There was one plan out of streaming giant Netflix (NFLX) that sort of slipped under the radar. We have not had the chance to talk about Netflix’s plan to renovate an old army base in New Jersey for several months. But new word emerged earlier today about that exact plan, and it is looking impressive. Investors, meanwhile, did not even slightly care, and fled the stage in droves, sending shares into a free-fall that took around 3.5% of their value in the closing minutes of Tuesday’s trading.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Netflix recently broke ground at the old Army base in Monmouth County, a massive 289-acre facility that offered up plenty of opportunity for Netflix to work. The base itself not only contained a 90,000 square foot facility known as the McAfee Center, but also a bowling alley from 1965. Another 13 buildings are also found on the property, all of which are slated for demolition, reports noted.

In their place will go a set of four soundstages, office space, and production support space. This will include a warehouse for storage and a mill building for production. Then, in a later phase of the project, another eight soundstages will be installed, a second set of production and office buildings, and even a set of “visitor attractions.” Netflix looks for construction to be complete by 2028.

Maybe a Little Too Valuable

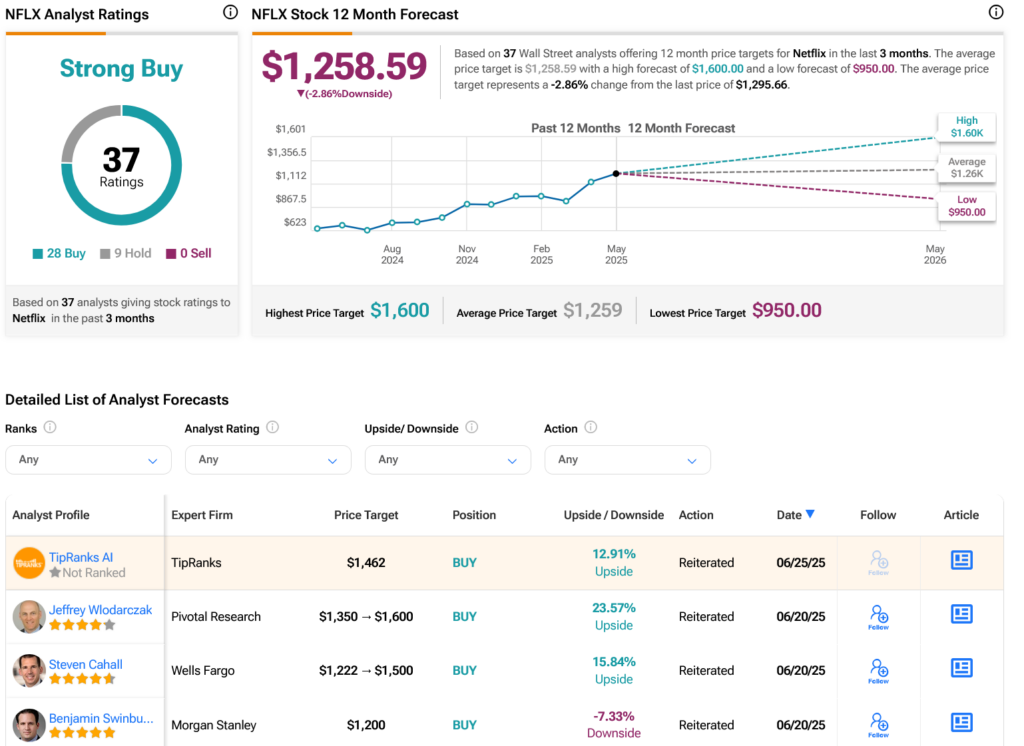

Meanwhile, a new report has some analysts gravely concerned. Netflix shares are expensive. Just take a look at the graphic below to see for yourself. And while Netflix has delivered impressive returns for that equally-impressive price tag, some wonder if, perhaps, Netflix shares are just plain old too expensive.

The stock price has already doubled over the last 12 months, reports note, and its valuation is currently around 45 times expected earnings for the next year. Even Nvidia (NVDA) stands at 32 times, and the entire Nasdaq 100 is only 27 times. That led Allspring Global Investments senior portfolio manager and head of growth equity Michael Smith to note “…expectations have gotten to the point that any disappointment would be a risk.”

Is Netflix Stock a Good Buy Right Now?

Turning to Wall Street, analysts have a Strong Buy consensus rating on NFLX stock based on 28 Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 97.05% rally in its share price over the past year, the average NFLX price target of $1,259 per share implies 2.86% downside risk.