Energy equipment and services group GE Vernova (GEV), whose range of products includes gas, steam, and wind turbines, has received positive backing from Wall Street analysts despite posting below-consensus fourth-quarter revenue and earnings. Analysts from Goldman Sachs raised the company’s price target to $500 from $446 and kept a Buy rating on the stock. The new price target implies an upside of 14% from GE Vernova’s closing price of $437.71 on Thursday.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Further, analysts from Wells Fargo also felt the energy, upping GE Vernova’s price target to $474 from $411 and retaining a Buy rating.

GE Vernova Delivers Mixed Q4 Figures, but Orders Boom

GE Vernova, which was spun off from its parent company, GE, last April, reported adjusted earnings of $1.73 per share, compared to earnings of $0.72 per share in the same period last year. However, Q4 EPS dropped below the consensus estimate of $2.30 per share.

Despite revenue rising 5% year-on-year to $10.6 billion, it missed Wall Street estimates of $10.7 billion.

However, there were also positives to go with the negatives at the energy group. Its total orders climbed 22% year-on-year on an organic basis to a best-ever $13.37 billion in Q4, driven by a 118.2% surge in Electrification orders and a 20.2% increase in Power. This offset a 41.2% drop in Wind orders.

The company also reiterated its FY25 guidance, with revenues in the range of $36 billion to $37 billion and adjusted EBITDA margin likely to be in the “high-single digits.”

Analysts Expect GE Vernova to Keep Powering Ahead

Goldman Sachs analyst Joe Ritchie acknowledged that the company’s fourth-quarter results were below consensus. However, the analyst was impressed by the number of orders received in the period, particularly the demand for gas turbines. Ritchie expects the company’s Power division to keep motoring with growth in gas equipment orders.

Likewise, Wells Fargo analyst Michael Bloom liked GE Vernova’s growing backlog for Power and Electrification orders.

Further, BMO Capital analyst Ameet Thakkar raised GE Vernova’s price target to $471 from $420 and maintained a Buy rating. Thakkar likes the company’s “breadth across nearly all aspects of power infrastructure that are most needed to accommodate the level of power demand growth not seen in developed economies over the last couple of decades”.

Indeed, Bank of America (BofA) analyst Andrew Obin, who has a $415 target for GE Vernova, believes it will be buoyed by President Trump’s national energy emergency and the need for a ramp-up in the production and generation of US resources.

Is GEV a Good Buy?

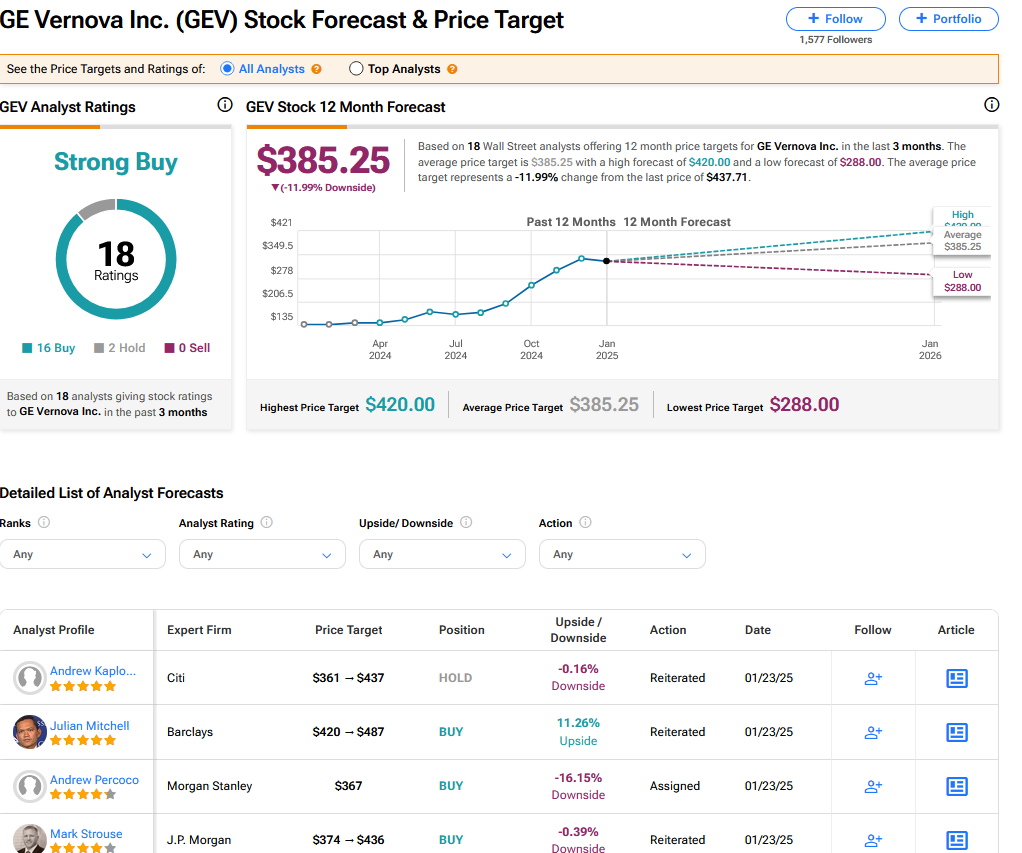

On TipRanks, GEV has a Strong Buy consensus based on 16 Buys, 2 Holds, and no Sell ratings. The average GEV stock price target is $385.25, which indicates a 12% downside risk.