Gold is about to end the year with unprecedented momentum. Spot prices have pushed to record highs, around $4,450–$4,500 an ounce, up ~70% this year as investors seek shelter from rate volatility, lack of faith in fiat currencies, and geopolitical flare-ups. Central banks are buying, bond yields are slipping, and the dollar no longer feels like the only safe harbor.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In that kind of world, the world’s largest listed gold miner, Newmont Mining (NEM), is poised to keep benefiting massively. Therefore, I am bullish on the stock despite its ~177% rally that has left many market participants wary of a sharp pullback.

Gold’s Breakout and the Fiat Hangover

Gold’s rally this year shouldn’t have surprised anyone. Real yields have rolled over as markets price further Federal Reserve cuts, reducing the opportunity cost of holding a metal that pays no coupon. Meanwhile, government debt loads keep climbing, global liquidity is about to surge, and geopolitical tensions remain volatile, making a strong case for investors to take a risk-off exit to the sidelines and hoard gold.

At the margin, there is a quiet crisis of confidence in fiat money. Central banks from China to Poland and Brazil have been adding aggressively to their bullion reserves, explicitly diversifying away from the dollar and Treasuries. Private investors are following that shift, with inflows into bullion, ETFs, and even Costco’s (COST) fast-selling gold bars surging as spot prices break record after record.

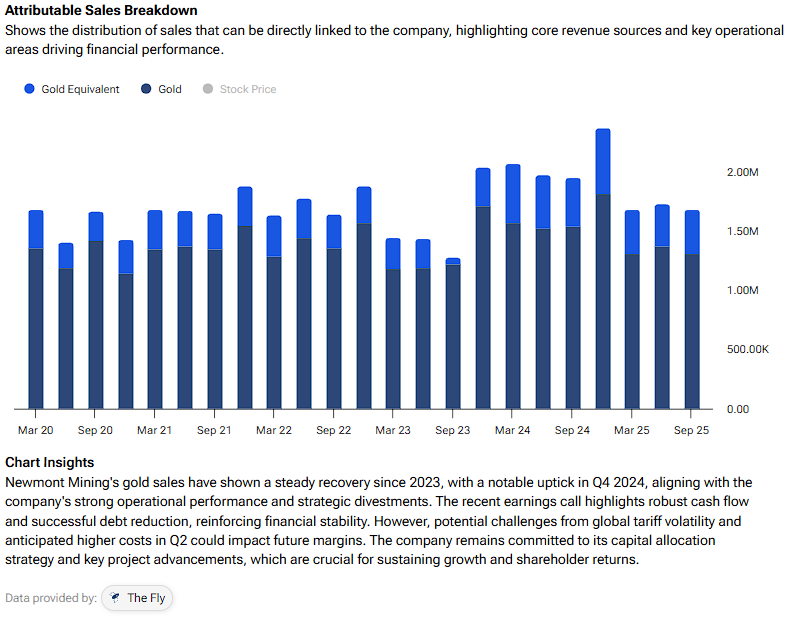

This is the ecosystem Newmont occupies. Newmont is still primarily a gold producer, at ~80%+ of sales, and copper, silver, zinc, and lead as its valuable by-products. When the gold price lurches higher, much of that uplift drops through to operating margins once fixed costs and sustaining capex are covered. After acquiring Newcrest last year and selling several non-core mines for more than $4 billion, Newmont has focused on lower-cost, longer-life assets, which has increased its operating leverage.

Earnings Leverage Now, 2026 Upside Next

You can already see the effect of higher gold prices in Newmont’s reported numbers. In Q3, Newmont generated $5.5 billion of revenue (up 19.7% YoY) and $1.8 billion of net income, alongside record free cash flow of $1.6 billion. Its adjusted EPS of about $1.71 beat expectations by a notable $0.27, helped by an average realized gold price of ~$3,500 an ounce and improving all-in sustaining costs despite lower production.

Since the Q3 print in October, gold has accelerated. Prices have climbed from the mid-$3,000s to ~$4,500 per ounce by late December, marking one of the strongest annual moves since the inflation shocks of the late 1970s.

Street estimates for Newmont’s Q4 already assume even more impressive figures, with consensus seeing $6.1 billion of revenue and roughly $1.84 in EPS (up 31.2% YoY). However, many of those forecasts were set before the latest leg higher in the gold price. If spot holds anything like current levels, the bias for Q4 2025 and full-year 2026 still looks upward.

