GoDaddy (GDDY) provides website building solutions, from domain name registration to web hosting and security services. The company was founded in 1997 and is based in Arizona.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, GoDaddy reported a 16.6% year-over-year rise in revenue to $1.02 billion and surpassed the consensus estimate of $970.5 million. It posted adjusted EPS of $0.52, which rose from $0.41 in the same quarter the previous year and beat the consensus estimate of $0.41.

The company ended the quarter with about $1.3 billion in cash. It has a $3 billion multi-year share repurchase program in place. It recently kicked off the program with a $750 million accelerated share repurchase arrangement with Goldman Sachs (GS) and Morgan Stanley (MS).

With this in mind, we used TipRanks to take a look at the newly added risk factors for GoDaddy.

Risk Factors

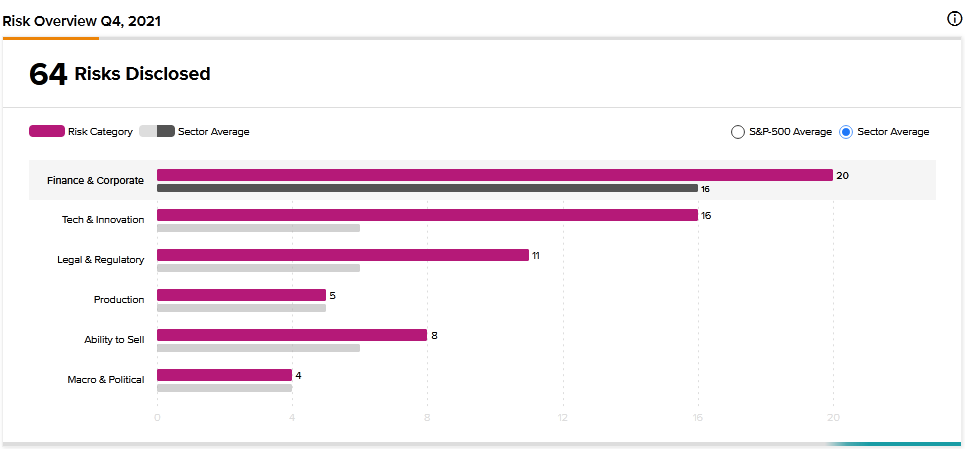

According to the new TipRanks Risk Factors tool, GoDaddy’s main risk category is Finance and Corporate, with 20 of the total 64 risks identified for the stock. Tech and Innovation and Legal and Regulatory are the next two major risk categories with 16 and 11 risks, respectively. GoDaddy has recently updated its profile with six new risk factors.

GoDaddy informs investors that its updated bylaws contain provisions that could prevent another company from acquiring it, even if such a transaction would be in the best interest of shareholders. There are plans to drop some of the anti-takeover provisions, such as the classified board structure. But the company cautions that it cannot guarantee that shareholders will back the proposal at the 2022 annual meeting.

Additionally, GoDaddy’s updated bylaws designate a specific court in Delaware as the exclusive forum for resolving certain lawsuits that shareholders may bring against the company. The choice of forum may limit shareholders’ ability to file claims in courts that they may find favorable, which may discourage shareholder lawsuits against the company. However, GoDaddy warns that it may incur additional costs if it were forced to resolve shareholder lawsuits outside its preferred court.

GoDaddy tells investors that it focuses on serving small businesses and believes the market is underserved. Therefore, it plans to continue to make significant investments in the market. The problem is that small businesses often have limited budgets, which could result in them reducing spending on GoDaddy solutions in times of economic uncertainty. Therefore, GoDaddy cautions that its revenue and profitability may be harmed if the small business market turns out to be less lucrative than anticipated.

Analysts’ Take

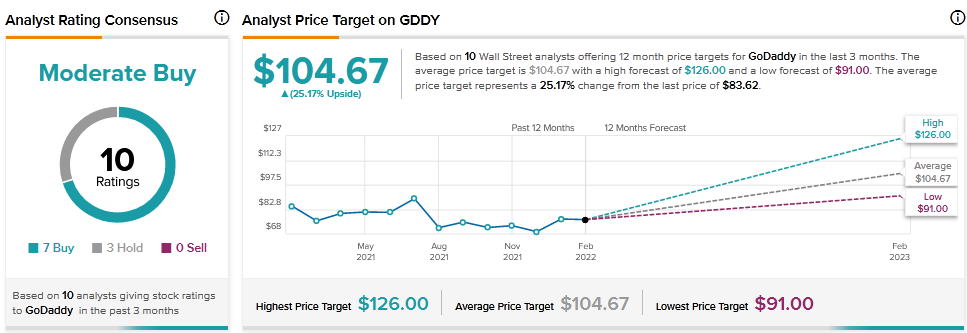

William Blair analyst Matthew Pfau recently reiterated a Buy rating on GoDaddy stock without assigning it a price target. Pfau noted that GoDaddy’s three-year growth plan includes a 10% compounded annual revenue growth rate. The analyst also cited GoDaddy’s share repurchase program, saying it will be funded with existing cash and free cash flow.

Consensus among analysts is a Moderate Buy based on 7 Buys and 3 Holds. The average GoDaddy price target of $104.67 implies 25.17% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

NatWest Returns to Profit in 2021

Air Canada Reduces Loss to C$503M in Q4

Frontline Beats Q4 Revenues Expectations; Shares up 7%