Anheuser-Busch InBev (NYSE:BUD) gained in pre-market trading on Tuesday after the beer giant and the parent company behind Bud Light maintained its FY23 guidance. The company anticipates its EBITDA to grow between 4% and 8% in line with its medium-term outlook and its revenue “to grow ahead of EBITDA from a healthy combination of volume and price.”

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Anheuser reported Q3 earnings of $0.86 per share as compared to $0.84 per share in the same period last year beating consensus estimates of $0.84 per share. The company’s revenues grew by 5% year-over-year on an organic basis to $15.1 billion but fell short of analysts’ expectations of $15.72 billion. BUD’s revenues took a hit as volumes declined by 3.4% with beer volumes down by 4% while non-beer volumes up by 1.4%.

The company stated that its “total beer market share has remained stable since the last week of April through the end of September.”

The company has approved a cash tender offer for repurchasing up to $3 billion worth of debt and $1 billion of stock over the next year.

Is BUD Stock a Buy Now?

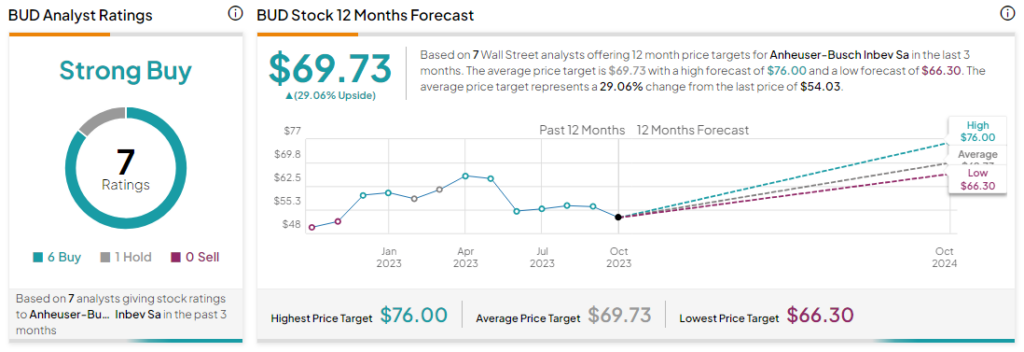

Analysts remain bullish about BUD stock with a Strong Buy consensus rating based on six Buys and one Hold. The average BUD price target of $69.73 implies an upside potential of 29.1% at current levels.