Chinese tech giant Ant International is eyeing a rise in the number of mobile payments made using smart glasses.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

AI Power

Ant, in which Chinese tech giant Alibaba (BABA) holds a stake, said that the first such payment outside of mainland China was made this week in Hong Kong using Meizu’s StarV smart glasses.

The transaction was made by Alipay+ using Meizu StarV Snap smart glasses integrated with AlipayHK, Hong Kong’s leading digital superapp. Meizu’s glasses were able to scan the QR code and use voice commands. The whole process was powered by Ant’s AI-powered voice interface, intent recognition, and voiceprint authentication technologies.

The momentum in the market is clear to see.

“In the coming years, this technology could enable people to complete transactions simply by looking at or gesturing towards a product,” Ant said.

Growth Outlook

Alipay+ is looking to expand the adoption of smart glasses for payments through its e-wallet partners worldwide. This includes 36 mobile payment apps such as Line Pay and GrabPay through the Alipay+ network that connects more than 1.7 billion user accounts in 70 markets.

The smart glasses market is forecast for huge growth over the next few years.

The market was estimated at $1.93 billion in 2024 and is projected to reach $8.26 billion by 2030, growing at a CAGR of 27.3% from 2025 to 2030. This is for use in a variety of sectors such as healthcare, education, and manufacturing.

A number of major US tech giants are also developing smart glasses, such as Apple (AAPL) and Meta Platforms (META).

Is BABA a Good Stock to Buy Now?

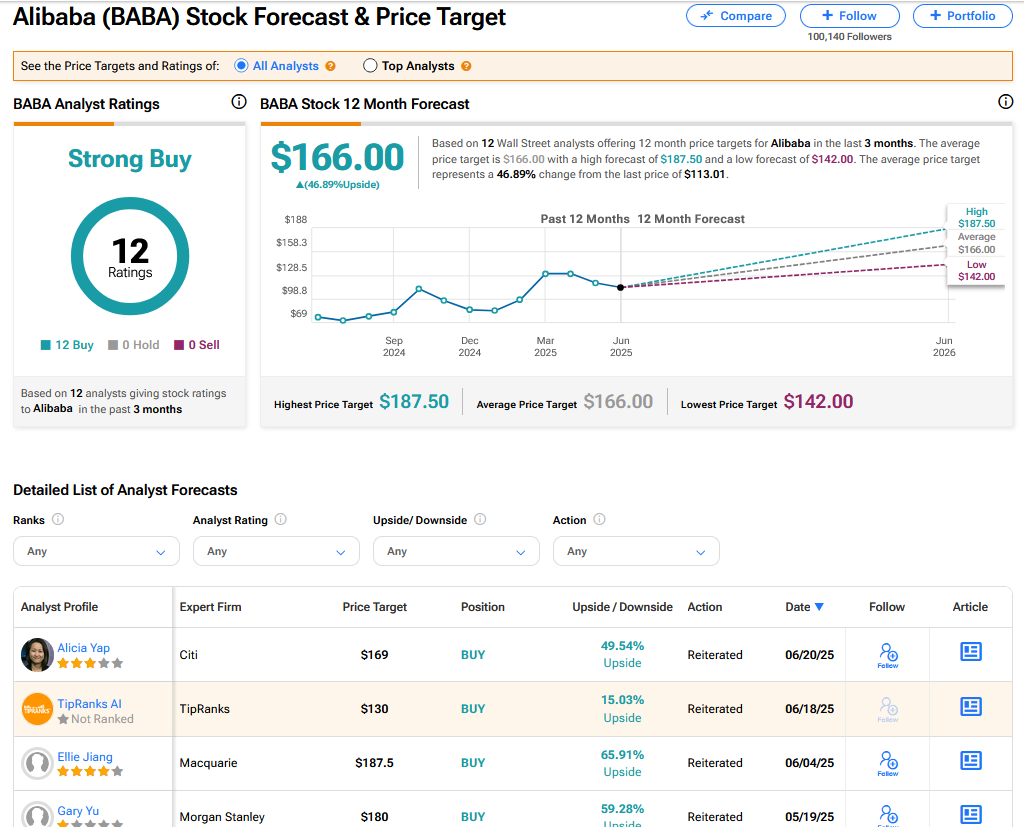

On TipRanks, BABA has a Strong Buy consensus based on 12 Buy ratings. Its highest price target is $187.50. BABA stock’s consensus price target is $166 implying an 46.89% upside.