Upstart Holdings (UPST) provides credit services. It offers an artificial intelligence-powered platform used by banks and credit unions to inform their lending decisions. Upstart-powered lenders report lower loss rates and higher approval rates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, Upstart reported a 252% year-over-year jump in revenue to $305 million, exceeding the consensus estimate of $263 million. It posted adjusted EPS of $0.89, which rose from $0.07 in the same quarter the previous year and beat the consensus estimate of $0.51.

For Q1 2022, the company anticipates revenue in the band of $295 million $305 million. Upstart recently launched a $400 million share repurchase program. The company plans to repurchase shares from time to time in the open market and through privately negotiated transactions. The program has no expiration date.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Upstart.

Risk Factors

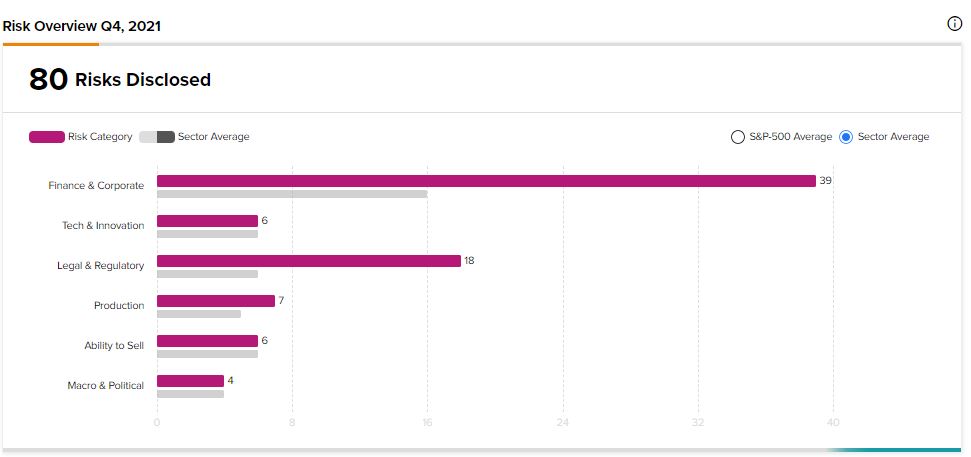

According to the new TipRanks Risk Factors tool, Upstart’s main risk category is Finance and Corporate, with 39 out of the total 80 risks identified for the stock. Legal and Regulatory and Production are the next two major risk categories with 18 and 7 risks, respectively. Upstart recently updated its profile with nine new risk factors across various categories.

The company cautions investors that there is no assurance that its share repurchase program will be fully completed. Further, Upstart says it cannot guarantee that the program will enhance long-term shareholder value. The company explains that if it were to terminate the program, its stock price may decline. Additionally, the company cautions that the repurchase program will reduce its cash reserve.

Upstart informs investors that some of its debt securities contain provisions that could deter a third party from acquiring it, despite such a transaction potentially being favorable to shareholders.

The company cautions that errors or misconduct by its employees or vendors could subject it to significant liability and damage its reputation. Upstart explains that it operates in an industry where integrity and confidence are of critical importance. It says that its employees and vendors handle increasingly complex transactions and sensitive information. Upstart warns that if its employees or vendors engage in illegal activity, its relationship with bank partners may be harmed, its reputation damaged, and its business and financial condition could be adversely impacted.

Analysts’ Take

Barclays analyst Ramsey El-Assal recently reiterated a Buy rating on Upstart stock but lowered the price target to $180 from $285. El-Assal’s reduced price target still suggests 38.41% upside potential.

Consensus among analysts is a Moderate Buy based on 6 Buys and 3 Holds. The average Upstart price target of $213.33 implies 64.04% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

2 Beaten-Down Stocks to Bottom-Fish With the Insiders

Southwest Airlines Stock: Historically Low Forward EBITDA Valuation

New Fortress Energy: Massive Upside Potential