Apple stock (AAPL) is slipping down analysts’ priority lists. Several firms have cut their price targets in recent days. They flagged a mix of soft iPhone demand, growing macro pressures, and tariff risks that could hit earnings harder than investors expected.

Jefferies Slashes Target on Weak iPhone Outlook

First up, Jefferies nudged Apple a notch higher. The firm upgraded the stock from Underperform to Hold.

But that came with a catch — the firm also cut its price target from $202.33 to $167.88. Analyst Edison Lee warned that soft iPhone demand and global economic pressure could weigh heavily on earnings in the near term.

In a note to clients, Lee said Apple’s AI revenue is still in its “early innings” and won’t be enough to offset hardware weakness just yet. The firm’s view: Apple isn’t in bad shape, but investors shouldn’t expect it to outperform either.

It’s a classic case of mixed signals — the rating moves slightly up, while the numbers move down.

JPMorgan Trims Price Target on Macro Concerns

JPMorgan (JPM) also weighed in with a more cautious tone. The firm maintained its Overweight rating but lowered its price target from $270 to $245. Analyst Samik Chatterjee cited “rising macroeconomic headwinds” and ongoing softness in global device spending as key reasons for the cut.

While JPMorgan still sees Apple as a long-term outperformer, the message is clear: near-term growth could be shakier than expected. Chatterjee’s note pointed out that services and wearables remain bright spots, but even those segments may slow if broader economic pressures persist.

It’s another sign that even Apple’s strongest institutional backers are adjusting their models to account for a bumpier ride ahead.

KeyBanc Turns Neutral After Tariff Relief

KeyBanc offered a small silver lining. The firm upgraded Apple from Underweight to Sector Weight after the U.S. rolled back some of its proposed tariffs on tech imports. Analyst Brandon Nispel called the move a “best-case scenario for Apple” but still warned that demand softness remains a risk in the quarters ahead.

So, while the tariff overhang eased, the outlook still feels a bit cloudy.

Is Apple a Buy or Sell Right Now?

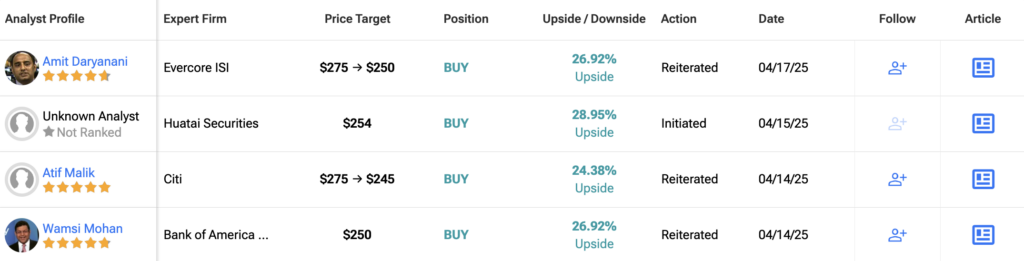

Overall, analysts have a Moderate Buy consensus rating on AAPL stock based on 18 Buys, 13 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $239.67 per share— still implying 22% upside, but far from the confident tone seen earlier this year.

Analysts aren’t abandoning Apple. But they are rebalancing their expectations — and for now, that means lower targets and a little less faith in short-term upside.