Caribou Biosciences (CRBU) reported better-than-expected earnings in the first quarter, with top and bottom-line beats. Despite this, the company’s stock fell to a 52-week low, in part driven by declining market sentiment as Caribou ended 2024 with a decreased cash reserve and reported increased R&D expenditures, while also experiencing a notable reduction in licensing revenue due to a terminated agreement, culminating in a net loss for the year. However, analysts remain bullish on the company’s advancing pipeline of treatments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Increased R&D Expenses on a Robust Treatment Pipeline

Caribou Biosciences is a clinical-stage biopharmaceutical company focusing on CRISPR genome editing to develop transformative therapies. Its core technology is the Cas12a chRDNA, which offers high precision in genome editing, potentially enabling the development of cell therapies designed to enhance disease-targeting activity. A key focus for Caribou is their pipeline of off-the-shelf cell therapies from a CAR-T platform aimed at providing extensive access and swift delivery of treatments for conditions such as hematologic malignancies and autoimmune diseases.

The company is advancing its portfolio of allogeneic CAR-T cell therapies with plans for significant data disclosures in the first half of 2025. The ANTLER Phase 1 trial, CB-010, targeting large B cell lymphoma, demonstrated potential parity with existing therapies, particularly when produced from donors with more HLA matches. Caribou is also advancing CB-011 for multiple myeloma through the CaMMouflage Phase 1 trial, showing positive signs at various doses following an enhanced lymphodepletion regimen. Moreover, CB-012 is being evaluated for acute myeloid leukemia in the AMPLIFY trial. Looking ahead to 2025, Caribou plans to initiate a pivotal Phase 3 trial for CB-010 if results remain promising and aims to continue advancing trials for its other pipeline assets.

Caribou reported financial results for the fourth quarter and full year of 2024 earlier this week, on March 10th. The company reported revenue of $2.08 million, exceeding forecasts by $0.24 million. However, the company faced a decline in its licensing and collaboration revenue, which fell from $34.5 million in 2023 to $10.0 million in 2024, primarily due to the termination of the AbbVie collaboration, which had contributed $20.8 million of deferred revenue in the prior year. Research and development expenses increased to $130.2 million in 2024, a rise attributed to advancing clinical trials and personnel-related costs, including stock-based compensation.

Consequently, Caribou’s net loss expanded to $149.1 million for the full year 2024, compared to $102.1 million in 2023. Yet, the GAAP EPS of -$0.39 slightly surpassed expectations by $0.02. As of the year’s end, Caribou’s cash and marketable securities totaled $249.4 million, a decrease from the previous year’s $372.4 million. However, management anticipates having sufficient funds to support operations into the second half of 2026.

Is CRBU Stock a Buy?

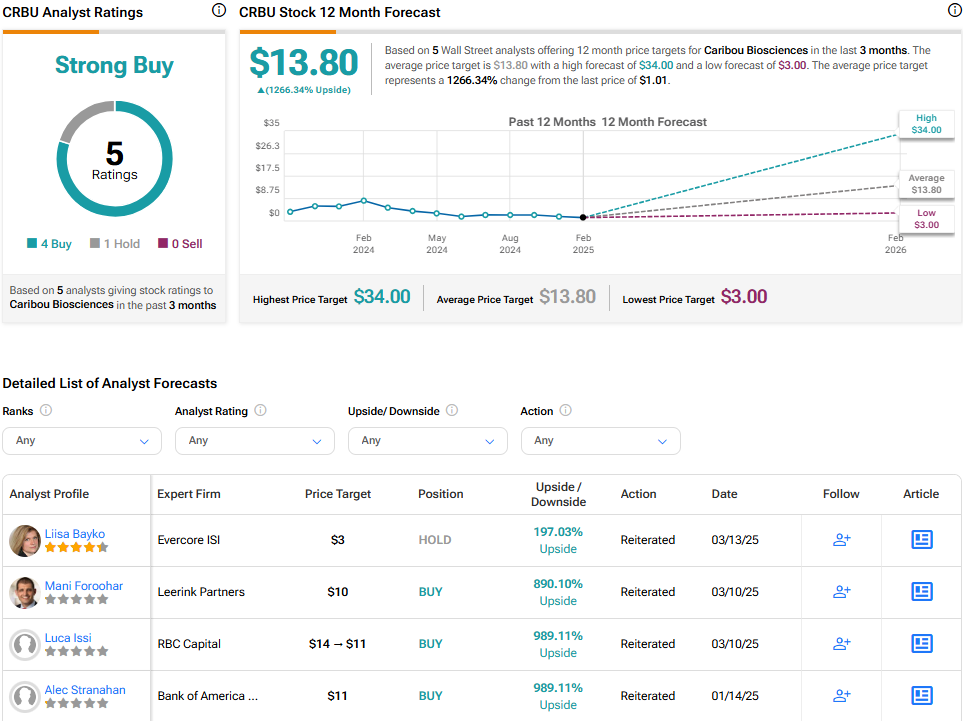

Despite the declining share price, analysts following the company have remained bullish on its prospects. Caribou Biosciences is rated a Strong Buy overall, based on the recent recommendations of five analysts. The average price target for CRBU stock is $13.80, which represents a potential upside of 1266.34% from current levels.