Shares in private equity giant Apollo Global Management (APO) were celebrating today on reports that it was lining up an up to $2.9 billion bid for Spanish football giant Atletico Madrid.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Majority Sale

It is understood that the current owners of Atletico, which has won the Spanish League 11 times in its 122-year history, are in advanced talks to sell a majority stake to Apollo.

The U.S. firm could take control of the club, which plays in the top division in Spain and in the main European competition the Champions League, by acquiring part of the stakes owned by the club’s chief executive officer, Miguel Angel Gil Marin, and its chairman, Enrique Cerezo. It could also buy shares from investment fund Ares Management (ARES).

It has been reported that Apollo might not get a majority stake at first, but is expected to obtain it during a later stage of the transaction.

A deal would mark the latest venture into European football by private equity firms, attracted by their stable and predictable revenue streams.

Indeed, over half of the 20 Premier League clubs in England have US investor participation, ranging from 100% ownership down to smaller stakes.

An example is American investment group ALK Capital which completed its takeover of Burnley by buying an 83% stake in 2020. Former NFL star JJ Watt – below – has also invested in the club.

American investor Todd Boehly and private equity firm Clearlake Capital completed a £4.25bn takeover of Chelsea in 2022.

Sports Push

The three investors in Atletico own about 70% of the club through Atletico Holco. The remainder is owned by shipping and energy group Quantum Pacific.

Apollo has three months of exclusivity that runs until mid-October to invest in the club, one of the people close to the talks is reported to have said.

Atletico de Madrid has said that it would need to undertake a capital increase of at least 60 million euros to invest in the squad and build sports and leisure projects around its Metropolitano Stadium in Madrid. It added it would bring in new partners to invest capital.

Apollo, which manages more than $800 billion in assets, – see above – is planning to launch a $5 billion sports investment vehicle.

The global sports sponsorship market is expected to reach $115 billion in 2025 and at the current growth rate, will top $160 billion by 2030, according to consultancy firm PwC.

Is APO a Good Stock to Buy Now?

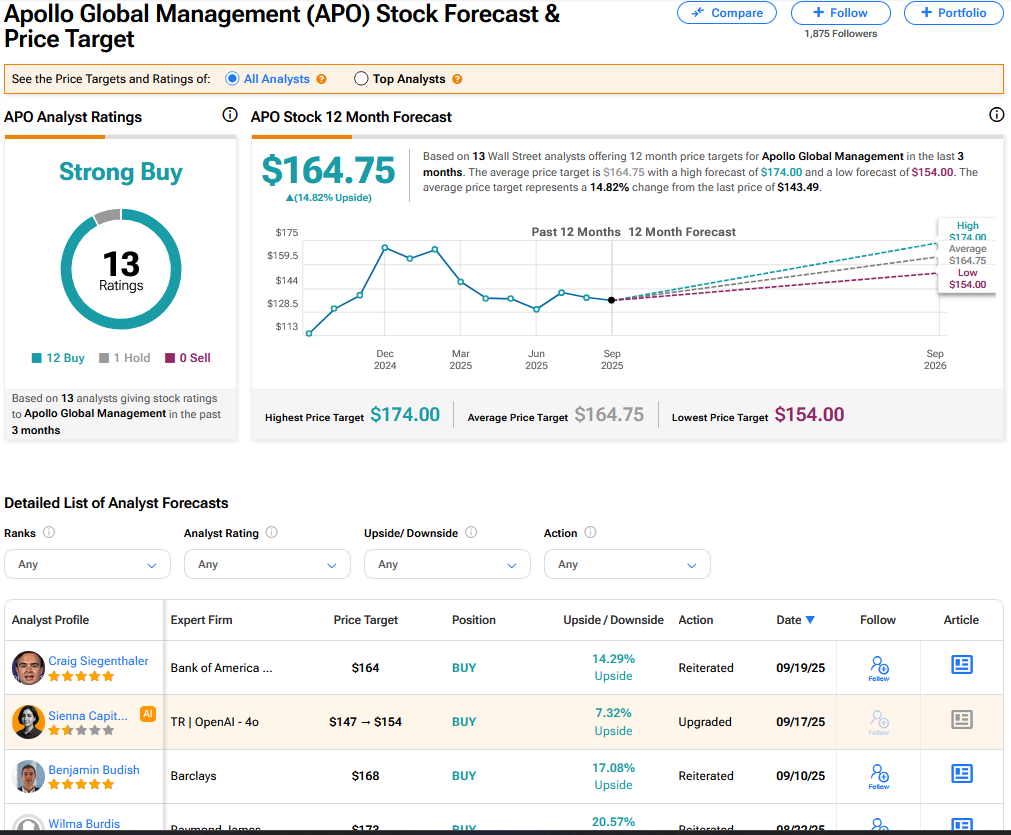

On TipRanks, APO has a Strong Buy consensus based on 12 Buy and 1 Hold ratings. Its highest target price is $174. APO stock’s consensus price target is $164.75, implying a 14.82% upside.