Analysts gave mixed reviews on Italy-based Ferrari S.p.A. (IT:RACE) after the carmaker released its Q3 results. The company reported a 2.2% year-over-year decline in Q3 shipments, totaling 3,383 units. Despite the lower shipments, Q3 revenues increased by 6.5% year-over-year to €1.64 billion and adjusted EBIT (earnings before interest and tax) rose 10.3% to €467 million.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company attributed this growth to a strong product mix and increased personalization. Following the results, Ferrari’s stock lost 7.06% on Tuesday, as the Q3 results missed market expectations.

Ferrari is a car manufacturer known worldwide for its innovation and performance.

Analysts Share Views on RACE Stock After Q3 Results

Analysts at Bernstein stated that the decline in shipments was expected, as it was not due to weak demand but Ferrari’s strategy of aligning shipments with its margin goals. They expect fourth-quarter shipments to exceed last year’s numbers.

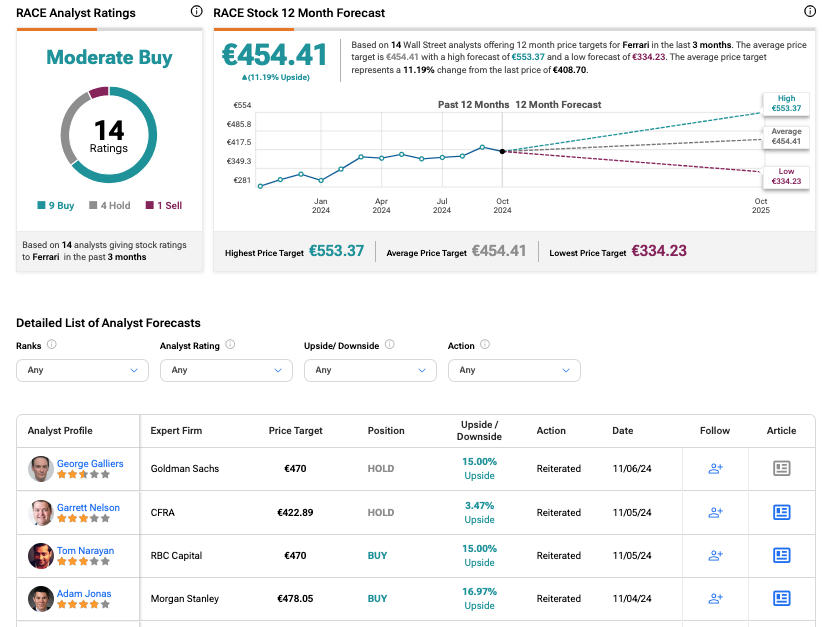

Meanwhile, analyst Garrett Nelson from CFRA reiterated a Hold rating on the stock, predicting a modest upside of 3.5%. Nelson stated that the company’s current valuation offers limited potential for further gains despite robust growth prospects for 2025. Similarly, Goldman Sachs analyst George Galliers also maintained a Hold rating on RACE stock.

At the same time, Citi analysts described Q3 results as solid but not extraordinary.

Ferrari Maintains Confidence in Full-Year Forecast

Ferrari expressed confidence in its full-year outlook and expects revenue to exceed €6.55 billion and adjusted EPS to reach at least €7.90. Additionally, the company maintained a robust order book with visibility through 2026. It further highlighted its advancements in electrification and sustainability, including the early shutdown of its gas-powered plant in Maranello.

Is Ferrari Stock a Good Buy?

According to TipRanks, RACE stock has received a Moderate Buy rating, backed by nine Buys, four Holds, and one Sell recommendation from analysts. The Ferrari share price target is €454.41, which implies an upside of 11.2% from the current trading level.