The Walt Disney Company (DIS) reported better-than-expected earnings for the first quarter of Fiscal 2025, thanks to the box office performance of Moana 2. While the company’s streaming business delivered yet another profitable quarter, subscribers for the flagship Disney+ service declined by 1% due to the recent price hike. Moreover, the company warned of a modest drop in Disney+ streaming subscribers in Q2 FY25. Nonetheless, many Wall Street analysts reiterated their Buy ratings, reflecting faith in Disney’s continued improvement.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Analysts Remain Confident about Disney’s Growth Potential

Following the Q1 print, UBS analyst John Hodulik reaffirmed a Buy rating on Disney stock and raised the price target to $130 from $120. Hodulik highlighted that the company achieved improved profitability across operating segments. He noted that while management did not raise but maintained the full-year guidance due to an uncertain macro backdrop, they believe the company is now in a position to outperform. Hodulik continues to be constructive on a multi-year acceleration in Disney’s bottom line growth, driven by ramping DTC (direct-to-consumer) profitability and improvements at the Parks.

Similarly, Goldman Sachs analyst Mike Ng noted that Disney’s Q1 FY25 beat was driven by its DTC business, which reflected the company’s solid operating expenses management. Ng added that the outperformance of the Experiences segment highlighted better-than-expected attendance trends. The analyst thinks that despite the earnings beat, the company maintained the full-year guidance perhaps due to conservatism amid the current macro backdrop. Overall, Ng reiterated a Buy rating on DIS stock with a price target of $139.

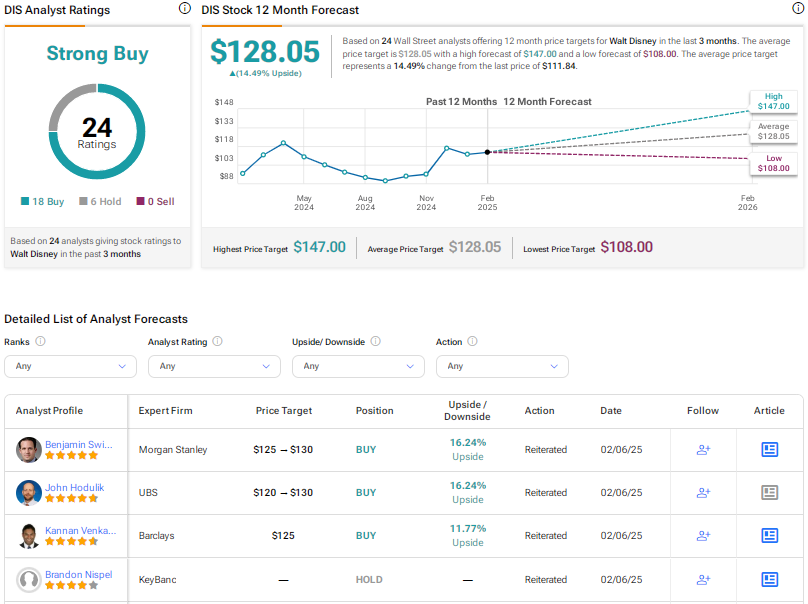

Another analyst, Benjamin Swinburne from Morgan Stanley, increased the price target for Walt Disney stock to $130 from $125 and maintained a Buy rating. Despite concerns over the company’s ability to accelerate the growth in the Experiences business and boost long-term streaming earnings, Swinburn sees an opportunity in DIS stock with a positive earnings revision cycle ahead and potential for expansion in the valuation multiple. Swinburne said that DIS stock remains his Top Pick in the Media & Entertainment space.

Is Disney Stock a Buy, Sell, or Hold?

Overall, Wall Street is bullish on Walt Disney stock’s growth potential, with a Strong Buy consensus rating based on 18 Buys and six Holds. The average DIS stock price target of $128.05 implies about 15% upside potential. DIS stock has risen about 12% over the past year.