The FTSE 100-listed Anglo American PLC (GB:AAL) has signed an agreement to shed its remaining steelmaking coal assets in Australia to U.S.-based miner Peabody Energy Corp. (BTU). Under this deal, Peabody will pay up to $3.8 billion, including $2.05 billion upfront and $725 million in deferred payments. This move is part of Anglo’s restructuring to streamline its portfolio and counter a nearly $50 billion takeover bid from rival BHP Group (AU:BHP). Anglo’s shares gained nearly 2% as of writing.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Anglo Moves Forward on a Major Restructuring Path

The deal comes just days before the end of a six-month pause, which would allow BHP to make a new bid for Anglo. In May, Anglo rejected takeover bids from BHP and initiated a restructuring plan to bolster shareholder confidence and fend off potential takeover attempts. With this deal, Anglo will move forward on this restructuring plan aimed at creating a simpler and more resilient business to boost its investment appeal.

Overall, under the restructuring plan, the company will divest its steelmaking coal, nickel, and platinum operations, while refocusing on key assets such as copper, premium iron ore, and crop nutrients.

Earlier this month, Anglo American announced the sale of its 33.3% stake in Australia’s Jellinbah Group for $1.1 billion as part of this strategy. On similar lines, Anglo revealed plans to spin off its diamond business, De Beers, in May 2024.

Additionally, the company stated that the demerger of Anglo American Platinum is expected by mid-2025, and the nickel business sale and De Beers’ separation are moving forward. Furthermore, the company is on track to achieve $1 billion in cost savings and an additional $800 million in pre-tax recurring cost benefits by the end of 2025 as part of its portfolio transformation.

Is Anglo American a Good Stock to Buy?

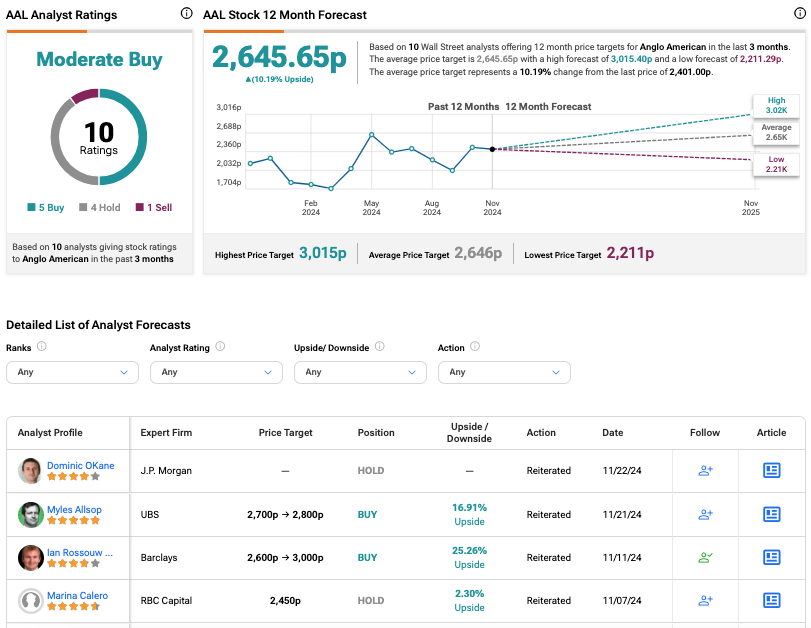

According to TipRanks’ consensus, AAL stock has been assigned a Moderate Buy rating, backed by five Buys, four Holds, and one Sell recommendation. The Anglo American share price target is 2,645.65p, which is 10.2% above the current trading price.