Initial public offerings are the lifeblood of the stock market, as they bring new blood onto the public trading floors. The regular addition to investors’ choices is a vital foundation for a capitalist system, making it possible for investors to make more and better-informed stock purchase choices.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The US markets are the driver of IPO activity. On the global stage, IPOs are down 12% in raw numbers from last year. The decline can be laid at the feet of some gathering headwinds, including the ongoing regional wars in Eastern Europe and the Middle East, and increased economic uncertainty following the UK and French elections.

In contrast, U.S. IPOs have surged by 27% in the first half of 2024 in terms of numbers and by 75% in terms of valuation. There were 80 IPOs in the U.S. during this period, raising a total of $17.8 billion.

Amidst this backdrop, we’ve used the TipRanks database to pinpoint 2 recent IPO stocks that have earned Strong Buy ratings from the analyst community. Let’s find out why you might want to pay attention here.

Waystar Holding (WAY)

The first stock on our list hit the public trading markets this past June 7, and the company was founded back in 2000. Waystar works with enterprise clients in the healthcare industry, offering software solutions that allow providers to simplify their payment procedures and prioritize attention to patient care. Waystar boasts some 30,000 clients that collectively represent more than 1 million providers, and its client list includes 18 of the 22 facilities on the US News Best Hospitals list.

Having a solid customer base like that has allowed Waystar to achieve a high level of financial success. The company’s enterprise-grade platform processes more than 5 billion healthcare payment transactions every year. These transactions span some 50% of patients in the US healthcare field, and total some $1.2 trillion in annual gross claims.

As noted, this company’s IPO opened on June 7. Waystar put 45 million shares on the market at an initial price of $21.50, near the middle of the indicated range. The IPO raised approximately $967 million in gross proceeds, and when the offering closed, Waystar claimed a fully diluted valuation of $3.69 billion. The shares have since fallen to some 2.6% below their opening price.

Canaccord analyst Richard Close has initiated coverage of this stock with an upbeat stance, focusing on Waystar’s strong position and the high potential of its addressable market.

“Waystar has established itself as a leading and trusted partner to healthcare organizations during an increasingly challenging and complex reimbursement environment, delivering modern cloud-based software solutions utilizing AI and machine learning technology that drive improved financial stability and enhanced security. While the company’s TAM is significant at ~$15 billion, it currently has less than 10% market share with the potential to double its revenue by further penetrating its client base with its current software solution offerings,” Close opined.

Summing up his position, Close adds, “In an environment of increased reimbursement complexity, rising patient financial responsibility, and heightened cybersecurity concerns, we believe Waystar’s position as a trusted and reliable partner with next generation software solutions can drive further market share gains as healthcare organizations seek newer and more secure technology solutions.”

These extensive comments back up Close’s Buy rating on WAY shares, while his $30 price target implies that the stock has a one-year gain of ~34% in the offing. (To watch Close’s track record, click here)

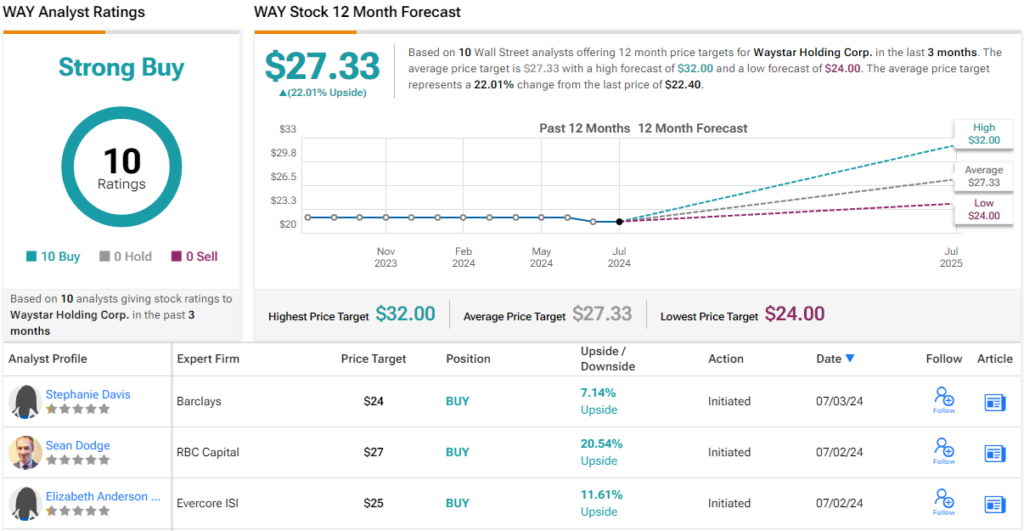

Overall, all 10 of the recent analyst reviews on this stock are positive, making the Strong Buy consensus rating unanimous. Waystar shares are priced at $22.40 right now, and the $27.33 average price target suggests that they have a 22% one-year upside potential. (See Waystar stock forecast)

Gauzy Ltd. (GAUZ)

Humans are heavily visually oriented, depending on our eyes for much of our perception of the world. This makes vision and light control technologies one of the most important niches that you’ve probably never heard of, and our second IPO stock, Gauzy, is a major player in that field. The company offers a variety of vision and light control solutions in a wide range of industries, including the aeronautics, architecture, automotive, and safety tech sectors.

Gauzy’s products include surfaces, systems, and solutions, ranging from glass that can switch between transparent and opaque to display surfaces and digital signage. These products are used in windows and passenger vehicles, in aircraft for cabin and cockpit shading, and in trucks and buses for driver protection. Gauzy markets and distributes these product lines, and more, in over 30 countries, to such customers as JPMorgan, Deloitte, Crowne Plaza Hotels, and LG Display.

Looking at the IPO, we find that GAUZ shares hit the public market on June 6. The company’s initial offering saw Gauzy put 4,411,765 up for sale, at a price of $17 each – and raise a total of $75 million in gross proceeds. Since then, the stock is down approximately 33% from its opening price.

Even though the shares are down, Cowen analyst Jeff Osborne has taken an optimistic stance on this new stock. He says of GAUZ in his initiation of coverage note, “What we like about the company is they are capital light and have multiple growth vectors ahead with multi-year contracts in hand outside of the automotive business. We see the automotive segment as a biotech-like opportunity ahead, and the acquisition of Hitachi Chemical’s SPD segment solidifies Gauzy as a potential one-stop shop for both PDLC and SPD solutions for automotive smart glass…”

“Looking ahead, we note Gauzy is running at 10-20% capacity and incremental volumes should flow through nicely to the bottom line… We note that we model Gauzy hitting EBITDA positive exiting 2024 and 2026 will have a full year with more diversified growth in Safety Tech and the benefit of the SV3 product cycle expanding margins coupled with margin expansion in aero/architecture as overall utilization rises,” the analyst added.

When he quantifies his position, Osborne puts a Buy rating on GAUZ shares, complementing that with a $24 price target that suggests a robust gain of ~114% for the next 12 months. (To watch Osborne’s track record, click here)

All in all, 3 Wall Street analysts have sounded off on GAUZ so far, and they are all in agreement that this is a stock to Buy – making the Strong Buy consensus rating unanimous. The average price target here is $22, implying a 96% upside potential from the current share price of $11.22. (See GAUZ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.