A Cheap Multiple on Rising Earnings

Today, Newmont trades slightly above $104 per share, having just broken new 12-month highs as gold set its own records. Consensus expects EPS of about $6.30 for 2025, putting the stock on ~16x this year’s EPS. This is not a demanding valuation for a sector leader with this kind of cash-flow torque to gold. But more important is the direction of those numbers. With spot gold at ~$4,500/ounce and analysts revising their metals price estimates higher, it would be surprising if 2025 EPS estimates did not nudge up as the year closes out.

Looking further ahead, consensus has 2026 EPS at about $7.76, reflecting a full year of higher realized prices and a cleaner post-Newcrest portfolio. On that 2026 figure, today’s share price implies a P/E of ~13.5 times, which, in my view, is inexpensive given Newmont’s scale and exposure to a generational metal that many investors now treat as alternative money. This is not the cyclical miner of the past.

There are obvious risks to Newmont’s investment case, such as cost inflation, operational hiccups, political risk in mining jurisdictions, and the possibility that gold simply reverts to its mean. Still, the earnings power implied by today’s gold curve looks under-appreciated in the equity. In the meantime, the company has a net cash position of $442 million, and its balance sheet is at its healthiest in decades, enhancing today’s setup.

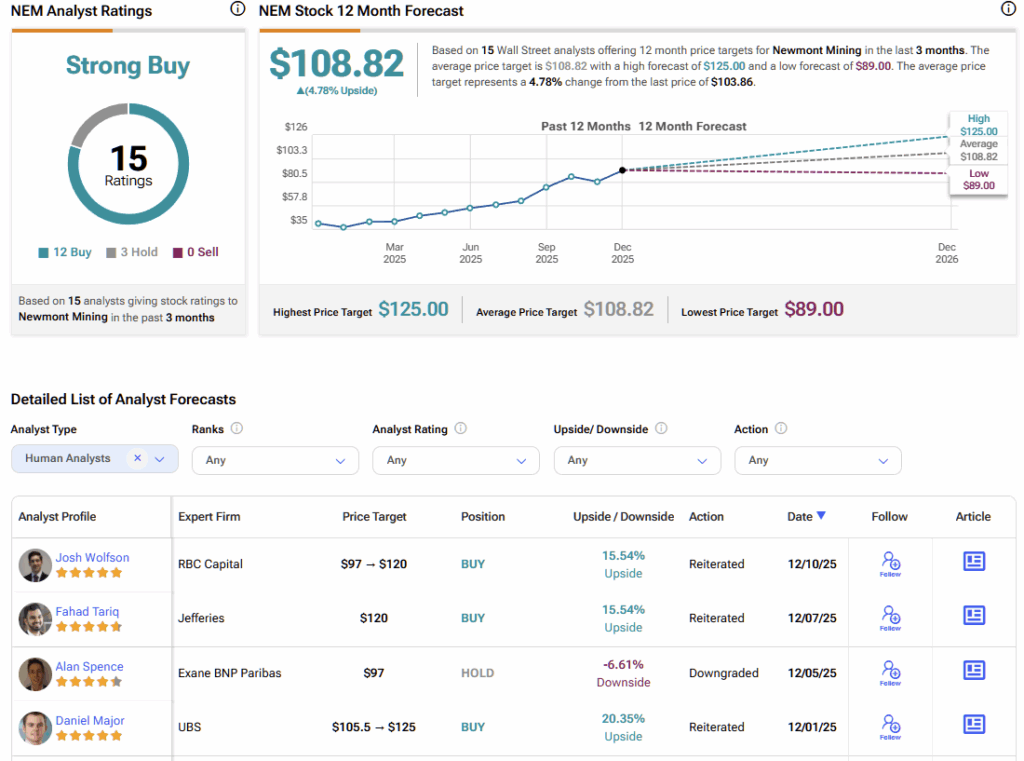

Is NEM a Good Stock to Buy Now?

On Wall Street, NEM stock boasts a Strong Buy consensus rating, based on 12 Buy and three Hold ratings. No analyst rates the stock a Sell. Furthermore, Newmont’s average stock price target of $108.82 implies ~5% upside potential over the course of 2026, despite its already extended rally.

Newmont is Mispriced in a World of Record Gold and Rising Volatility

Take a step back and consider the broader picture. Gold is trading at record highs, central banks are buying aggressively, and macro uncertainty continues to build. Yet Newmont (NEM) still trades at a valuation that appears disconnected from these powerful tailwinds.

Viewed through this lens, Newmont looks less like a speculative gold play and more like a compelling core holding for the environment we are heading into. The risks are real, but they are increasingly balanced by structural support from gold prices and global demand dynamics. Heading into 2026—particularly if volatility returns to traditional equity markets—I am comfortable remaining firmly bullish on NEM. The stock offers a rare combination of return potential and defensive characteristics, positioning it as both a source of upside and a hedge against broader market instability.