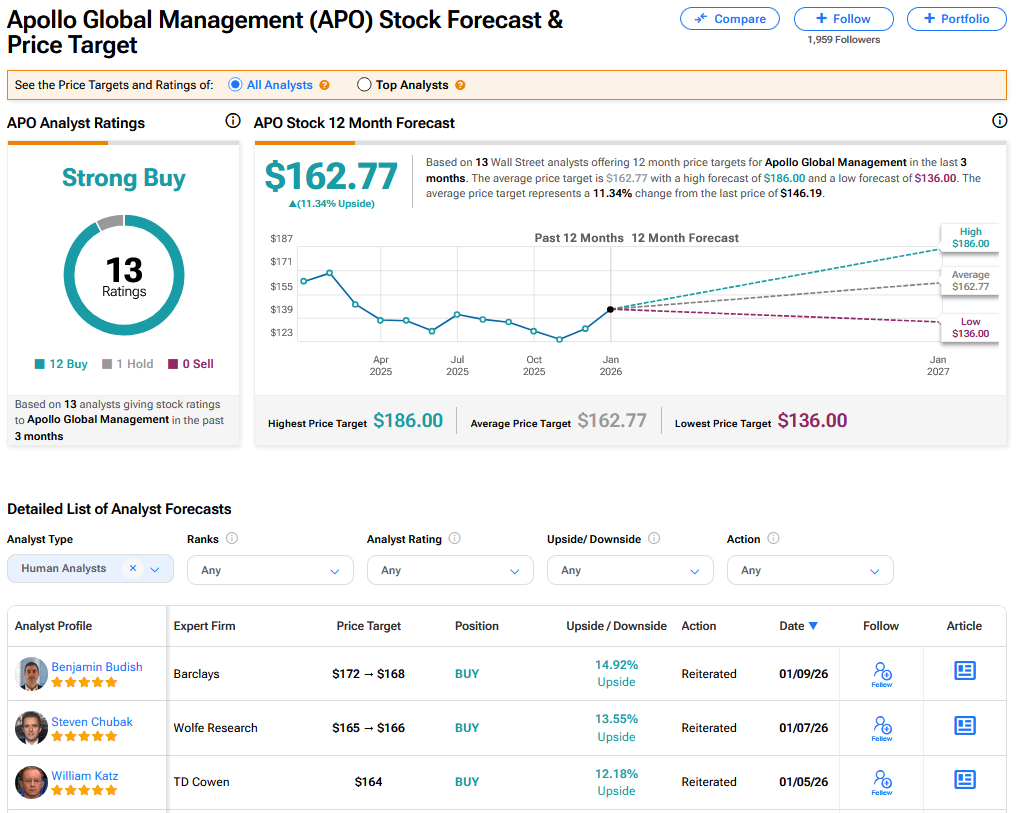

Is APO a Good Stock to Buy Now?

On TipRanks, APO has a Strong Buy consensus based on 12 Buy and 1 Hold ratings. Its highest price target is $186. APO stock’s consensus price target is $162.77, implying an 11.34% upside.