Did you think that the only way to invest in artificial intelligence (AI) was to buy in on some three-figure-per-share tech stock? As it turns out, there may be a whole new way to get in on AI, and it is all thanks to glasses frame maker Warby Parker (WRBY). Its recent deal with Alphabet (GOOG) is drawing attention all up and down the spectrum, and Warby Parker shares managed to gain over 2.5% in Wednesday afternoon’s trading as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The deal with Alphabet makes Warby Parker a potentially big player in the AI space, as Warby Parker’s upcoming smart glasses product will turn to the newly-minted Android XR operating system for their use. While products in this vein are not expected to release this year—the current projection is “after 2025”—they are already drawing attention from analysts.

Mark Altschwager with Baird—who has a four-star rating on TipRanks—noted that this move “…can both drive Warby Parker brand awareness and create a new revenue stream in an emerging category.” Fellow four-star analyst Oliver Chen with TD Cowen, meanwhile, hiked his price target on Warby Parker by an additional $4 per share, citing an improvement to “customer lifetime value” as well as “…a continuous focus on tech meets customer centricity.” Finally, Paul Lejuez with Citi, who has a five-star rating on TipRanks, noted that he has a “conservative view on the growth potential” as the adoption rate of smart glasses has been slow so far.

A Growing Market

It is easy to forget here that Meta Platforms (META) has been pursuing the smart glasses market for some time now, and has done a decent job with them so far, having sold two million pairs of the glasses in question. But that is not all the competition that Alphabet and Warby Parker will face here. Alphabet also announced a hookup with Gentle Monster, another major eyewear brand, to put together the smart glasses.

With a growing consensus seeming to suggest that the only real way to get smart glasses properly off the ground is to “…make them look cool,” enlisting major eyewear brands would seem to be the way to do it. And Alphabet’s connection to both Warby Parker and Gentle Monster might be exactly what is called for to get that vital aesthetic factor in place.

Is Warby Parker Stock a Buy or Sell?

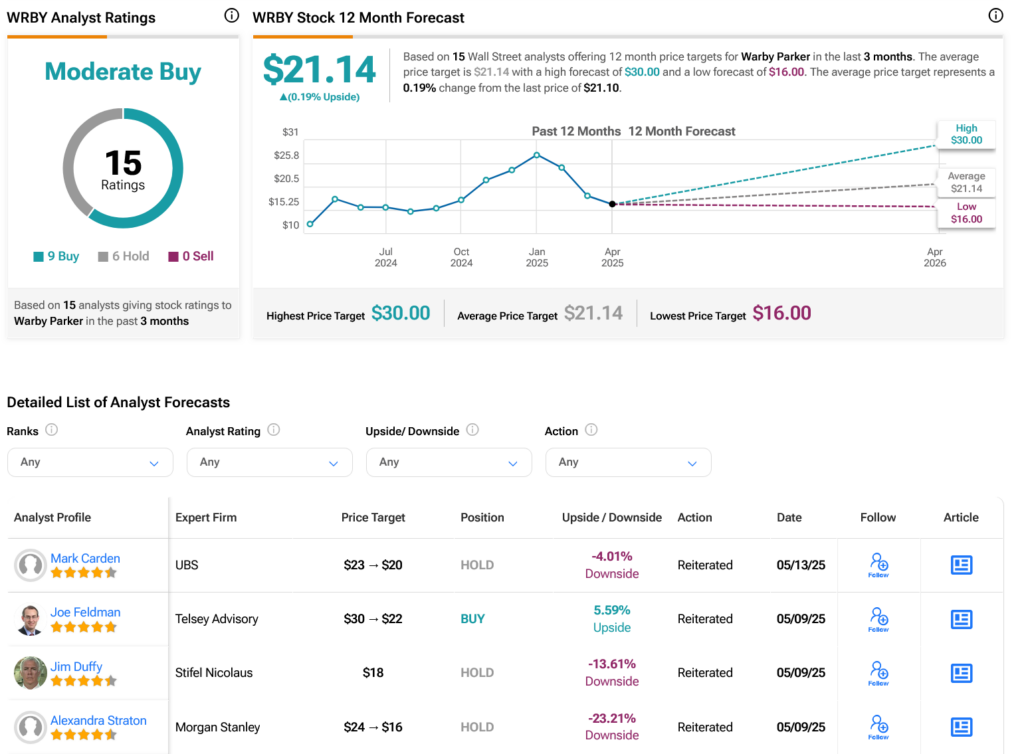

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WRBY stock based on nine Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 20.64% rally in its share price over the past year, the average WRBY price target of $21.14 per share implies 0.19% upside potential.